Whole life insurance sets the stage for a comprehensive look at a financial product that offers lifelong coverage and a cash value component. This type of insurance provides a safety net for your loved ones, ensuring their financial security in the event of your passing.

But it’s not just about protection; it’s also about building wealth through the accumulation of cash value, which can be accessed for various purposes, like retirement planning, education expenses, or even a down payment on a home.

Whole life insurance is a long-term investment that can offer a range of benefits, but it’s important to understand its intricacies and consider its potential drawbacks before making a decision. This guide delves into the details of whole life insurance, covering its benefits, drawbacks, and how to choose the right policy for your individual needs.

What is Whole Life Insurance?

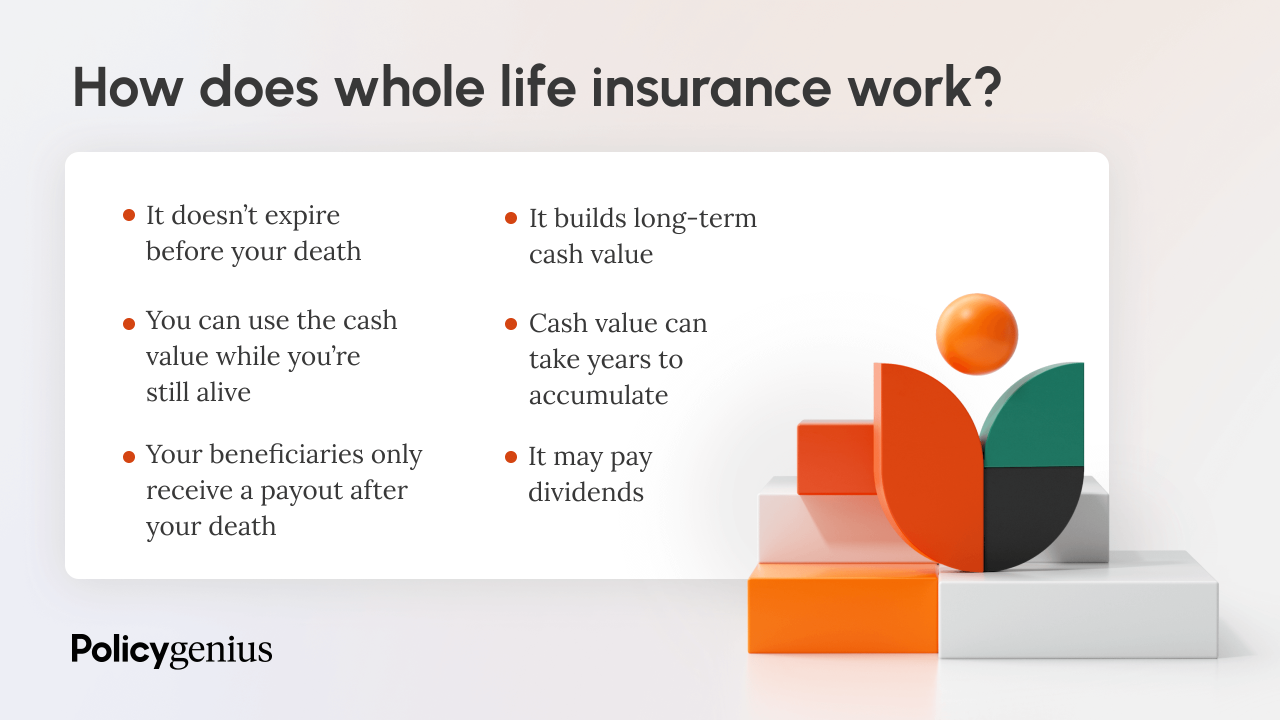

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and builds cash value. This means you’ll have coverage for your entire life, as long as you keep paying your premiums, and you’ll also have the opportunity to accumulate cash value that you can access in the future.

Key Features of Whole Life Insurance

Whole life insurance is characterized by its permanent coverage and cash value component. Let’s explore these features in more detail:

- Permanent Coverage:Whole life insurance policies provide lifelong coverage, meaning they will remain in effect for your entire life, as long as you continue to pay your premiums. This is in contrast to term life insurance, which only provides coverage for a specific period.

- Cash Value Component:A portion of your premium payments goes towards building cash value, which grows over time. This cash value can be accessed through borrowing or withdrawals, offering financial flexibility.

Situations Where Whole Life Insurance Might Be Suitable

Whole life insurance can be a suitable option for individuals seeking lifelong coverage and a savings component. Consider these situations:

- Long-term financial security:If you want guaranteed coverage for your entire life, whole life insurance can provide peace of mind.

- Estate planning:Whole life insurance can be used to provide funds for inheritance tax payments or cover estate administration costs.

- Retirement planning:The cash value component can be used as a source of funds during retirement.

- Legacy building:Whole life insurance can be used to leave a financial legacy for your loved ones.

Benefits of Whole Life Insurance

Whole life insurance offers a range of advantages, making it an attractive option for many individuals. Here are some key benefits:

Lifelong Coverage

Whole life insurance provides coverage for your entire life, as long as you continue to pay your premiums. This offers peace of mind knowing your loved ones will be financially protected regardless of when you pass away.

Guaranteed Premiums

Whole life insurance policies typically have fixed premiums that remain the same throughout the life of the policy. This predictability can help with long-term financial planning.

Cash Value Accumulation

A portion of your premium payments goes towards building cash value, which grows over time. This cash value can be used for various purposes, such as:

- Borrowing:You can borrow against your cash value at a relatively low interest rate, providing access to funds without having to sell the policy.

- Withdrawals:You can withdraw from your cash value, although withdrawals may reduce the death benefit and cash value growth.

- Retirement income:The cash value can be used as a source of income during retirement.

Potential Tax Benefits

Whole life insurance policies offer potential tax benefits, such as:

- Tax-deferred growth:The cash value grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them.

- Tax-free death benefit:The death benefit paid to your beneficiaries is generally tax-free.

Drawbacks of Whole Life Insurance

While whole life insurance offers numerous benefits, it’s essential to consider its potential drawbacks before making a decision. Here are some key disadvantages:

Higher Premiums

Whole life insurance premiums are typically higher than term life insurance premiums because they cover both death benefits and cash value accumulation. This can make whole life insurance less affordable for some individuals.

Potential for Lower Returns on Cash Value, Whole life insurance

The cash value component of whole life insurance may not grow as quickly as other investment options, such as stocks or mutual funds. This is because the cash value is invested in a conservative manner, typically in bonds or other fixed-income securities.

Risks Associated with Whole Life Insurance

Whole life insurance policies come with certain risks, such as:

- Lapsing the policy:If you stop paying your premiums, your policy may lapse, and you could lose the cash value you’ve accumulated.

- Lower death benefit:If you withdraw from your cash value, it may reduce the death benefit you receive.

Cost Comparison to Other Types of Life Insurance

When comparing the cost of whole life insurance to other types of life insurance, it’s essential to consider the trade-offs involved. While whole life insurance provides lifelong coverage and cash value accumulation, it comes with higher premiums. Term life insurance, on the other hand, is generally more affordable but only provides coverage for a specific period.

The best type of life insurance for you will depend on your individual needs and financial circumstances.

Choosing the Right Whole Life Insurance Policy

Choosing the right whole life insurance policy involves considering several factors. Here’s a guide to help you make an informed decision:

Factors to Consider

- Coverage amount:Determine how much coverage you need to meet your financial obligations and protect your loved ones.

- Premium affordability:Choose a policy with premiums you can comfortably afford throughout the life of the policy.

- Cash value growth potential:Consider the potential for cash value growth and how it aligns with your financial goals.

Checklist of Questions to Ask Potential Insurance Providers

When comparing whole life insurance policies, ask these questions to ensure you’re getting the best policy for your needs:

- What are the premiums and how are they calculated?

- What is the cash value growth rate and how is it determined?

- What are the fees and charges associated with the policy?

- What are the policy’s death benefit and cash value withdrawal options?

- What are the policy’s surrender charges and how long do they last?

- What are the policy’s loan options and interest rates?

Comparing Whole Life Insurance Policies

When comparing different whole life insurance policies, consider the following:

- Premiums:Compare the premiums of different policies based on the coverage amount and your age.

- Cash value growth:Compare the potential for cash value growth based on the policy’s interest rate and investment strategy.

- Fees and charges:Compare the fees and charges associated with each policy, such as surrender charges, loan interest rates, and administrative fees.

Whole Life Insurance vs. Term Life Insurance

Whole life insurance and term life insurance are two distinct types of life insurance that offer different benefits and drawbacks. Understanding their key differences can help you determine which type of insurance is right for you.

Key Differences

- Coverage Duration:Whole life insurance provides lifelong coverage, while term life insurance only provides coverage for a specific period, typically 10 to 30 years.

- Premiums:Whole life insurance premiums are generally higher than term life insurance premiums because they cover both death benefits and cash value accumulation.

- Cash Value:Whole life insurance policies build cash value, which can be accessed through borrowing or withdrawals. Term life insurance policies do not have a cash value component.

Pros and Cons

Whole Life Insurance

- Pros:Lifelong coverage, guaranteed premiums, cash value accumulation, potential tax benefits.

- Cons:Higher premiums, potential for lower returns on cash value, risk of lapsing the policy.

Term Life Insurance

- Pros:Lower premiums, more affordable, flexibility to adjust coverage as your needs change.

- Cons:Limited coverage period, no cash value accumulation, premiums may increase when you renew the policy.

Scenario-Based Analysis

Consider these scenarios to illustrate when each type of insurance might be the better choice:

- Young family with limited budget:Term life insurance may be a more affordable option to provide coverage for a specific period, such as while children are young.

- Individual seeking lifelong coverage and a savings component:Whole life insurance can provide both lifelong coverage and cash value accumulation.

- Individual nearing retirement:Term life insurance may no longer be necessary as financial obligations decrease, and whole life insurance can provide a source of retirement income through its cash value component.

Whole Life Insurance and Estate Planning

Whole life insurance can be a valuable tool for estate planning, providing funds for various purposes and ensuring a smooth transition of assets to your beneficiaries.

Uses in Estate Planning

- Inheritance tax payments:Whole life insurance can provide funds to cover inheritance taxes, ensuring your beneficiaries receive the full value of your estate.

- Estate administration costs:The death benefit can help cover estate administration costs, such as legal fees, probate fees, and funeral expenses.

- Business succession planning:Whole life insurance can be used to provide funds for a business buy-sell agreement, ensuring a smooth transition of ownership in the event of the owner’s death.

Incorporating Whole Life Insurance into Estate Planning Strategies

- Beneficiary designations:Carefully designate beneficiaries for your whole life insurance policy to ensure the death benefit is distributed according to your wishes.

- Trusts:You can set up a trust to hold your whole life insurance policy, providing greater control over how the death benefit is distributed and protecting assets from creditors.

Benefits and Drawbacks of Using Whole Life Insurance for Estate Planning

| Benefit | Drawback |

|---|---|

| Provides funds for inheritance tax payments and estate administration costs. | May not be the most cost-effective solution compared to other estate planning tools. |

| Can help ensure a smooth transition of assets to beneficiaries. | Premiums can be expensive, and the cash value may not grow as quickly as other investment options. |

| Can be used to create a legacy for your loved ones. | May not be suitable for all estate planning needs. |

Ultimate Conclusion

Whole life insurance is a powerful financial tool that can provide both protection and investment opportunities. However, it’s crucial to weigh its advantages against its potential drawbacks and to choose a policy that aligns with your specific financial goals and risk tolerance.

By carefully considering your options and understanding the nuances of whole life insurance, you can make an informed decision that empowers you to secure your family’s future and achieve your financial aspirations.