Insurance quotes are the foundation for securing financial protection, offering a snapshot of the cost of coverage for various risks. From car accidents to medical emergencies, understanding the factors that influence these quotes is crucial to finding the right policy for your needs.

The process of obtaining an insurance quote can seem daunting, but it’s actually quite straightforward. With the right information and tools, you can navigate the complexities of insurance and make informed decisions about your coverage.

Understanding Insurance Quotes

An insurance quote is a document that Artikels the estimated cost of an insurance policy based on your specific circumstances. It provides a snapshot of the premium you’d be expected to pay for coverage, including details about the policy’s terms and conditions.

Obtaining an accurate and comprehensive insurance quote is crucial before making any decisions about your insurance needs.

Key Components of an Insurance Quote

An insurance quote typically includes several key components that help you understand the coverage and cost involved. These components are essential for comparing different quotes and making an informed decision.

- Premium:This is the amount you’ll pay for your insurance policy on a regular basis, usually monthly, quarterly, or annually.

- Deductible:The deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually translates to a lower premium, and vice versa.

- Coverage Limits:These limits define the maximum amount your insurance company will pay for covered losses. Coverage limits can vary depending on the type of insurance and the specific policy.

- Exclusions:Exclusions specify situations or events that are not covered by your insurance policy. It’s crucial to understand these exclusions to avoid unexpected costs in case of a claim.

- Policy Period:The policy period specifies the duration of your insurance coverage, typically for a year. It’s important to note the renewal date and ensure you understand the renewal process.

Types of Insurance Quotes

Insurance quotes are available for various types of insurance, each tailored to specific needs and risks.

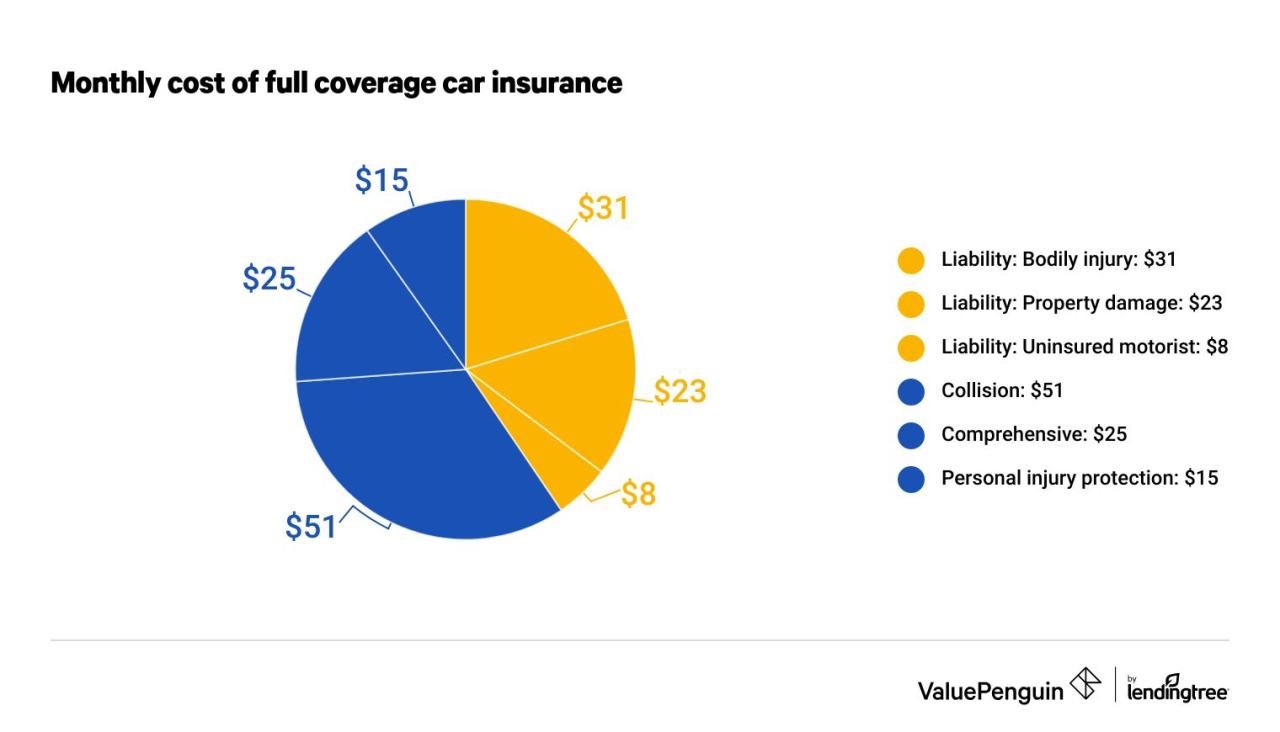

- Auto Insurance Quotes:These quotes provide coverage for your vehicle, including liability, collision, and comprehensive coverage. Factors like your driving history, vehicle type, and location influence the quote.

- Health Insurance Quotes:Health insurance quotes cover medical expenses, including hospitalization, surgeries, and prescription drugs. Your health status, age, and location play a significant role in determining the quote.

- Life Insurance Quotes:Life insurance quotes provide financial protection for your beneficiaries in the event of your death. Factors like your age, health, and desired coverage amount impact the quote.

- Homeowners Insurance Quotes:Homeowners insurance quotes cover your dwelling, personal belongings, and liability risks. The value of your home, location, and coverage options influence the quote.

- Renters Insurance Quotes:Renters insurance quotes protect your belongings and provide liability coverage for renters. Factors like the value of your belongings and the location of your rental unit influence the quote.

Obtaining an Insurance Quote

There are several ways to obtain an insurance quote, each with its own advantages and disadvantages. Choosing the right method depends on your preferences and the type of insurance you’re seeking.

Methods for Obtaining Insurance Quotes

- Online Platforms:Online insurance quote platforms allow you to compare quotes from multiple insurers in one place. This method is convenient and efficient, but it may not provide personalized advice or the opportunity to ask questions.

- Phone Calls:Contacting insurance companies directly by phone allows for personalized discussions and the opportunity to ask questions. However, this method can be time-consuming and may involve multiple calls to different insurers.

- In-Person Consultations:Meeting with an insurance agent in person offers the most personalized experience, allowing for detailed discussions and tailored advice. However, this method can be time-consuming and may involve travel.

Step-by-Step Guide to Requesting an Insurance Quote Online

- Visit the Insurance Company’s Website:Navigate to the website of the insurance company you’re interested in.

- Locate the “Get a Quote” or “Request a Quote” Button:Look for a prominent button on the website that initiates the quote process.

- Provide Your Information:Fill out the online form with your personal details, including your name, address, date of birth, and contact information.

- Enter Your Policy Details:Provide information about the insurance policy you’re seeking, including the type of coverage, vehicle details (for auto insurance), or property details (for homeowners or renters insurance).

- Submit Your Request:Once you’ve completed the form, submit your request for a quote. The insurance company will process your information and provide you with a quote.

- Review the Quote:Carefully review the insurance quote you receive, paying attention to the premium, deductible, coverage limits, exclusions, and policy period. You can compare quotes from different insurers to find the best option.

Factors Influencing Insurance Quotes

Insurance companies use a variety of factors to determine your insurance quote. These factors help them assess your individual risk profile and determine the likelihood of you filing a claim.

Key Factors Considered by Insurance Companies

- Age:Younger drivers and individuals are generally considered higher risk due to lack of experience. Older individuals may face higher premiums due to potential health concerns.

- Driving History:Your driving history, including accidents, tickets, and driving violations, significantly impacts your auto insurance quote. A clean driving record usually results in lower premiums.

- Health Status:Your health status is a crucial factor for health insurance quotes. Pre-existing conditions or health risks can influence the premium you pay.

- Location:Your location plays a role in determining insurance quotes, as factors like crime rates, weather patterns, and traffic density can influence risk levels.

- Credit Score:In some cases, your credit score can impact your insurance quote. A good credit score may indicate financial responsibility and lower risk.

- Vehicle Type:For auto insurance, the type of vehicle you drive affects your quote. Luxury cars or high-performance vehicles are typically more expensive to insure.

- Coverage Options:The type and amount of coverage you choose will influence your insurance quote. Higher coverage limits usually mean higher premiums.

Influence of Factors on Insurance Quotes

| Factor | Auto Insurance | Health Insurance | Life Insurance |

|---|---|---|---|

| Age | Younger drivers: Higher premiums; Older drivers: May face higher premiums due to health concerns | Younger individuals: Lower premiums; Older individuals: Higher premiums due to potential health risks | Younger individuals: Lower premiums; Older individuals: Higher premiums due to shorter life expectancy |

| Driving History | Clean record: Lower premiums; Accidents/violations: Higher premiums | N/A | N/A |

| Health Status | N/A | Pre-existing conditions: Higher premiums; Good health: Lower premiums | Pre-existing conditions: Higher premiums; Good health: Lower premiums |

| Location | High-crime areas: Higher premiums; Rural areas: Lower premiums | Urban areas: Higher premiums due to higher healthcare costs; Rural areas: Lower premiums | N/A |

Comparing Insurance Quotes

Comparing insurance quotes from different providers is essential to ensure you’re getting the best value for your money. It’s not just about finding the lowest price; you need to consider various factors to make an informed decision.

Getting the right auto insurance can be a real headache, but it doesn’t have to be. Finding the best price for your needs is easier than you think, especially with resources like auto insurance quote websites. They can help you compare different policies and find the best coverage for your budget.

So, ditch the stress and start comparing quotes today!

Factors to Consider Beyond Price

- Coverage Details:Compare the coverage limits, deductibles, and exclusions offered by different insurers. Ensure the coverage meets your specific needs and risk profile.

- Customer Service:Consider the reputation of the insurance company for customer service, responsiveness, and claim handling. Read reviews and testimonials to gauge their customer satisfaction levels.

- Financial Stability:Research the financial stability of the insurer to ensure they have the resources to pay claims in the event of a major loss. Look for ratings from reputable agencies like A.M. Best.

- Discounts and Bundling Options:Inquire about available discounts for safe driving, good credit, multiple policies, or other factors. Explore bundling options to potentially save on premiums.

Comparing Insurance Quotes

| Factor | Insurer A | Insurer B | Insurer C |

|---|---|---|---|

| Premium | $100/month | $120/month | $90/month |

| Deductible | $500 | $1000 | $250 |

| Coverage Limits | $100,000 | $200,000 | $150,000 |

| Exclusions | Flood damage | Earthquake damage | None |

| Customer Service Rating | 4/5 | 3/5 | 5/5 |

| Financial Stability Rating | A+ | A | A- |

Understanding Insurance Terminology

Insurance quotes often use specialized terminology that can be confusing. Understanding these terms is crucial for interpreting quotes and making informed decisions about your coverage.

Key Insurance Terms

- Deductible:The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium.

- Premium:The regular payment you make for your insurance policy. Premiums can be paid monthly, quarterly, or annually.

- Coverage Limits:The maximum amount your insurance company will pay for covered losses. Coverage limits vary depending on the type of insurance and the specific policy.

- Exclusions:Situations or events that are not covered by your insurance policy. It’s crucial to understand exclusions to avoid unexpected costs in case of a claim.

- Policy Period:The duration of your insurance coverage, typically for a year. It’s important to note the renewal date and understand the renewal process.

- Beneficiary:The person or entity who will receive the benefits of your insurance policy, typically in the event of your death (for life insurance).

- Claim:A formal request for payment from your insurance company for a covered loss. The claim process involves providing documentation and information about the loss.

- Endorsement:An addition to your insurance policy that extends or modifies coverage. Endorsements can be added to customize your policy to meet specific needs.

- Rider:Similar to an endorsement, a rider is an add-on to your insurance policy that provides additional coverage or benefits. Riders are often used for life insurance policies.

Examples of Insurance Terminology in Quotes

- “Your deductible for collision coverage is $500.”This means you’ll pay $500 out-of-pocket before your insurance covers the remaining costs of repairs or replacement for a collision accident.

- “Your annual premium for this policy is $1,200.”This means you’ll pay $1,200 per year for your insurance coverage.

- “The coverage limit for liability is $100,000 per person and $300,000 per accident.”This means your insurance company will pay up to $100,000 for injuries to a single person and up to $300,000 for injuries to multiple people in a single accident.

- “This policy excludes coverage for flood damage.”This means your insurance won’t cover losses caused by flooding, and you’ll be responsible for those costs.

Tips for Getting the Best Insurance Quote

Getting the best insurance quote involves more than just comparing prices. It’s about finding a policy that provides adequate coverage at a competitive price and from a reputable insurer.

Looking to save money on your car insurance? Getting an auto insurance quote is the first step. It allows you to compare rates from different insurers and find the best deal for your needs. This can save you a significant amount of money over time, so it’s definitely worth doing.

Tips for Obtaining Favorable Quotes

- Shop Around:Get quotes from multiple insurance companies to compare premiums, coverage options, and customer service. Online quote platforms can simplify this process.

- Negotiate with Insurers:Once you’ve received quotes, don’t hesitate to negotiate with insurers to try and get a better price. Highlight your good driving record, credit score, or other factors that may qualify you for discounts.

- Review Your Coverage Needs:Before requesting quotes, assess your individual needs and risk factors. Determine the type and amount of coverage you require to protect yourself and your assets.

- Consider Bundling Policies:If you have multiple insurance needs, like auto and homeowners insurance, consider bundling your policies with the same insurer. You may qualify for discounts for bundling multiple policies.

- Ask About Discounts:Inquire about available discounts for safe driving, good credit, multiple policies, or other factors that may apply to you.

- Read the Fine Print:Carefully review the terms and conditions of each insurance quote, including coverage limits, deductibles, exclusions, and policy periods. Ensure you understand the details before making a decision.

Negotiating with an Insurance Provider

- Prepare Your Information:Gather information about your driving history, credit score, and any other factors that may qualify you for discounts. Be prepared to discuss your needs and risk profile.

- Start with a Specific Goal:Have a clear idea of the premium you’re aiming for or the specific discounts you’re seeking. This will help you focus your negotiation efforts.

- Be Polite and Professional:Maintain a respectful and courteous tone throughout the negotiation. Be prepared to compromise and find a solution that works for both parties.

- Highlight Your Strengths:Emphasize your positive attributes, such as a clean driving record, good credit score, or years of experience in a particular field. These factors can make you a less risky customer.

- Be Willing to Walk Away:If the insurer is unwilling to negotiate to a point that satisfies your needs, be prepared to walk away and consider other options. Don’t feel pressured to accept a quote that doesn’t meet your requirements.

Outcome Summary

Ultimately, the key to getting the best insurance quote lies in understanding your individual needs, researching different providers, and comparing quotes carefully. By taking the time to educate yourself and shop around, you can ensure that you’re getting the coverage you need at a price you can afford.