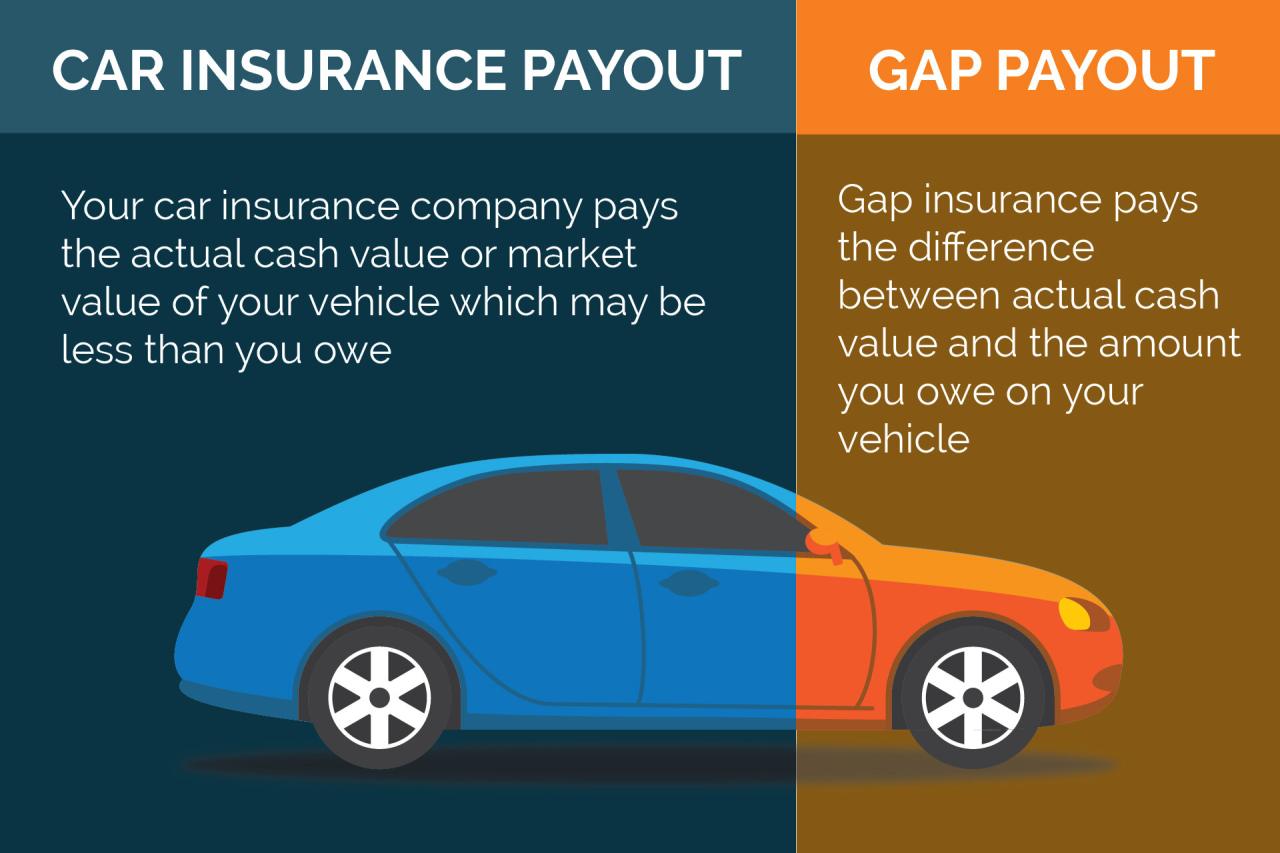

What is gap insurance? It’s a type of insurance that covers the difference between what you owe on your car loan and what your car is worth in the event of a total loss. Imagine this: you’re driving your car and it’s totaled in an accident.

Your insurance company pays out the actual cash value of your car, but that amount might be less than what you still owe on your loan. This is where gap insurance steps in, filling the financial gap and protecting you from potentially significant out-of-pocket expenses.

Gap insurance is often purchased alongside your regular car insurance and can be a valuable addition for those who finance their vehicles. It’s particularly beneficial for individuals who make a large down payment or have a long loan term, as these factors can increase the potential difference between the car’s value and the loan amount.

What is Gap Insurance?

Gap insurance is a type of insurance that helps to cover the difference between the actual cash value (ACV) of your vehicle and the amount you still owe on your auto loan or lease. It’s essentially a safety net for situations where your vehicle is totaled or stolen, and your insurance payout doesn’t fully cover your outstanding debt.

Getting an insurance quote is a good first step to securing the right coverage for your needs. It allows you to compare prices and coverage options from different providers to find the best deal for you.

Defining Gap Insurance and Its Purpose

Gap insurance is designed to protect you from financial hardship if your vehicle is damaged beyond repair or stolen. It bridges the gap between what your insurance company pays for your vehicle and what you still owe on your loan or lease.

Distinguishing Gap Insurance from Other Insurance Types

Gap insurance is distinct from other types of auto insurance, such as collision, comprehensive, or liability coverage. While these policies cover damages caused by accidents or theft, they only pay the ACV of your vehicle, which typically depreciates over time.

Gap insurance steps in to cover the remaining balance you owe, protecting you from potential financial losses.

Situations Where Gap Insurance Might Be Beneficial

- New Vehicles:New cars depreciate quickly, making gap insurance especially valuable for new car owners. The difference between the ACV and the loan amount can be significant, especially if you financed the vehicle for a longer term.

- High-Value Vehicles:Luxury or high-performance vehicles tend to depreciate faster than average vehicles. Gap insurance can help mitigate the financial risk associated with these vehicles.

- Longer Loan Terms:The longer your loan term, the more time your vehicle has to depreciate, increasing the potential gap between the ACV and the loan amount. Gap insurance can protect you in these situations.

How Gap Insurance Works

Gap insurance works by paying the difference between the ACV of your vehicle and the outstanding balance on your loan or lease, up to a certain limit. The payout is typically calculated based on the difference between these two amounts at the time of the loss.

Calculating Gap Insurance Payouts

To determine the gap insurance payout, the insurer will typically consider the following factors:

- ACV of the vehicle:This is the estimated market value of your vehicle based on its age, condition, and mileage.

- Outstanding loan or lease balance:This is the amount you still owe on your vehicle financing.

- Gap insurance coverage limit:This is the maximum amount your gap insurance policy will pay out.

Factors Influencing Gap Insurance Costs

The cost of gap insurance can vary depending on several factors, including:

- Vehicle make and model:Certain vehicles depreciate faster than others, influencing the potential gap and the cost of insurance.

- Loan amount:The higher your loan amount, the greater the potential gap, and the higher the insurance cost.

- Loan term:Longer loan terms typically result in higher gap insurance premiums.

- Your driving history:Your driving record can impact your overall insurance premiums, including gap insurance.

Choosing the Right Gap Insurance Policy

When choosing a gap insurance policy, consider the following tips:

- Compare policies from different insurers:Shop around to find the best coverage and rates.

- Understand the coverage limits:Be sure to understand the maximum amount your policy will pay out.

- Review the terms and conditions:Pay attention to any exclusions or limitations in the policy.

Benefits of Gap Insurance

Gap insurance provides valuable financial protection for car owners, helping to mitigate the financial burden associated with vehicle loss or damage.

Getting an insurance quote is a smart move before you commit to any policy. It gives you a clear picture of the costs involved and helps you compare different options. This way, you can find the best coverage at the most affordable price.

Financial Protection

Gap insurance acts as a financial safety net, ensuring that you’re not left with a substantial debt after a total loss or theft. It covers the difference between your insurance payout and the remaining loan balance, preventing you from facing financial hardship.

Reduced Out-of-Pocket Expenses

Without gap insurance, you could be responsible for paying the difference between the ACV and the loan amount out of your own pocket. Gap insurance helps reduce these out-of-pocket expenses, protecting your financial well-being.

Real-Life Scenarios

- Scenario 1:A new car owner is involved in an accident that totals their vehicle. Their insurance company pays the ACV, which is significantly lower than the outstanding loan balance. Gap insurance covers the remaining debt, preventing the owner from being stuck with a large financial burden.

- Scenario 2:A car owner with a high-value vehicle has their car stolen. Their insurance payout covers the ACV, but the loan balance is much higher. Gap insurance steps in to bridge the financial gap, allowing the owner to replace their vehicle without incurring significant out-of-pocket expenses.

Who Needs Gap Insurance?: What Is Gap Insurance

While gap insurance can be beneficial for many car owners, it’s particularly important for individuals in specific situations.

Individuals Who Benefit Most

- New car buyers:New vehicles depreciate quickly, making gap insurance a valuable protection for new car owners.

- Owners of high-value vehicles:Luxury or high-performance vehicles depreciate faster than average vehicles, increasing the potential gap between the ACV and the loan amount.

- Individuals with longer loan terms:The longer your loan term, the more time your vehicle has to depreciate, making gap insurance more beneficial.

Potential Risks of Not Having Gap Insurance

Not having gap insurance can lead to significant financial risks, particularly in situations where your vehicle is totaled or stolen and the insurance payout is less than your loan balance. You could be left with a substantial debt that you’ll need to pay off, even though you no longer have a vehicle.

Factors to Consider, What is gap insurance

When deciding whether gap insurance is necessary, consider the following factors:

- Vehicle age and condition:Newer vehicles depreciate faster, increasing the potential gap.

- Loan amount and term:Higher loan amounts and longer loan terms increase the potential gap.

- Your financial situation:Assess your ability to cover a significant out-of-pocket expense in the event of a total loss or theft.

Common Misconceptions about Gap Insurance

There are some common misconceptions about gap insurance that can lead to confusion and potentially hinder your decision-making process.

Addressing Misconceptions

- Misconception 1:Gap insurance is only for new cars. Fact:While gap insurance is often recommended for new vehicles, it can also be beneficial for used cars, especially if the vehicle is financed for a longer term or has a high value.

- Misconception 2:Gap insurance is unnecessary. Fact:Gap insurance can provide valuable financial protection, particularly in situations where the insurance payout is less than the outstanding loan balance. It can help prevent you from being stuck with a large debt after a total loss or theft.

Understanding Terms and Conditions

It’s essential to understand the specific terms and conditions of your gap insurance policy. Pay attention to any exclusions, limitations, or requirements. For example, some policies may have a coverage limit, or they may not cover certain types of losses, such as damage caused by wear and tear.

Accurate Information

To ensure you’re making an informed decision, rely on accurate information from reputable sources, such as your insurance agent or financial advisor. Avoid relying on misinformation or hearsay.

Last Recap

Ultimately, deciding whether or not to purchase gap insurance is a personal choice that depends on your individual circumstances. By understanding the potential risks and benefits, you can make an informed decision about whether this type of coverage is right for you.

Remember, while it may seem like an extra expense, gap insurance can provide peace of mind and financial protection in the event of a major accident.