House insurance is a crucial financial safety net for homeowners, providing peace of mind in the face of unexpected events. It’s a comprehensive policy that covers various risks, from natural disasters to theft, safeguarding your biggest investment. Understanding the different types of coverage, factors influencing premiums, and the claims process is essential for making informed decisions about your home’s protection.

This guide delves into the intricacies of house insurance, offering a comprehensive overview of its features, benefits, and considerations. Whether you’re a first-time homeowner or seeking to review your existing policy, this information will empower you to make wise choices regarding your home’s security.

What is House Insurance?

House insurance, also known as homeowners insurance, is a type of insurance that provides financial protection against losses or damages to your home and belongings. It’s a crucial safety net that can help you recover from unexpected events like fire, theft, natural disasters, and other unforeseen circumstances.

Purpose of House Insurance

The primary purpose of house insurance is to provide financial assistance to cover the costs of repairing or rebuilding your home and replacing your belongings in the event of a covered loss. It helps to minimize the financial burden and disruption that can arise from unexpected events.

It’s always wise to think about your financial security, especially in case of unexpected events. One important aspect is having disability insurance , which provides financial support if you’re unable to work due to an illness or injury. It can help cover your expenses and ensure you have peace of mind during a challenging time.

Types of House Insurance

House insurance policies come in various forms, each offering different levels of coverage and protection. Here are some common types:

- Basic Coverage:This provides the most fundamental protection, covering losses from fire, lightning, and other specified perils. It usually includes coverage for the structure of your home, but may have limited coverage for personal belongings.

- Broad Coverage:This offers broader protection than basic coverage, including coverage for additional perils such as windstorm, hail, and vandalism. It typically provides more comprehensive coverage for your belongings.

- Comprehensive Coverage:This provides the most extensive protection, covering a wide range of perils, including those not typically covered by basic or broad policies. It often includes coverage for valuable items, such as jewelry and artwork.

- Actual Cash Value (ACV):This type of coverage reimburses you for the depreciated value of your belongings, meaning you receive the current market value minus depreciation. For example, if your 10-year-old TV is damaged, you’ll receive the current market value of a similar TV, minus depreciation based on its age.

- Replacement Cost Value (RCV):This type of coverage reimburses you for the full cost of replacing your belongings, regardless of their age or depreciation. So, if your 10-year-old TV is damaged, you’ll receive the full cost of replacing it with a new, similar TV.

Benefits of Having House Insurance

House insurance offers numerous benefits, providing peace of mind and financial security. Here are some key advantages:

- Financial Protection:It safeguards you from significant financial losses in the event of a covered disaster, ensuring you can rebuild your home and replace your belongings.

- Peace of Mind:Knowing you have insurance coverage can alleviate stress and anxiety, allowing you to focus on recovery and rebuilding after an event.

- Liability Coverage:Most house insurance policies include liability coverage, which protects you from financial responsibility if someone is injured on your property.

- Legal Protection:It can provide legal assistance and representation if you’re involved in a lawsuit related to your property.

Factors Affecting House Insurance Premiums

The cost of your house insurance premium is influenced by several factors. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premium.

Life can throw you curveballs, and sometimes those curveballs can leave you unable to work. That’s where disability insurance comes in. It provides financial support if you’re unable to work due to an illness or injury, helping you cover your expenses and maintain your lifestyle.

Key Factors Influencing Premiums, House insurance

Here are some of the key factors that insurance companies consider when determining your house insurance premium:

- Location:The location of your home plays a significant role. Areas prone to natural disasters, such as earthquakes, hurricanes, or floods, tend to have higher premiums. Similarly, homes in high-crime areas may also have higher premiums.

- Home Value:The market value of your home is a major factor. The higher the value of your home, the more it will cost to insure. This is because the insurance company is responsible for rebuilding or repairing your home in the event of a covered loss.

- Construction Materials:The materials used to build your home can also affect your premium. Homes built with fire-resistant materials, such as brick or concrete, may have lower premiums compared to homes built with wood.

- Age of Home:Older homes may have higher premiums due to factors such as outdated wiring or plumbing, which could increase the risk of fire or other damage.

- Roof Condition:The condition of your roof is an important factor. Homes with newer roofs in good condition may have lower premiums, as a well-maintained roof reduces the risk of water damage.

- Security Features:Security features, such as alarm systems, fire extinguishers, and deadbolt locks, can lower your premium. These features help reduce the risk of theft and other crimes.

- Claims History:Your past claims history can impact your premium. If you have filed multiple claims in the past, your premium may be higher.

- Credit Score:In some cases, your credit score may be considered when determining your premium. A higher credit score may result in lower premiums.

Examples of Premium Impact

Here are some examples of how different factors can impact your house insurance premium:

- A home located in a hurricane-prone area may have a significantly higher premium compared to a home in a less-risky area.

- A home with a new roof in good condition may have a lower premium compared to a home with an old, damaged roof.

- A home with a security system may have a lower premium compared to a home without one.

Common House Insurance Coverage

House insurance policies typically include various types of coverage to protect you from different types of losses. Understanding these coverages can help you determine the right policy for your needs.

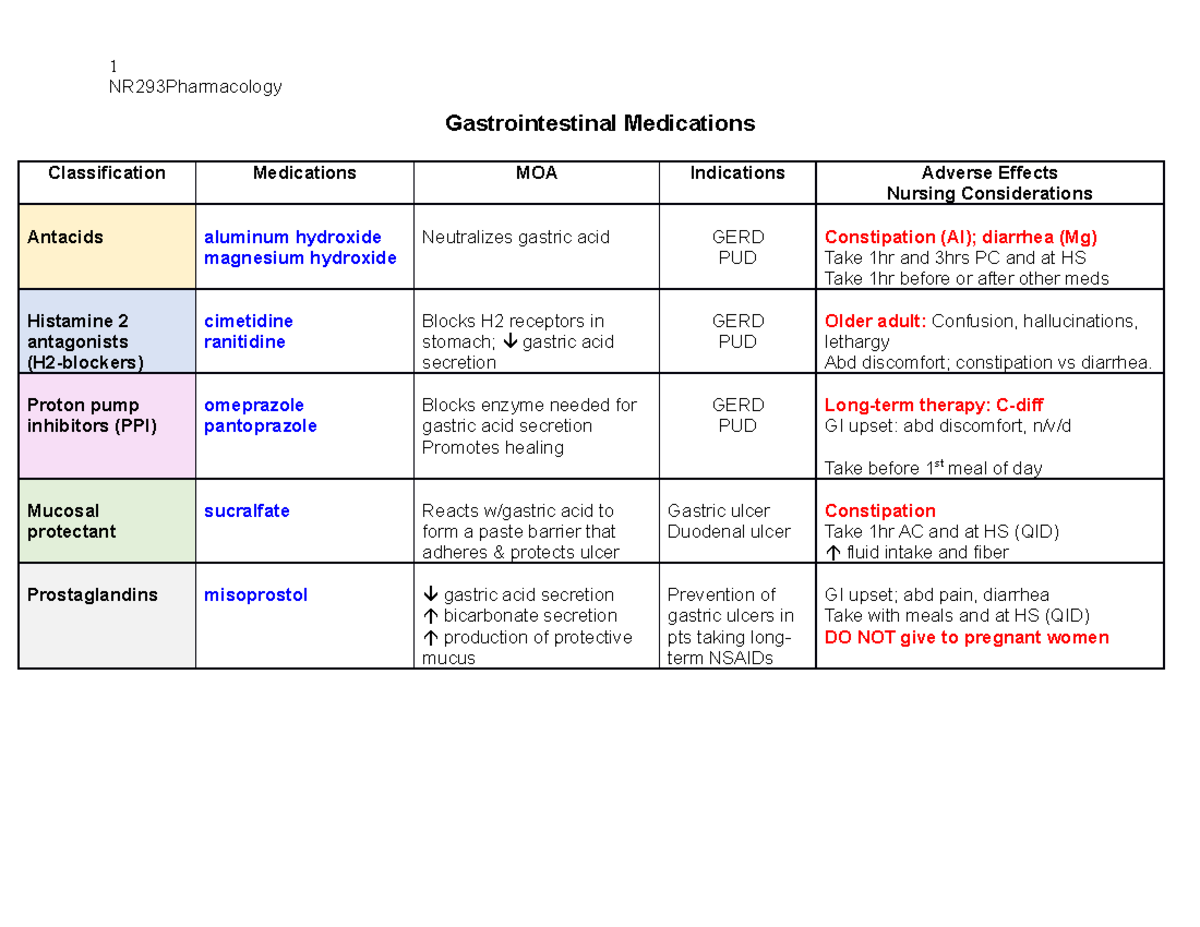

Coverage Types and Descriptions

Here’s a table outlining common types of coverage included in house insurance policies:

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers damage to the physical structure of your home, including the walls, roof, foundation, and plumbing. |

| Personal Property Coverage | Protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. |

| Liability Coverage | Provides financial protection if someone is injured on your property or if you are found liable for damages to another person’s property. |

| Medical Payments Coverage | Covers medical expenses for injuries sustained by guests on your property, regardless of who is at fault. |

| Loss of Use Coverage | Provides financial assistance for additional living expenses if you are unable to live in your home due to a covered loss. |

| Additional Living Expenses Coverage | Covers the cost of temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt. |

| Personal Liability Coverage | Protects you from financial responsibility if you are sued for negligence or wrongdoing. |

| Guest Medical Coverage | Covers medical expenses for guests who are injured on your property. |

| Deductible | The amount you are responsible for paying out of pocket before your insurance coverage kicks in. |

Coverage Scenarios

Here are some examples of scenarios where each type of coverage would be applicable:

- Dwelling Coverage:A fire damages your home’s roof, requiring repairs or replacement. Dwelling coverage will help cover the costs of these repairs.

- Personal Property Coverage:A theft occurs, and your belongings are stolen. Personal property coverage will help replace the stolen items.

- Liability Coverage:A guest slips and falls on your icy driveway, sustaining an injury. Liability coverage will help cover the costs of medical expenses and legal fees if you are found liable.

- Loss of Use Coverage:Your home is damaged by a storm, and you are unable to live in it for several weeks while repairs are made. Loss of use coverage will help cover the costs of temporary housing and other living expenses.

Choosing the Right House Insurance Policy

Selecting the right house insurance policy is crucial to ensure you have adequate protection for your home and belongings. Consider these factors when making your decision:

Factors to Consider

Here are some key factors to consider when choosing a house insurance policy:

- Coverage Limits:Determine the coverage limits you need for your dwelling, personal property, and liability. Make sure the limits are sufficient to cover the replacement cost of your home and belongings.

- Deductibles:Choose a deductible amount that you can comfortably afford. A higher deductible typically results in a lower premium, but you will have to pay more out of pocket in the event of a claim.

- Premiums:Compare premiums from different insurance companies to find the best value for your coverage needs.

- Discounts:Ask about available discounts, such as those for security features, fire alarms, and bundling your home and auto insurance.

- Claims Process:Understand the insurance company’s claims process, including how to file a claim, the required documentation, and the time it takes to process claims.

- Reputation:Research the insurance company’s reputation for customer service, claims handling, and financial stability.

Comparing Policy Options

When comparing different policy options, consider the following:

- Coverage:Compare the types of coverage offered by each policy and ensure they meet your needs.

- Premiums:Compare the premiums for similar coverage levels and deductibles.

- Benefits:Consider any additional benefits offered, such as discounts, claim forgiveness, or specialized coverage for valuable items.

Checklist of Questions

Here’s a checklist of questions to ask insurance providers before making a decision:

- What types of coverage are included in your policy?

- What are the coverage limits for each type of coverage?

- What is the deductible amount?

- What are the premiums for the policy?

- What discounts are available?

- How do I file a claim?

- What documentation is required for a claim?

- How long does it typically take to process claims?

- What is the insurance company’s reputation for customer service and claims handling?

- Is the insurance company financially stable?

Filing a House Insurance Claim

If you experience a covered loss, it’s important to know how to file a house insurance claim. Here’s a step-by-step guide:

Claim Filing Process

Follow these steps to file a claim:

- Contact Your Insurance Company:Immediately notify your insurance company about the loss. They will provide you with instructions on how to proceed.

- Secure Your Property:Take steps to protect your property from further damage. For example, if your roof is damaged, cover it with a tarp to prevent water damage.

- Document the Damage:Take photographs or videos of the damage to your home and belongings. This documentation will be helpful when filing your claim.

- Gather Supporting Documents:Collect any relevant documents, such as receipts for damaged items, repair estimates, and police reports if applicable.

- File Your Claim:Submit your claim to your insurance company, providing all the necessary documentation.

- Cooperate with the Adjuster:An insurance adjuster will be assigned to your claim. Cooperate with the adjuster by providing access to your property and answering their questions.

- Negotiate Settlement:Once the adjuster has completed their investigation, they will provide you with a settlement offer. You have the right to negotiate the settlement if you believe it is not fair.

Documentation and Information

Here’s a list of documentation and information you may need to provide when filing a claim:

- Policy Information:Your policy number, coverage limits, and deductible.

- Date and Time of Loss:The date and time the loss occurred.

- Details of the Loss:A detailed description of the damage or loss.

- Photographs or Videos:Documentation of the damage.

- Repair Estimates:Estimates for the cost of repairs or replacement.

- Police Reports:If the loss was caused by theft or vandalism.

- Receipts for Damaged Items:Proof of purchase for damaged belongings.

Tips for Protecting Your Home

Taking preventative measures can significantly reduce the risk of damage to your home and belongings. Here are some practical tips for protecting your home:

Preventative Measures

Here are some preventative measures you can take:

- Maintain Your Home:Regularly inspect your home for potential problems, such as leaks, cracks, or loose wiring. Address any issues promptly to prevent them from becoming major problems.

- Install Smoke Detectors:Install smoke detectors on every level of your home and test them regularly. Ensure you have a working fire escape plan.

- Install Carbon Monoxide Detectors:Carbon monoxide is a colorless, odorless gas that can be deadly. Install carbon monoxide detectors in your home, especially near fuel-burning appliances.

- Trim Trees and Shrubs:Trim trees and shrubs around your home to prevent them from coming into contact with your roof or power lines. This can help prevent damage from storms and falling branches.

- Secure Your Doors and Windows:Install strong locks on all doors and windows, and make sure they are properly secured when you are away from home.

- Install a Security System:Consider installing a home security system with alarms and sensors. This can deter criminals and alert you to potential intruders.

- Be Aware of Your Surroundings:Pay attention to your surroundings and report any suspicious activity to the authorities.

Home Security Measures

Here are some examples of home security measures:

- Motion-Sensing Lights:Install motion-sensing lights around your property to deter criminals and illuminate areas that may be dark.

- Security Cameras:Install security cameras to monitor your property and record any suspicious activity.

- Door and Window Sensors:Install sensors on doors and windows that will trigger an alarm if they are opened without authorization.

Maintenance Practices

Here are some maintenance practices that can help protect your home:

- Roof Inspections:Have your roof inspected regularly by a qualified professional to ensure it is in good condition and free from leaks or damage.

- Gutter Cleaning:Clean your gutters regularly to prevent debris from accumulating and causing blockages. Blockages can lead to water damage to your roof and foundation.

- Chimney Inspections:Have your chimney inspected annually to ensure it is clean and free from blockages. Blockages can lead to chimney fires.

- Plumbing Inspections:Have your plumbing system inspected regularly to identify and address any leaks or problems that could lead to water damage.

Final Summary

By understanding the ins and outs of house insurance, you can confidently navigate the complexities of protecting your home. Remember, a well-informed homeowner is a well-protected homeowner. With the right policy, you can face the future with assurance, knowing that your investment is secure against unforeseen circumstances.