Full coverage car insurance offers a comprehensive shield against financial burdens in the event of an accident, theft, or damage. It’s a safety net that provides peace of mind, knowing you’re protected from the unexpected. This type of insurance goes beyond the legal minimum requirements, offering a broader range of coverage that can safeguard your financial well-being and your vehicle.

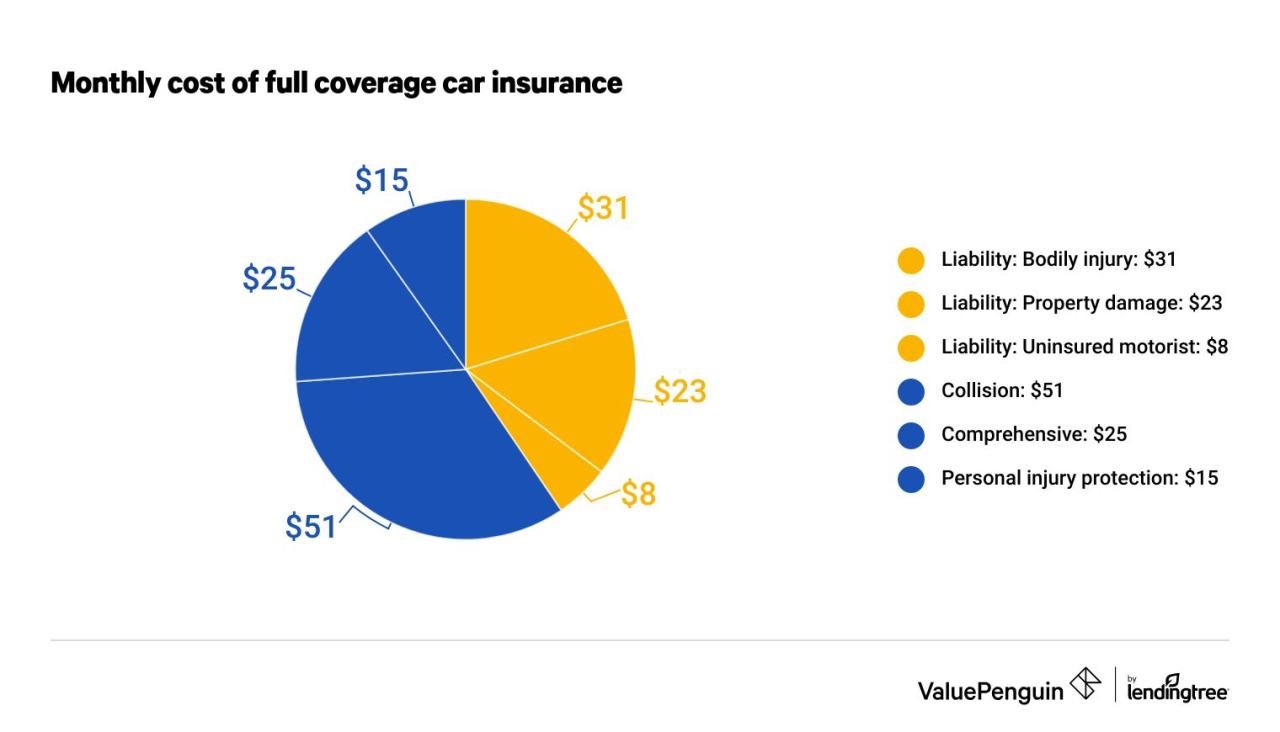

Full coverage car insurance typically includes collision, comprehensive, liability, and uninsured/underinsured motorist coverage. Collision coverage protects you if you’re in an accident with another vehicle or an object, while comprehensive coverage covers damage from events like theft, vandalism, or natural disasters.

Liability coverage protects you financially if you cause an accident and injure someone or damage their property. Uninsured/underinsured motorist coverage steps in if you’re hit by a driver who doesn’t have insurance or has inadequate coverage.

What is Full Coverage Car Insurance?

Full coverage car insurance is a comprehensive type of insurance policy that provides protection against a wide range of risks, including accidents, theft, and damage to your vehicle. This type of insurance offers peace of mind and financial security, ensuring you’re covered in various unforeseen situations.

It’s essential to understand the different components of full coverage insurance to make an informed decision about your car insurance needs.

Core Components of Full Coverage Car Insurance

Full coverage car insurance typically includes several key components, each designed to cover specific risks:

- Collision Coverage:This coverage pays for repairs or replacement of your vehicle if it’s involved in an accident, regardless of who’s at fault. For example, if you hit another car or collide with a stationary object, collision coverage will help cover the costs of repairs or replacement.

- Comprehensive Coverage:This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, natural disasters (like hail or floods), and animal collisions. For instance, if your car is stolen or damaged by a hailstorm, comprehensive coverage will help you recover the costs.

- Liability Coverage:This coverage is mandatory in most states and protects you financially if you’re responsible for an accident that causes injury or damage to another person or property. Liability coverage covers medical expenses, property damage, and legal fees associated with the accident.

For example, if you cause an accident and injure another driver, liability coverage will help pay for their medical bills and other related expenses.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical expenses, lost wages, and property damage if the other driver is at fault. For instance, if you’re hit by a driver who doesn’t have insurance, uninsured motorist coverage will help cover your losses.

Cybersecurity is a major concern for businesses of all sizes, and having the right insurance coverage is essential. If you’re looking for comprehensive protection, check out the cyber insurance coverage Silverfort offers. Their policies can help you mitigate the financial risks associated with data breaches, ransomware attacks, and other cyber threats.

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers several benefits that can provide peace of mind and financial protection:

- Financial Protection in Case of Accidents:Full coverage insurance helps you financially recover from accidents, whether you’re at fault or not. It covers repairs or replacement of your vehicle, medical expenses, and property damage, reducing the financial burden of an accident.

- Protection Against Theft and Damage:Comprehensive coverage protects your vehicle from theft, vandalism, and damage caused by events like hailstorms, floods, and animal collisions. This coverage ensures you’re financially covered in case of unexpected events that damage your car.

- Maintaining Credit Score:If you’re involved in an accident and don’t have full coverage insurance, you might face significant financial losses that could negatively impact your credit score. Full coverage insurance helps protect your credit score by ensuring you can handle the costs associated with accidents or damage to your vehicle.

Cybersecurity is a critical concern for businesses of all sizes, and having the right insurance coverage is essential. If you’re looking for a comprehensive solution, check out cyber insurance coverage Silverfort. Their policies offer protection against a wide range of cyber threats, including data breaches, ransomware attacks, and more.

- Peace of Mind:Knowing you have full coverage insurance can provide peace of mind, knowing you’re financially protected in case of unexpected events. This peace of mind can reduce stress and allow you to focus on other aspects of your life.

Factors Affecting Full Coverage Premiums

Several factors influence the cost of full coverage car insurance premiums. Understanding these factors can help you make informed decisions and potentially lower your insurance costs:

Key Factors Influencing Full Coverage Premiums

- Driving History:Your driving history, including accidents, traffic violations, and driving record, significantly impacts your insurance premiums. Drivers with a clean driving record generally receive lower premiums than those with a history of accidents or violations.

- Age:Younger drivers typically pay higher insurance premiums due to their higher risk of accidents. As you age and gain experience, your premiums tend to decrease. Insurance companies consider age as a factor in assessing risk.

- Vehicle Type:The type of vehicle you drive significantly affects your insurance premiums. High-performance cars, luxury vehicles, and vehicles with high repair costs generally have higher insurance premiums. This is because these vehicles are considered higher risk and more expensive to repair or replace.

- Location:Your location plays a role in determining your insurance premiums. Areas with higher crime rates, traffic congestion, and accident rates often have higher insurance premiums. Insurance companies consider the risk of accidents and theft in different locations.

- Credit Score:In some states, insurance companies may use your credit score as a factor in determining your insurance premiums. This is because studies have shown a correlation between credit score and insurance claims. Drivers with good credit scores may receive lower premiums.

Tips to Potentially Lower Insurance Premiums

- Maintain a Clean Driving Record:Avoid accidents and traffic violations to keep your driving record clean. This can significantly reduce your insurance premiums.

- Consider a Safe Driving Course:Completing a safe driving course can demonstrate your commitment to safe driving and may result in a discount on your insurance premiums.

- Choose a Safe Vehicle:Opt for a vehicle with safety features like airbags, anti-lock brakes, and stability control. These features can reduce your risk of accidents and potentially lower your premiums.

- Increase Your Deductible:A higher deductible means you pay more out of pocket in case of an accident, but it can lower your insurance premiums. Consider your financial situation and risk tolerance when deciding on a deductible.

- Shop Around for Quotes:Get quotes from multiple insurance companies to compare prices and coverage options. This can help you find the best deal that meets your needs and budget.

Full Coverage vs. Minimum Coverage: Full Coverage Car Insurance

Full coverage car insurance provides comprehensive protection, but it’s not always the most cost-effective option for everyone. Minimum coverage, also known as liability-only coverage, is a less expensive option that meets the minimum state requirements. Understanding the pros and cons of each type of coverage can help you choose the best option for your situation.

Full Coverage

- Pros:

- Comprehensive protection against accidents, theft, and damage.

- Financial security in case of unexpected events.

- Peace of mind knowing you’re covered.

- Cons:

- Higher premiums compared to minimum coverage.

- May not be necessary if you have an older vehicle with low value.

Minimum Coverage

- Pros:

- Lower premiums than full coverage.

- Meets minimum state requirements.

- Cons:

- Limited coverage, only protecting you against liability claims.

- No coverage for damage to your own vehicle in an accident.

- Financial risk if your vehicle is damaged or stolen.

Choosing the Right Coverage

- Vehicle Value:If you have a newer or high-value vehicle, full coverage might be more suitable. If your vehicle is older and has a lower value, minimum coverage might be sufficient.

- Financial Situation:Consider your financial situation and ability to cover costs in case of an accident or damage to your vehicle. If you can’t afford full coverage, minimum coverage might be a better option.

- Risk Tolerance:Assess your risk tolerance. If you’re comfortable taking on more financial risk, minimum coverage might be sufficient. If you prefer the peace of mind that comes with full coverage, then full coverage might be a better choice.

Choosing the Right Full Coverage Policy

Selecting the appropriate full coverage insurance policy involves considering your individual needs and circumstances. Understanding the different aspects of a policy can help you make an informed decision.

Coverage Limits and Deductibles, Full coverage car insurance

- Coverage Limits:These limits determine the maximum amount your insurance company will pay for covered losses. Higher coverage limits provide more financial protection but also come with higher premiums.

- Deductibles:This is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, but you’ll have to pay more in case of an accident.

Role of Insurance Agents and Brokers

- Insurance agents and brokers can provide valuable guidance in choosing the right full coverage policy. They can help you understand different coverage options, compare quotes, and find the best policy that meets your needs and budget.

Full Coverage Car Insurance in Different Situations

Full coverage car insurance provides protection in various situations, offering financial security and peace of mind.

Accidents Involving Multiple Vehicles

- Full coverage insurance can help cover costs associated with accidents involving multiple vehicles, including repairs or replacement of your vehicle, medical expenses, and property damage. It also protects you from liability claims from other drivers involved in the accident.

Natural Disasters

- Comprehensive coverage protects your vehicle from damage caused by natural disasters like hailstorms, floods, and earthquakes. This coverage ensures you’re financially covered in case of unexpected events that damage your car.

Vehicle Theft

- Comprehensive coverage provides financial protection if your vehicle is stolen. It covers the cost of replacing your vehicle or compensating you for its value, depending on the policy terms.

Claims Process

- If you need to file a claim, your insurance company will guide you through the process. You’ll typically need to provide details about the incident, such as a police report or witness statements. The insurance company will investigate the claim and determine the extent of coverage and compensation.

Closing Summary

Understanding the nuances of full coverage car insurance is crucial for making informed decisions about your financial protection on the road. By weighing the benefits and considering your individual needs, you can choose the right policy to ensure peace of mind and financial security.

Remember, your car insurance is a critical investment in your well-being and financial stability. Take the time to understand your options and select a policy that provides the coverage you need.