Cheap health insurance can be a tempting option, but it’s crucial to understand the trade-offs involved. While the idea of lower premiums is appealing, it’s important to consider what you’re getting for your money and whether the coverage will actually meet your needs.

After all, healthcare is a complex and unpredictable expense, and choosing the right insurance plan can make a significant difference in your financial well-being.

This guide explores the world of cheap health insurance, covering everything from the different types of plans available to the factors you should consider when making a decision. We’ll discuss how to find affordable options, evaluate coverage, and manage healthcare costs effectively.

Understanding “Cheap” Health Insurance: Cheap Health Insurance

When it comes to healthcare, cost is a major concern for many individuals and families. This is where the concept of “cheap” health insurance comes into play. However, it’s crucial to understand that “cheap” doesn’t always equate to “good.” While cheap health insurance plans can offer significant savings, they often come with trade-offs that might impact your overall healthcare experience.

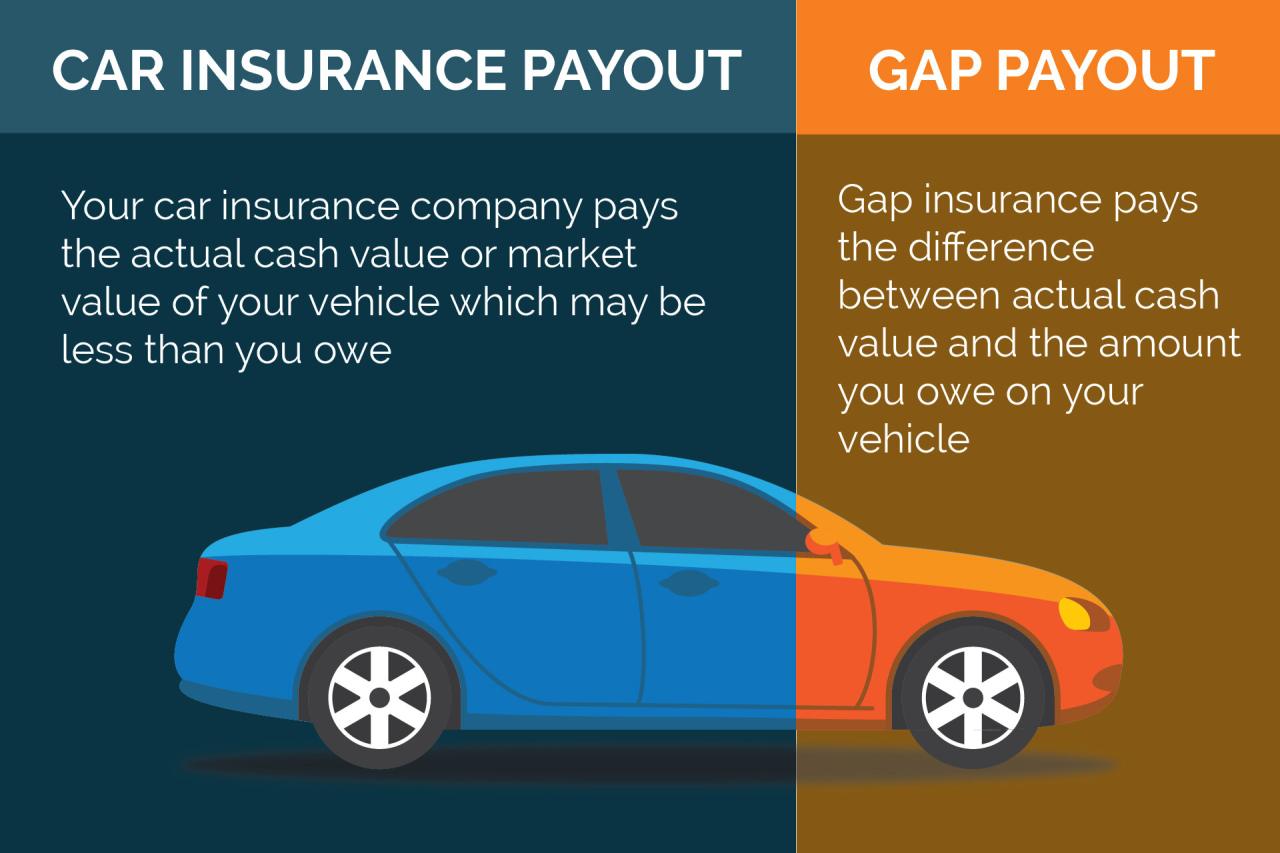

Shopping for car insurance can feel overwhelming, but it doesn’t have to be. Getting a car insurance quote is quick and easy, and it can help you compare prices and coverage options from different companies. Just fill out a few basic details about yourself and your car, and you’ll get a personalized quote in minutes.

You can then use this information to choose the best policy for your needs and budget.

Affordability vs. Coverage

The affordability of health insurance is directly linked to the level of coverage it provides. “Cheap” health insurance plans typically have lower monthly premiums but may have higher deductibles, copayments, and out-of-pocket maximums. This means you might pay less each month, but you’ll likely end up paying more out of pocket when you need healthcare services.

Trade-offs Between Cost and Coverage

The key to finding the right health insurance plan is to balance affordability with the level of coverage you need. If you’re generally healthy and only need basic healthcare services, a cheap plan with a higher deductible might be a good option.

However, if you have pre-existing conditions or anticipate needing frequent healthcare, a more comprehensive plan with lower out-of-pocket costs might be more beneficial in the long run.

Factors Influencing Health Insurance Costs

Several factors contribute to the cost of health insurance, including:

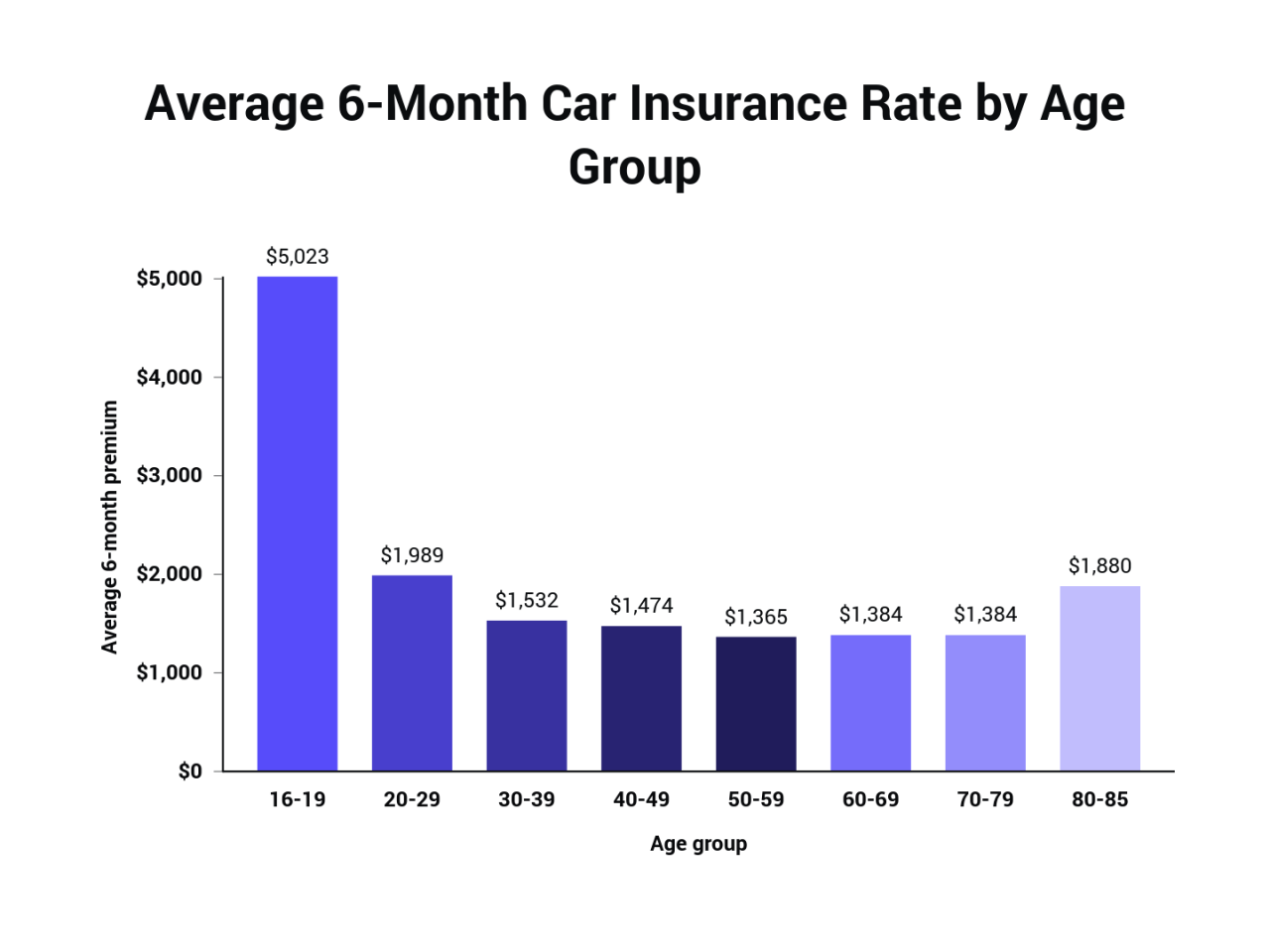

- Age:Generally, older individuals pay higher premiums because they tend to have more health issues.

- Health Status:People with pre-existing conditions often face higher premiums as insurers perceive them as higher risk.

- Location:The cost of healthcare varies depending on where you live. Urban areas often have higher premiums due to higher healthcare costs.

- Coverage Level:Plans with broader coverage, such as comprehensive benefits and a wider network of providers, typically have higher premiums.

Types of Cheap Health Insurance Plans

There are various types of cheap health insurance plans available, each with its own set of features, benefits, and limitations. Understanding these options is crucial for choosing the right plan for your individual needs.

High-Deductible Health Plans (HDHPs)

HDHPs are known for their low monthly premiums. However, they come with high deductibles, meaning you’ll have to pay a significant amount out of pocket before your insurance kicks in.

- Pros:Lower monthly premiums, potential for tax advantages if paired with a Health Savings Account (HSA).

- Cons:High deductibles, potentially higher out-of-pocket costs if you need frequent healthcare.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts that can be used to pay for healthcare expenses. They are often paired with HDHPs.

- Pros:Tax-deductible contributions, tax-free withdrawals for qualified medical expenses, funds roll over year to year.

- Cons:Only available with HDHPs, limited to certain healthcare expenses.

Short-Term Health Insurance Plans

Short-term health insurance plans provide temporary coverage for a limited period, usually 30 to 364 days. They are often cheaper than traditional health insurance plans but offer limited coverage.

- Pros:Lower premiums, can bridge gaps in coverage.

- Cons:Limited coverage, may not cover pre-existing conditions, typically not renewable after the term ends.

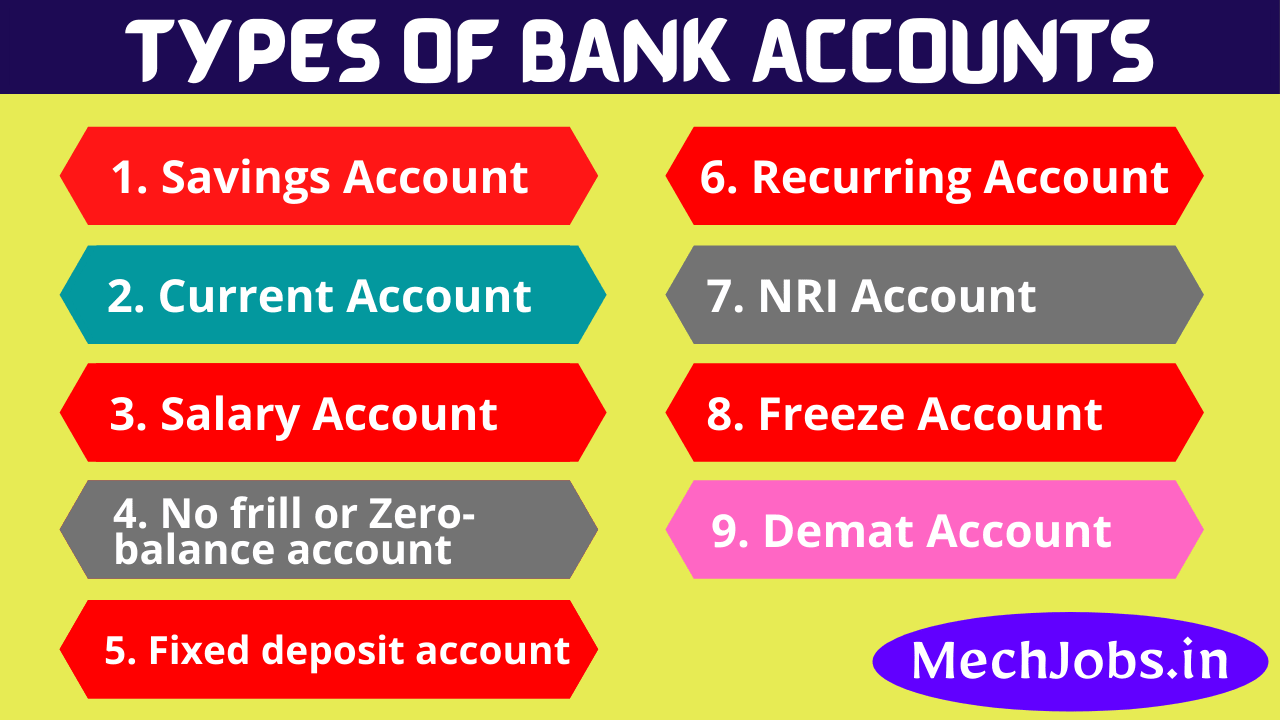

Government-Sponsored Programs

Government-sponsored programs like Medicaid and Medicare offer affordable health insurance options for eligible individuals.

- Medicaid:Provides health insurance to low-income individuals and families.

- Medicare:Provides health insurance to individuals aged 65 and older and those with certain disabilities.

Finding and Evaluating Cheap Health Insurance Options

Finding affordable health insurance plans requires research and comparison. Here are some tips for finding the best options:

Online Marketplaces

Online marketplaces like Healthcare.gov (for individual plans) and state-based marketplaces offer a wide range of health insurance plans from different insurers. They allow you to compare plans side-by-side and enroll in coverage.

Insurance Brokers

Insurance brokers can help you navigate the health insurance market and find plans that meet your specific needs. They work with multiple insurers and can provide personalized recommendations.

Shopping around for car insurance can be a real headache, but it doesn’t have to be! Getting a car insurance quote is quick and easy, and it can help you compare prices and find the best coverage for your needs.

So, ditch the stress and get started today!

Direct Carrier Websites

You can also visit the websites of individual insurance carriers to get quotes and learn about their plans. This can give you a direct perspective on their offerings.

Key Factors to Consider When Evaluating Cheap Health Insurance Plans

When comparing cheap health insurance plans, it’s essential to consider the following factors:

- Deductibles and Copayments:Understand the amount you’ll have to pay out of pocket before your insurance kicks in and the cost of each doctor’s visit or prescription.

- Out-of-Pocket Maximums:Know the maximum amount you’ll have to pay for healthcare expenses in a given year.

- Network Coverage:Ensure that your preferred doctors and hospitals are included in the plan’s network.

- Prescription Drug Coverage:Check the plan’s formulary (list of covered medications) and the copay amounts for your prescriptions.

- Provider Availability:Confirm that the plan covers the specialists and services you need.

Comparing Quotes and Understanding the Fine Print

Always compare quotes from multiple insurers and carefully review the plan documents before making a decision. Pay attention to the fine print, including exclusions, limitations, and any hidden fees.

Considerations for Choosing Cheap Health Insurance

Choosing a cheap health insurance plan can be a cost-effective decision, but it’s crucial to weigh the potential risks and benefits.

Potential Risks of Cheap Health Insurance

- Limited Coverage:Cheap plans often have lower coverage levels, meaning you might have to pay more out of pocket for certain services.

- Higher Out-of-Pocket Costs:You might face higher deductibles, copayments, and out-of-pocket maximums, leading to significant expenses if you need healthcare.

- Limited Network:Cheap plans may have smaller provider networks, limiting your choices for doctors and hospitals.

Potential Benefits of Cheap Health Insurance

- Lower Monthly Premiums:Cheap plans can save you money on your monthly insurance costs.

- Affordable Option for Healthy Individuals:If you’re generally healthy and only need basic healthcare services, a cheap plan might be sufficient.

- Flexibility:Cheap plans often offer more flexibility in terms of coverage options and customization.

Impact of Cost-Sharing on Healthcare Access and Affordability

High deductibles and copayments can make healthcare less accessible and affordable, especially for low-income individuals and families. They may delay or avoid seeking necessary medical care due to financial constraints.

Comparing Pros and Cons of Different Cheap Health Insurance Options

Here’s a table summarizing the pros and cons of different cheap health insurance options:

| Plan Type | Pros | Cons | Suitable For |

|---|---|---|---|

| HDHPs | Lower monthly premiums, potential for tax advantages with HSAs. | High deductibles, potentially higher out-of-pocket costs. | Healthy individuals with low healthcare needs, those who can afford to save for high deductibles. |

| Short-Term Health Insurance | Lower premiums, can bridge gaps in coverage. | Limited coverage, may not cover pre-existing conditions, not renewable after term ends. | Individuals needing temporary coverage, those who are healthy and don’t anticipate major healthcare needs. |

| Government-Sponsored Programs (Medicaid, Medicare) | Affordable coverage for eligible individuals. | Eligibility requirements, limited provider networks in some areas. | Low-income individuals and families (Medicaid), individuals aged 65 and older or with disabilities (Medicare). |

Maintaining Affordable Healthcare

Even with cheap health insurance, managing healthcare costs is essential. Here are some tips for keeping your healthcare expenses under control:

Utilize Preventive Care Services

Preventive care services, such as annual checkups and screenings, can help detect health issues early, potentially preventing more expensive treatments later. Most health insurance plans cover these services with little or no out-of-pocket costs.

Negotiate Medical Bills

Don’t be afraid to negotiate medical bills. Many hospitals and healthcare providers are willing to work with patients on payment plans or offer discounts.

Seek Affordable Prescription Drugs

Explore options for affordable prescription drugs, such as generic medications, mail-order pharmacies, and prescription discount cards.

Explore Alternative Healthcare Options

Consider alternative healthcare options, such as telehealth services, community health centers, and free clinics, which can offer lower-cost care.

Understanding Your Health Insurance Plan

Take the time to understand your health insurance plan’s coverage, benefits, and limitations. This will help you make informed decisions about your healthcare and maximize the value of your plan.

Final Review

Navigating the world of health insurance can be daunting, but understanding the options and making informed choices can lead to peace of mind. By weighing the pros and cons of different plans, considering your individual needs and circumstances, and taking steps to manage healthcare costs, you can find a solution that fits your budget and provides the coverage you need.

Remember, health insurance is an investment in your well-being, and it’s worth taking the time to find the right plan for you.