Gap insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It’s a crucial financial safety net that can shield you from significant financial burdens when your vehicle is damaged or stolen.

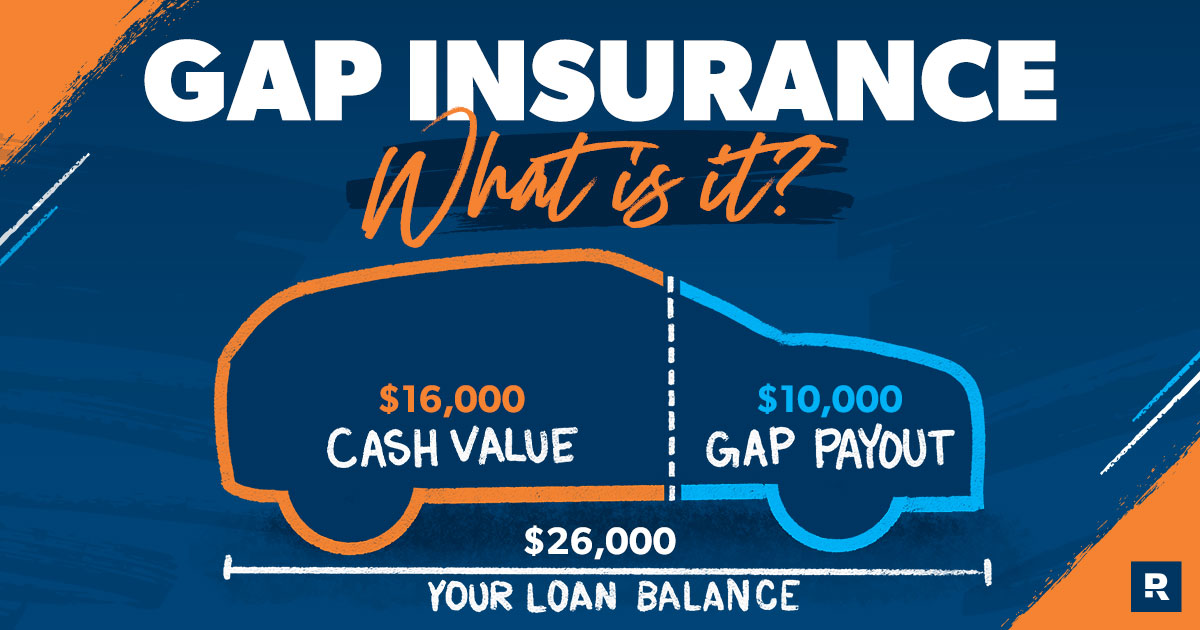

Imagine this: You’re in an accident, and your car is totaled. Your insurance covers the actual cash value (ACV) of the car, but it’s significantly less than what you owe on your loan. This is where gap insurance steps in, bridging the gap between your insurance payout and the remaining loan balance.

If you’ve been caught driving without insurance or have a suspended license, you might need to get SR22 insurance. It’s a certificate that proves you have the minimum required insurance coverage, and it’s usually required by the state to reinstate your driving privileges.

Gap insurance is a type of insurance that covers the difference between the actual cash value of your vehicle and the amount you owe on your loan. It’s designed to protect you from financial hardship in the event of a total loss, ensuring you don’t end up owing more than your car is worth.

What is Gap Insurance?

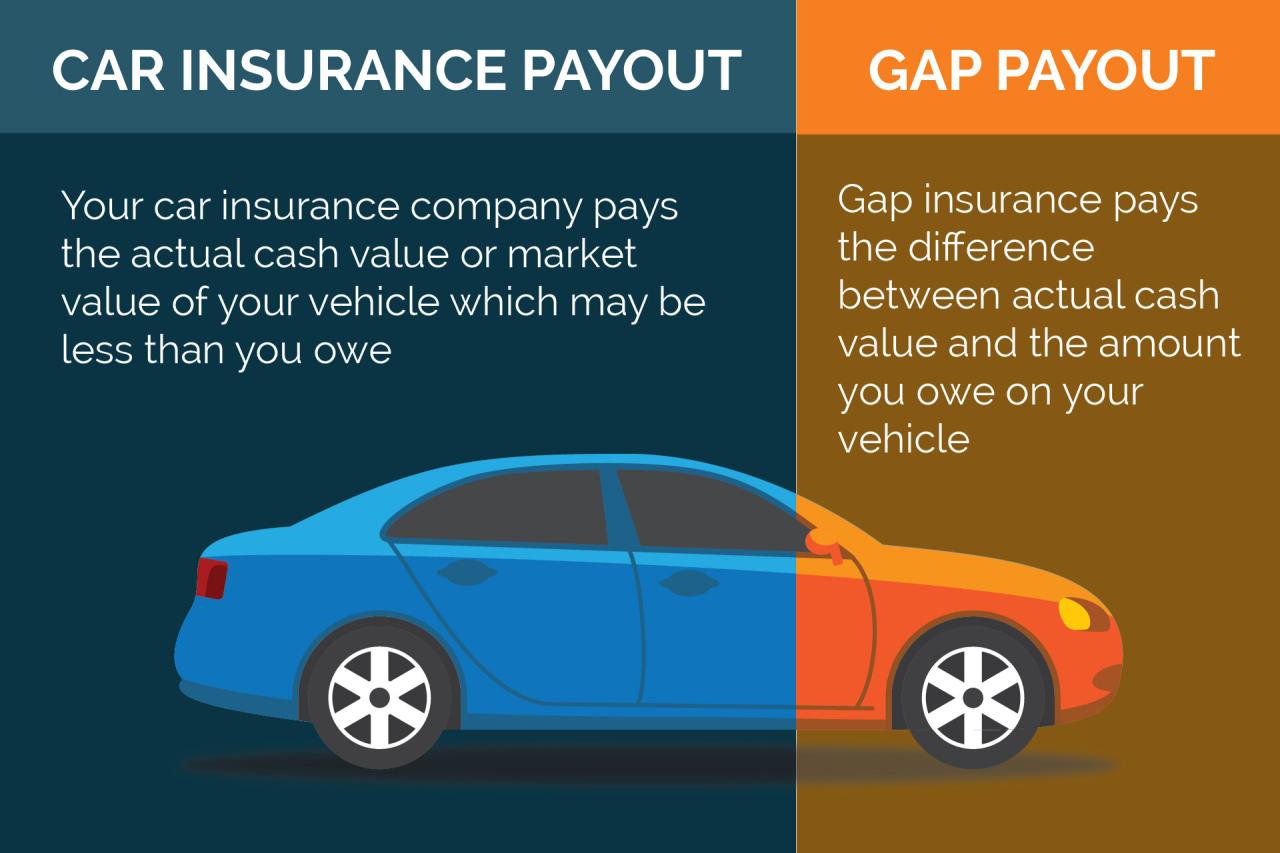

Gap insurance is a type of insurance that helps cover the difference between what your car insurance pays out in the event of a total loss and the amount you still owe on your car loan or lease. In simpler terms, it protects you from being stuck with a significant financial burden after an accident.

Purpose of Gap Insurance

The primary purpose of gap insurance is to safeguard you from financial hardship if your vehicle is totaled in an accident and you still owe more on your loan than the car’s actual cash value (ACV). This is because car insurance typically only covers the ACV of your vehicle, not the outstanding loan balance.

Real-Life Scenario

Imagine you purchase a new car for $30,000 and take out a loan for the full amount. After a few years, your car is totaled in an accident. Your car insurance policy pays out $15,000, which is the ACV of your car at the time of the accident.

You still owe $20,000 on your loan. In this situation, gap insurance would step in to cover the remaining $5,000, preventing you from being responsible for the shortfall.

How Gap Insurance Works

The term “gap” in gap insurance refers to the difference between the ACV of your vehicle and the outstanding loan balance. Gap insurance is designed to bridge this gap, ensuring that you’re not left with a substantial debt after a total loss.

Coverage Provided

Gap insurance typically covers the following:

- The difference between the ACV of your vehicle and the outstanding loan balance.

- Any remaining lease payments after a total loss.

- Deductibles associated with your comprehensive and collision coverage.

Payout Situations

Gap insurance will pay out in the following situations:

- Your vehicle is declared a total loss due to an accident, theft, or other covered event.

- The ACV of your vehicle is less than the outstanding loan balance.

- You are still making payments on your car loan or lease.

When is Gap Insurance Necessary?

Gap insurance is generally considered most relevant for individuals who finance or lease newer vehicles, especially those with a high loan-to-value ratio.

Types of Vehicles

- New Cars:New cars depreciate rapidly, meaning their ACV drops significantly within the first few years. This creates a larger gap between the loan balance and the ACV, making gap insurance more beneficial.

- Luxury Cars:Luxury cars often have higher loan amounts and depreciate faster than standard vehicles, increasing the need for gap insurance.

- Vehicles with Long Loan Terms:Longer loan terms allow for more depreciation to occur before the loan is fully paid off, making gap insurance more appealing.

Factors Increasing Need

- High Loan-to-Value Ratio:A higher loan-to-value ratio (LTV) indicates a larger loan amount relative to the vehicle’s value, increasing the potential for a gap.

- Limited Down Payment:A smaller down payment on a vehicle means a larger loan balance, increasing the likelihood of a gap.

- High Interest Rates:Higher interest rates on car loans can result in a larger loan balance over time, creating a bigger gap.

Financial Implications of Not Having Gap Insurance

If you don’t have gap insurance and your vehicle is totaled, you could be responsible for paying the difference between the ACV and the outstanding loan balance. This could result in significant financial hardship, potentially leading to debt and impacting your credit score.

Benefits of Gap Insurance

Gap insurance offers several advantages, protecting you from financial burdens in the event of a total loss.

If you’ve been in a car accident or gotten a DUI, you might need sr22 insurance. It’s a certificate that proves you have financial responsibility to cover any future accidents. This type of insurance is required by most states for drivers who have been deemed high-risk.

Key Benefits

- Financial Protection:Gap insurance shields you from financial hardship by covering the difference between the ACV and the outstanding loan balance.

- Peace of Mind:Knowing you have gap insurance can provide peace of mind, knowing you’re protected from significant financial loss in case of a total loss.

- Credit Score Protection:Gap insurance can help protect your credit score by preventing you from defaulting on your car loan.

- Flexibility:Gap insurance can give you the flexibility to purchase a new car after a total loss without being burdened by a large debt.

Examples of Protection

- Avoiding Debt:Gap insurance can prevent you from taking on additional debt to cover the shortfall between the ACV and the loan balance.

- Maintaining Credit Score:Gap insurance can help you avoid damaging your credit score by ensuring you can continue making car loan payments after a total loss.

- Replacing Your Vehicle:Gap insurance can help you replace your vehicle after a total loss without having to pay a large out-of-pocket expense.

Benefits Table

| Benefit | Description |

|---|---|

| Financial Protection | Covers the difference between the ACV and the loan balance. |

| Peace of Mind | Provides reassurance knowing you’re protected from financial loss. |

| Credit Score Protection | Helps maintain a good credit score by preventing loan default. |

| Flexibility | Allows you to replace your vehicle after a total loss without significant debt. |

Considerations Before Buying Gap Insurance

While gap insurance can be beneficial, it’s important to weigh the potential drawbacks and consider if it’s truly necessary for your situation.

Potential Drawbacks

- Cost:Gap insurance can be an additional expense on top of your regular car insurance premiums.

- Limited Coverage:Gap insurance typically only covers total losses, not partial damage or other types of events.

- Short-Term Coverage:Gap insurance coverage often expires when your car loan or lease is paid off.

Situations Where Gap Insurance Might Not Be Necessary

- Small Loan Balance:If you have a small loan balance relative to the value of your vehicle, the gap between the ACV and the loan balance may be minimal, making gap insurance less essential.

- Older Vehicles:Older vehicles depreciate at a slower rate, reducing the likelihood of a significant gap between the ACV and the loan balance.

- Cash Purchase:If you purchase your vehicle outright with cash, you won’t have a loan to worry about, eliminating the need for gap insurance.

Cost Comparison

Before purchasing gap insurance, compare the cost with other types of insurance, such as comprehensive and collision coverage. Consider whether the added protection of gap insurance justifies the additional expense.

How to Get Gap Insurance

Obtaining gap insurance is a relatively straightforward process. You can typically purchase it through your car dealership, your insurance company, or a third-party provider.

Steps to Obtain Gap Insurance

- Contact Your Car Dealership:Many dealerships offer gap insurance as an add-on during the car purchase process.

- Talk to Your Insurance Company:Your insurance company may offer gap insurance as part of your car insurance policy.

- Shop Around with Third-Party Providers:Several third-party providers specialize in gap insurance, offering competitive rates and coverage options.

Finding Affordable Options, Gap insurance

- Compare Quotes:Get quotes from multiple providers to compare rates and coverage options.

- Consider Bundling:Some insurance companies offer discounts if you bundle gap insurance with other types of insurance.

- Negotiate:Don’t be afraid to negotiate with providers to try and get a better price.

Providers of Gap Insurance

- Car Dealerships:Many dealerships offer gap insurance as an add-on during the car purchase process.

- Insurance Companies:Most major insurance companies offer gap insurance as part of their car insurance policies.

- Third-Party Providers:Several third-party providers specialize in gap insurance, offering competitive rates and coverage options.

Understanding the Terms and Conditions

It’s crucial to understand the terms and conditions of your gap insurance policy to ensure you’re getting the coverage you need.

Key Terms and Conditions

- Deductible:This is the amount you’ll have to pay out-of-pocket before your gap insurance coverage kicks in.

- Coverage Period:This is the length of time your gap insurance policy is in effect.

- Maximum Coverage Amount:This is the maximum amount your gap insurance will pay out in the event of a total loss.

- Exclusions:These are specific events or situations that are not covered by your gap insurance policy.

Common Exclusions

- Wear and Tear:Gap insurance typically doesn’t cover damage caused by normal wear and tear.

- Pre-Existing Conditions:Pre-existing damage or problems with your vehicle may not be covered by gap insurance.

- Certain Types of Accidents:Some accidents, such as those caused by reckless driving or driving under the influence, may not be covered.

Terms and Conditions Table

| Term | Description |

|---|---|

| Deductible | The amount you pay out-of-pocket before coverage kicks in. |

| Coverage Period | The length of time your policy is in effect. |

| Maximum Coverage Amount | The maximum amount your policy will pay out. |

| Exclusions | Events or situations not covered by the policy. |

Last Point

In conclusion, gap insurance offers valuable protection for those who want to safeguard their finances in the event of a total vehicle loss. While it’s not mandatory, it can be a wise investment for drivers with newer vehicles, those with substantial loan balances, or those who have financed their vehicles for longer terms.

By understanding the benefits and considerations, you can make an informed decision about whether gap insurance is right for you.