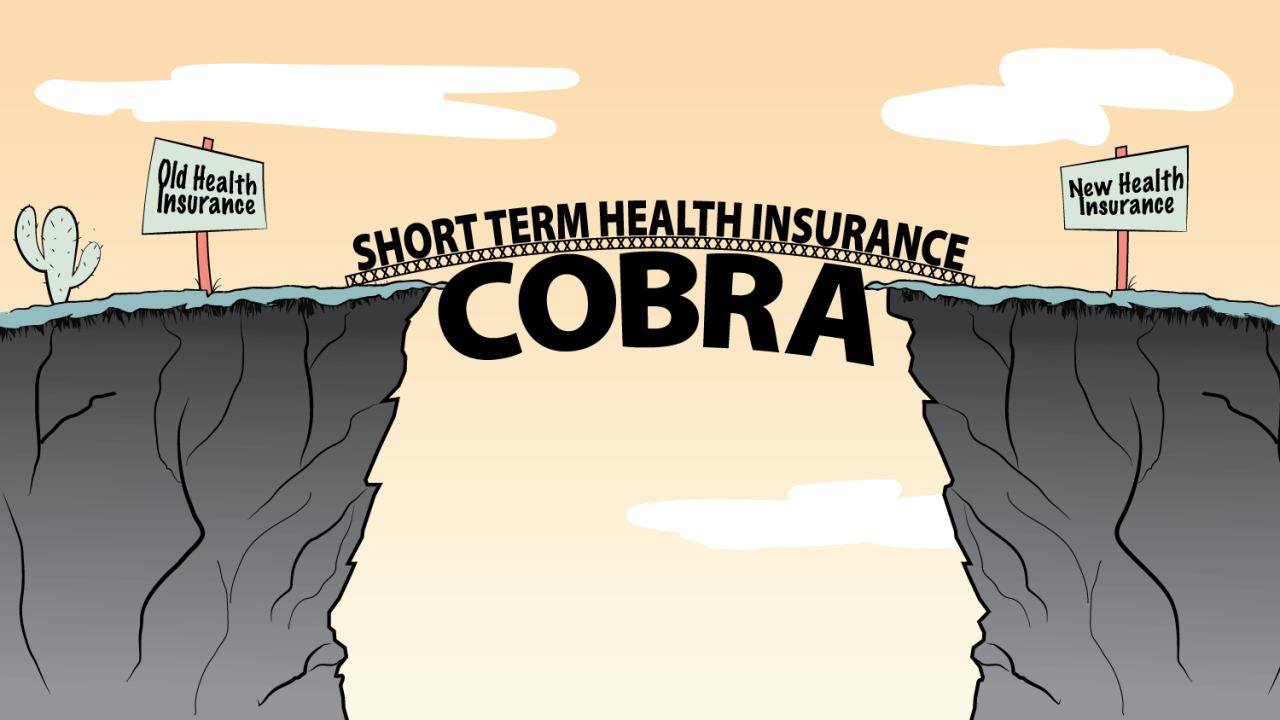

Cobra insurance, short for Consolidated Omnibus Budget Reconciliation Act, provides a lifeline to individuals who have lost their employer-sponsored health insurance. This vital program allows former employees to continue their coverage for a limited time, bridging the gap between jobs and ensuring access to essential healthcare.

Understanding the nuances of Cobra insurance is crucial, as it involves eligibility criteria, premium costs, coverage limitations, and potential alternatives. This guide will delve into the intricacies of this program, empowering you with the knowledge to navigate the complexities of health insurance during a job transition.

Cobra Insurance Overview

Cobra insurance, also known as the Consolidated Omnibus Budget Reconciliation Act of 1985, is a federal law that allows eligible individuals to continue their health insurance coverage after losing their jobs or experiencing a change in employment status.

Cobra insurance is designed to provide a temporary bridge for individuals who have lost their employer-sponsored health insurance, allowing them to maintain coverage until they find new employment or qualify for another health insurance plan.

Cobra Insurance Program

The Cobra insurance program provides individuals with the option to continue their existing health insurance plan through their former employer, under certain conditions. This coverage is typically available for a limited period of time, generally 18 months, but can be extended in certain circumstances.

Cobra Insurance Eligibility

To be eligible for Cobra insurance, individuals must meet specific criteria, which typically include:

- Having lost their jobs due to termination, layoff, or reduction in work hours

- Having been covered under the employer’s health insurance plan immediately before the qualifying event

- The employer must have at least 20 employees

Individuals may be ineligible for Cobra insurance if they are:

- Fired for gross misconduct

- Enrolled in Medicare

- Covered under another group health plan

Cobra Insurance Premiums and Costs

Cobra insurance premiums are typically higher than employer-sponsored health insurance premiums. This is because employers are not required to subsidize Cobra premiums, and the insurance company must cover administrative costs and the risk of insuring a group of individuals who may be more likely to have health issues.

Factors that can influence Cobra insurance premiums include:

- The type of health insurance plan

- The individual’s age and health status

- The geographic location

Here is a table outlining the potential costs associated with Cobra insurance:

| Cost | Potential Amount |

|---|---|

| Monthly Premium | $500-$1,500 or more |

| Out-of-Pocket Expenses | Varies depending on the plan and health needs |

Cobra Insurance Coverage and Benefits

Cobra insurance plans typically cover the same benefits as the employer-sponsored health insurance plan that the individual was previously enrolled in. These benefits may include:

- Hospitalization

- Surgical procedures

- Doctor visits

- Prescription drugs

Cobra insurance may have some limitations compared to other types of health insurance plans, such as:

- Higher premiums

- Limited coverage for pre-existing conditions

- Shorter duration of coverage

Here is a table comparing Cobra insurance benefits with other types of health insurance plans:

| Benefit | Cobra Insurance | Employer-Sponsored Health Insurance | Individual Health Insurance |

|---|---|---|---|

| Premiums | Higher | Lower | Varies |

| Coverage | Limited | Comprehensive | Varies |

| Benefits | Same as previous employer plan | May vary depending on employer | Varies depending on plan |

Cobra Insurance Alternatives

Individuals who are not eligible for Cobra insurance or who find the cost of Cobra insurance to be prohibitive may want to consider alternative health insurance options.

Here are some common alternatives to Cobra insurance:

- Individual health insurance plans

- State health insurance marketplaces

- Medicaid

- Medicare

Cobra Insurance and the Affordable Care Act

The Affordable Care Act (ACA) has significantly impacted the health insurance landscape in the United States, including Cobra insurance. The ACA has expanded health insurance coverage for millions of Americans and has made it easier for individuals to find affordable health insurance plans.

The ACA has also made some changes to Cobra insurance, including:

- Extending the Cobra coverage period for individuals who have lost their jobs due to a plant closing or mass layoff

- Providing subsidies to help individuals afford Cobra insurance

Cobra Insurance and Small Businesses

Cobra insurance can present challenges for small businesses, as they are required to offer Cobra coverage to former employees under certain circumstances. Small businesses may find it difficult to manage the costs of Cobra insurance, especially if they have a high turnover rate.

Here are some strategies that small businesses can employ to manage Cobra insurance costs:

- Offer a self-funded health insurance plan

- Shop around for the most affordable Cobra insurance plan

- Consider offering a health savings account (HSA) to employees

Cobra Insurance and Legal Considerations

Cobra insurance is subject to a number of legal regulations, including the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. These laws Artikel the rights and responsibilities of employers and employees under Cobra insurance.

Here are some key legal considerations for Cobra insurance:

- Employers must provide Cobra coverage to eligible individuals

- Employers must notify employees of their Cobra rights

- Employees have the right to appeal Cobra coverage decisions

Cobra Insurance and Financial Planning

Cobra insurance can have significant financial implications for individuals. It is important to factor in the cost of Cobra insurance when planning your finances.

Here are some tips for managing the cost of Cobra insurance:

- Shop around for the most affordable Cobra insurance plan

- Consider using a health savings account (HSA) to pay for medical expenses

- Budget for Cobra insurance premiums

Cobra Insurance: Future Trends

The future of Cobra insurance is uncertain, as the health insurance landscape continues to evolve. Some potential trends include:

- Increased use of telehealth and virtual care

- Growing popularity of high-deductible health plans

- Potential changes to Cobra regulations

Last Recap: Cobra Insurance

Navigating the world of health insurance can be daunting, especially when faced with job loss. Cobra insurance provides a crucial safety net, offering temporary coverage and peace of mind during a transition period. By understanding the intricacies of this program, individuals can make informed decisions about their health insurance needs and ensure continuity of care.