Camden National Bank, a prominent financial institution with a rich history, offers a comprehensive range of banking services to individuals and businesses throughout Maine and New Hampshire. Founded in 1875, the bank has grown into a respected leader in the region, known for its commitment to customer satisfaction and community engagement.

Camden National Bank’s mission is to provide exceptional financial solutions while supporting the economic well-being of its customers and the communities it serves.

This exploration delves into Camden National Bank’s history, its current offerings, and its commitment to financial performance and customer service. We’ll examine its financial performance, growth strategies, and its impact on the communities it serves. We’ll also look at the bank’s approach to customer experience, digital banking capabilities, and its commitment to community involvement and social responsibility.

Camden National Bank Overview

Camden National Bank, a prominent financial institution in the northeastern United States, has a rich history spanning over 150 years. Founded in 1864, the bank has grown significantly, expanding its services and geographic reach to serve a diverse customer base.

Camden National Bank is committed to providing a wide range of financial products and services to individuals, businesses, and communities.

History of Camden National Bank

Camden National Bank’s journey began in 1864 when it was established in Camden, Maine. The bank has since grown organically and through strategic acquisitions, expanding its presence across Maine, New Hampshire, and Massachusetts. Throughout its history, Camden National Bank has consistently demonstrated a commitment to community banking principles, emphasizing personalized service and strong relationships with its customers.

If you’re a Chase Bank customer and need assistance with your account, you can find helpful information about their customer service options on the Chase Bank customer service page. This resource covers various contact methods, including phone numbers, online chat, and branch locations, so you can choose the most convenient way to get in touch.

Current Services and Offerings

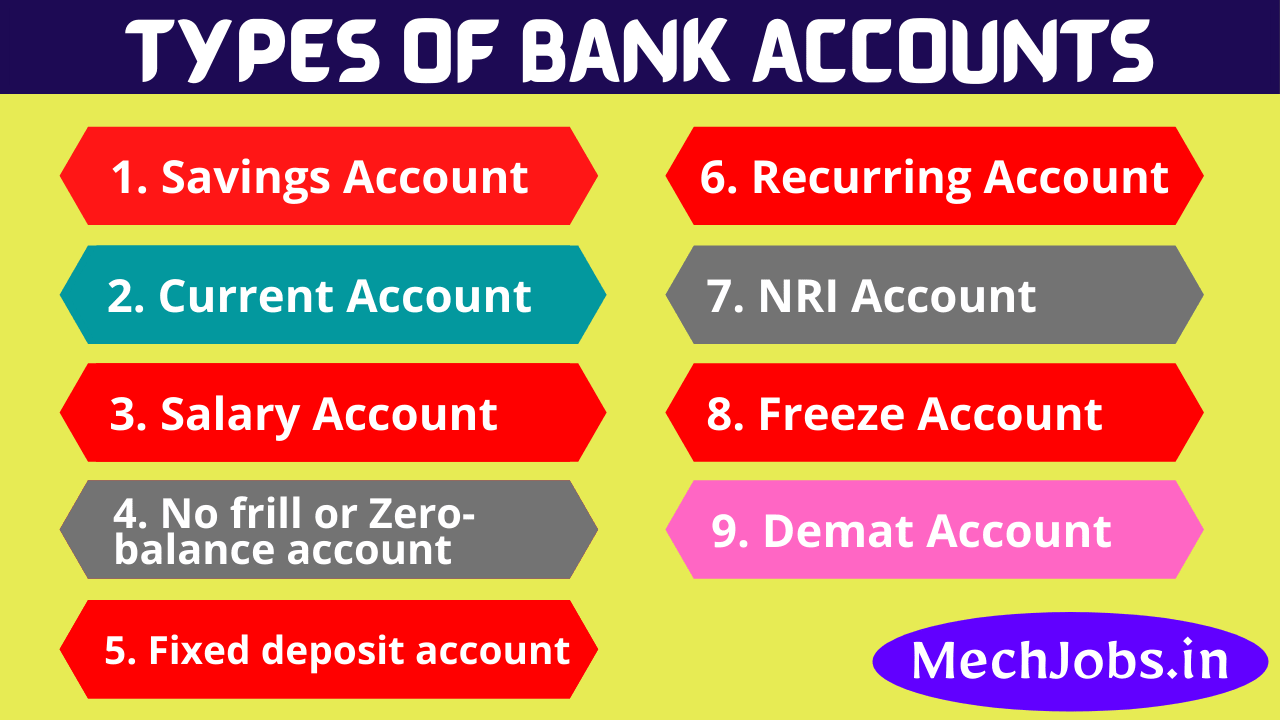

Camden National Bank offers a comprehensive suite of financial products and services tailored to meet the diverse needs of its customers. These include:

- Personal Banking: Checking and savings accounts, debit and credit cards, loans, mortgages, and investment services.

- Business Banking: Commercial loans, lines of credit, treasury management services, merchant services, and equipment financing.

- Wealth Management: Investment management, financial planning, trust services, and estate planning.

Mission and Values

Camden National Bank’s mission is to be the trusted financial partner for its customers and communities. The bank’s core values guide its operations and decision-making, ensuring a commitment to:

- Customer Focus: Providing exceptional customer service and building lasting relationships.

- Integrity: Adhering to the highest ethical standards and operating with transparency.

- Community Involvement: Supporting local initiatives and contributing to the well-being of the communities it serves.

- Innovation: Embracing new technologies and ideas to enhance customer experience and efficiency.

Key Locations and Branches

Camden National Bank has a network of branches strategically located across Maine, New Hampshire, and Massachusetts. The bank’s presence in these key locations ensures convenient access to its services for customers in the region. The bank also leverages online and mobile banking platforms to provide 24/7 access to its services.

Financial Performance and Growth

Camden National Bank has consistently demonstrated strong financial performance and growth over the years. The bank’s commitment to responsible lending practices, prudent asset management, and strategic initiatives has contributed to its financial stability and expansion.

Recent Financial Performance

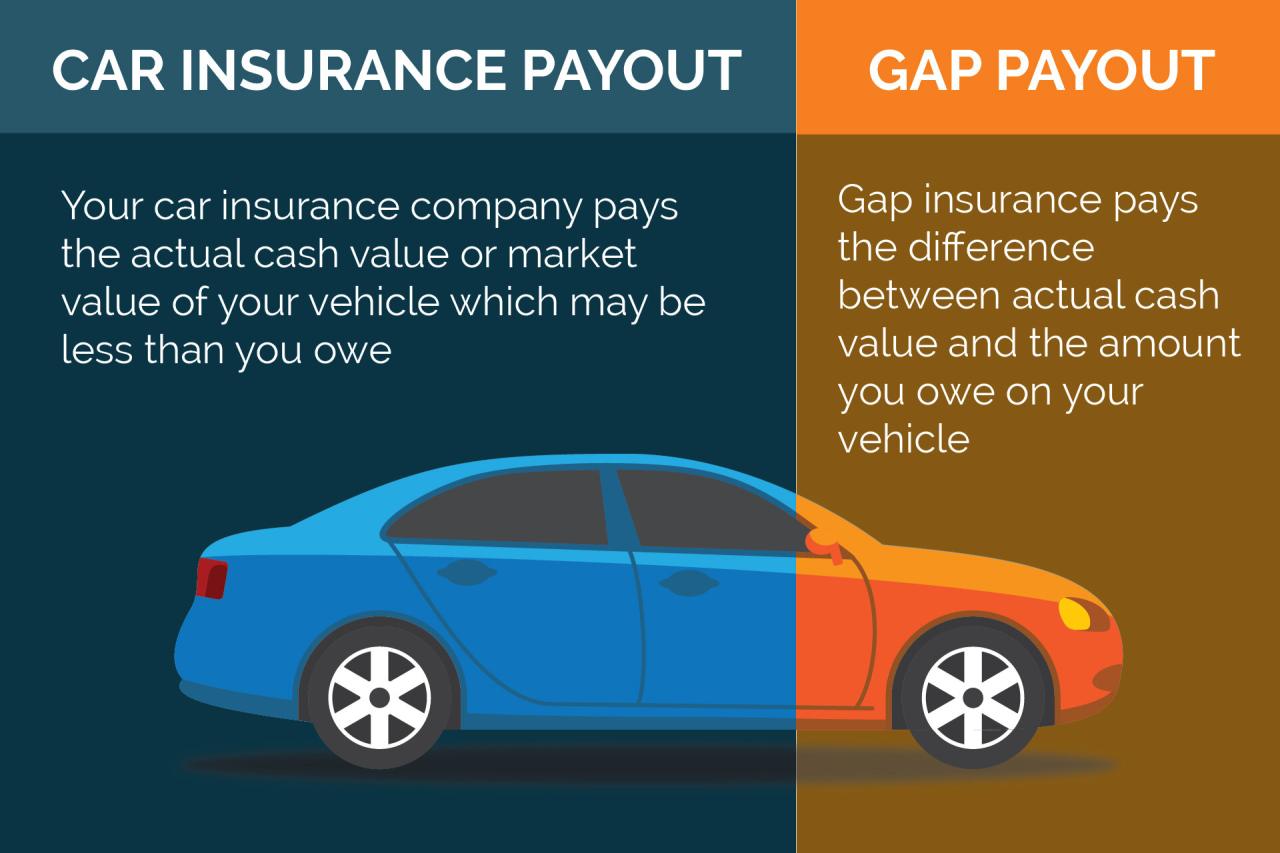

In recent years, Camden National Bank has reported solid financial results, reflecting its ability to navigate market fluctuations and maintain profitability. Key financial metrics like revenue, net income, and assets have shown positive trends, indicating the bank’s continued growth and resilience.

Key Financial Metrics

- Revenue: Camden National Bank’s revenue has steadily increased in recent years, driven by growth in loan originations, deposit balances, and fee-based services.

- Net Income: The bank’s net income has also shown a positive trend, reflecting its efficient operations and strong earnings performance.

- Assets: Camden National Bank’s assets have grown significantly over the years, indicating its expansion and increasing market share.

Growth Compared to Industry Benchmarks, Camden national bank

Camden National Bank’s growth has outpaced industry benchmarks, demonstrating its competitive advantage and ability to attract new customers and retain existing ones. The bank’s focus on personalized service, community involvement, and innovative solutions has contributed to its success.

Strategic Initiatives and Acquisitions

Camden National Bank has implemented strategic initiatives and acquisitions to enhance its product offerings, expand its geographic reach, and strengthen its market position. These initiatives have included investments in technology, expansion into new markets, and acquisitions of smaller banks.

If you’re having trouble with your Chase account, you might want to check out chase bank customer service options. They offer a variety of ways to get in touch, including online chat, phone, and email. You can also find answers to common questions on their website.

Customer Experience and Services: Camden National Bank

Camden National Bank is committed to providing exceptional customer service and creating a positive experience for its clients. The bank prioritizes building strong relationships with its customers and providing personalized solutions to meet their financial needs.

Customer Service Approach and Policies

Camden National Bank’s customer service approach is based on the principles of personalized attention, responsiveness, and transparency. The bank’s employees are trained to understand the unique needs of each customer and provide tailored solutions. The bank also has clear policies and procedures in place to ensure fair and ethical treatment of its customers.

Comparison of Services with Competitors

Camden National Bank’s services are comparable to those offered by its competitors in terms of product offerings and technology. However, the bank differentiates itself through its commitment to personalized service, community involvement, and its focus on building long-term relationships with its customers.

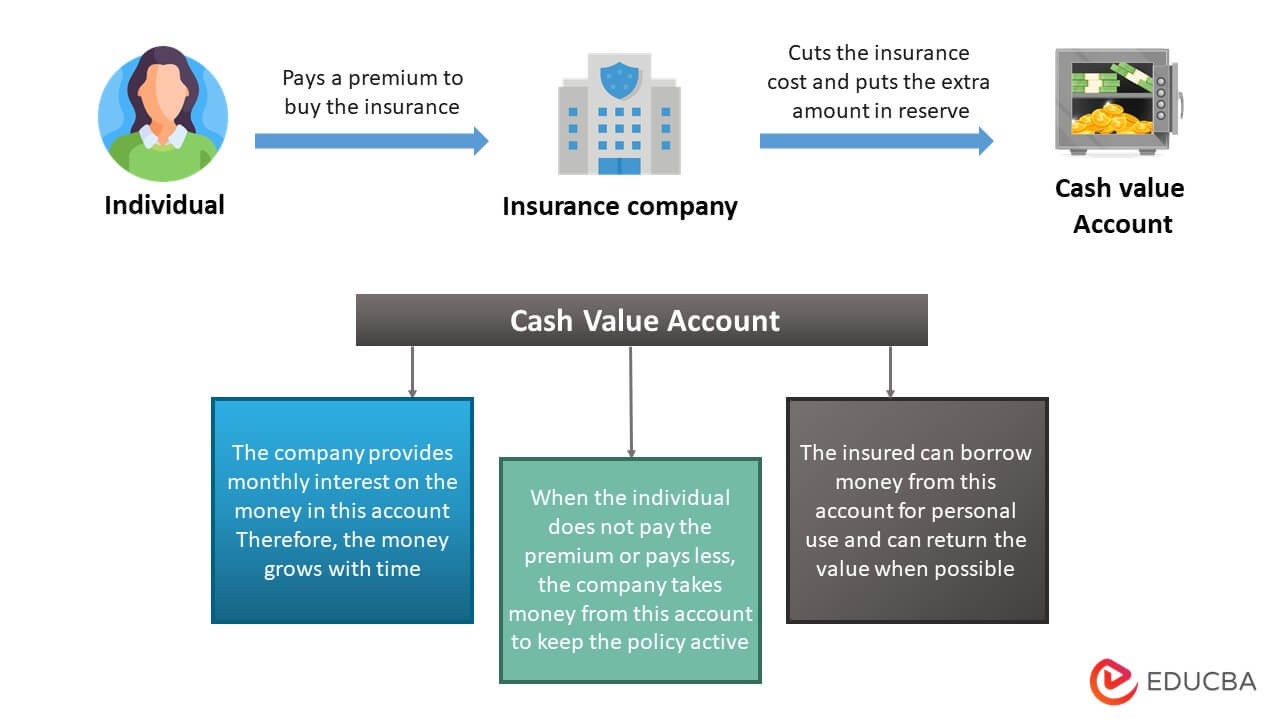

Digital Banking Features and Mobile App Capabilities

Camden National Bank offers a robust digital banking platform that provides customers with 24/7 access to their accounts and services. The bank’s mobile app allows customers to manage their finances, transfer funds, pay bills, and access other features from their smartphones or tablets.

| Feature | Description |

|---|---|

| Account Management | View account balances, transaction history, and statements. |

| Bill Pay | Schedule and pay bills online or through the mobile app. |

| Mobile Deposits | Deposit checks using your smartphone or tablet. |

| Account Transfers | Transfer funds between accounts easily and securely. |

| Alerts and Notifications | Receive alerts for low balances, transactions, and other important events. |

Case Study: Helping Businesses Succeed

Camden National Bank has a long history of supporting businesses in the communities it serves. One example is the bank’s partnership with a local manufacturing company that was facing financial challenges. Camden National Bank provided the company with a loan and financial guidance that helped it overcome its difficulties and achieve sustainable growth.

Community Involvement and Social Responsibility

Camden National Bank is deeply committed to its communities and believes in giving back to the areas where it operates. The bank actively engages in philanthropic activities, sponsorships, and initiatives to promote financial literacy and sustainability.

Commitment to Community Engagement

Camden National Bank is a strong advocate for community development and believes in supporting local initiatives that improve the quality of life for its residents. The bank’s employees are encouraged to volunteer their time and resources to local organizations and causes.

Philanthropic Activities and Sponsorships

Camden National Bank supports a wide range of philanthropic activities and sponsorships, including:

- Financial support for local non-profit organizations focused on education, healthcare, and social services.

- Sponsorships of community events and festivals.

- Employee volunteer programs that encourage employees to give back to their communities.

Environmental Sustainability Practices

Camden National Bank is committed to environmental sustainability and has implemented various practices to reduce its environmental impact, such as:

- Promoting energy efficiency in its branches and offices.

- Using recycled materials in its operations.

- Supporting initiatives that promote environmental conservation.

Financial Literacy and Education Initiatives

Camden National Bank believes in promoting financial literacy and education to empower individuals and communities. The bank offers various programs and resources to educate the public on financial topics such as budgeting, saving, and investing.

Industry Trends and Competitive Landscape

The banking industry is constantly evolving, driven by technological advancements, regulatory changes, and changing customer expectations. Camden National Bank is actively monitoring these trends and adapting its strategies to remain competitive in the marketplace.

Current Trends in the Banking Industry

Key trends shaping the banking industry include:

- Digital Transformation: Banks are increasingly adopting digital technologies to enhance customer experience, improve efficiency, and expand their reach.

- Regulatory Changes: The banking industry is subject to ongoing regulatory changes, which impact banks’ operations and compliance requirements.

- Competition from Non-Traditional Players: Banks are facing increased competition from non-traditional players such as fintech companies and technology giants that are offering financial services.

Major Competitors of Camden National Bank

Camden National Bank faces competition from a variety of financial institutions, including:

- Regional Banks: Other regional banks operating in the northeastern United States.

- National Banks: Large national banks with branches in the region.

- Credit Unions: Cooperative financial institutions serving specific groups of members.

- Fintech Companies: Technology-driven companies offering financial services.

Impact of Regulatory Changes and Technological Advancements

Regulatory changes and technological advancements have a significant impact on the banking industry. Banks must adapt to new regulations, invest in technology, and innovate to stay ahead of the curve.

Strengths and Weaknesses Compared to Competitors

| Strength | Weakness |

|---|---|

| Strong Community Presence | Smaller Geographic Reach Compared to National Banks |

| Personalized Customer Service | Limited Investment Products Compared to Larger Banks |

| Commitment to Community Involvement | Less Digital Innovation Compared to Some Fintech Companies |

Concluding Remarks

Camden National Bank stands as a testament to the power of community-focused banking. Its dedication to customer service, financial stability, and community engagement has solidified its position as a trusted partner in the region. The bank’s commitment to innovation, coupled with its unwavering commitment to its customers and communities, positions it for continued growth and success in the evolving banking landscape.