Insure vs ensure – two words that sound similar but carry distinct meanings. While both relate to making something certain, the nuances of their application can be easily confused. “Insure” primarily deals with mitigating financial risk through insurance policies, offering protection against potential losses.

“Ensure,” on the other hand, focuses on guaranteeing a desired outcome, implying a level of certainty and control. Let’s dive into the depths of these words to unravel their distinct meanings and proper usage.

This exploration will delve into the grammatical structures, semantic distinctions, and practical applications of “insure” and “ensure” across various fields. We’ll analyze how the choice between these words impacts the clarity and precision of communication, and ultimately, how they shape the intended meaning of a message.

Understanding the Nuances of “Insure” and “Ensure”

The words “insure” and “ensure” are often used interchangeably, leading to confusion about their distinct meanings. However, understanding their nuances is crucial for precise communication, especially in professional contexts. This article will delve into the subtle differences between these two words, exploring their grammatical structures, semantic implications, and applications in various fields.

Distinguishing the Meanings of “Insure” and “Ensure”

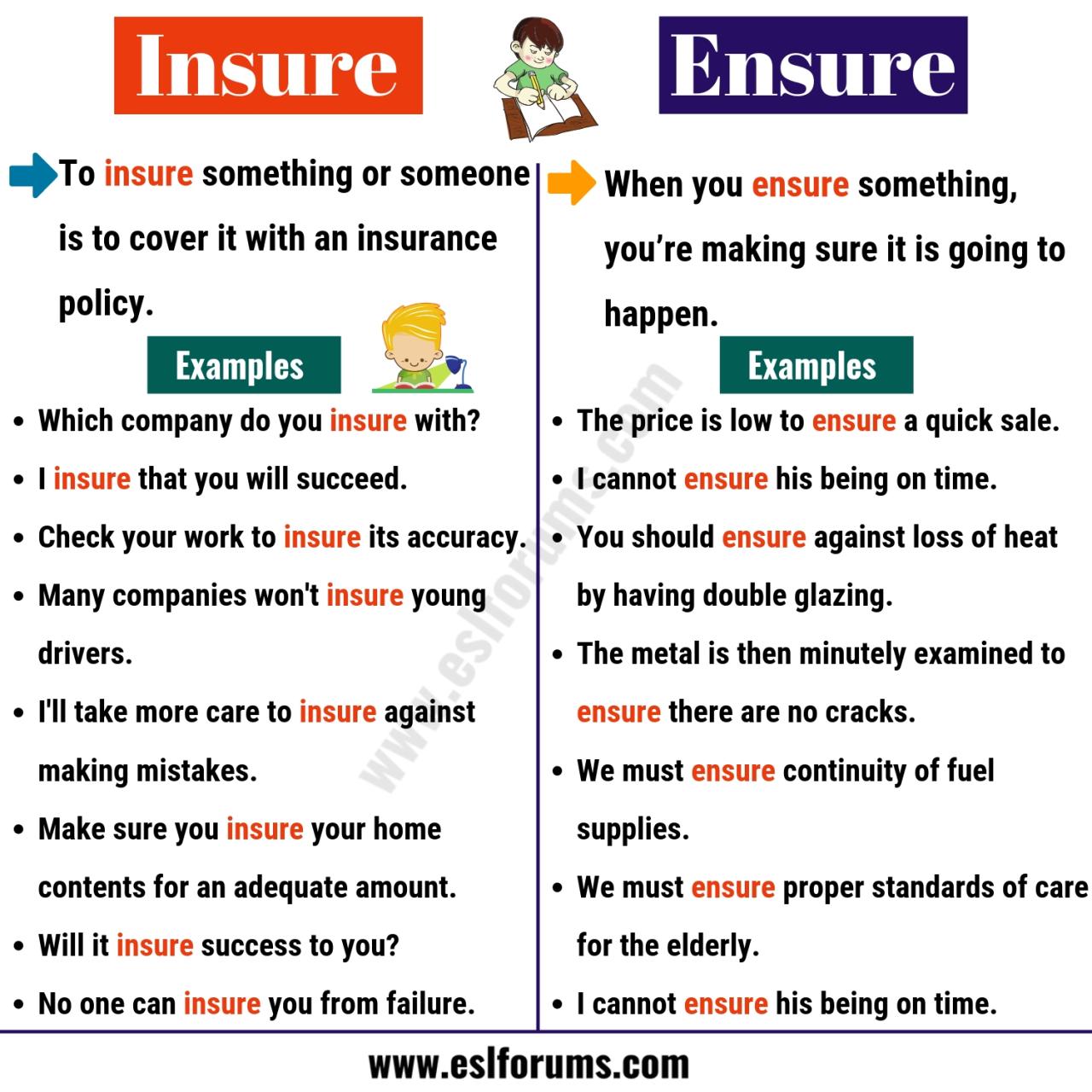

The key distinction lies in their association with risk mitigation and certainty. “Insure” focuses on protecting against potential losses, while “ensure” emphasizes guaranteeing a desired outcome.

If you’re looking for a straightforward and affordable way to protect your loved ones financially in the event of your passing, term life insurance might be a good option. It provides coverage for a specific period, typically 10 to 30 years, and pays out a death benefit to your beneficiaries if you pass away during that term.

- “Insure” is commonly used in the context of financial protection, such as insurance policies. For example, “I insure my car against accidents.” This implies that the insurance policy will provide financial compensation in case of an accident.

- “Ensure” emphasizes certainty and guarantees. For instance, “I will ensure that the project is completed on time.” This statement implies a commitment to take necessary actions to guarantee the project’s timely completion.

Examining the Grammatical Differences

While both “insure” and “ensure” function as verbs, their grammatical structures and usage can differ. “Insure” typically takes a direct object, indicating the entity being protected, while “ensure” often uses a clause or prepositional phrase to specify the desired outcome.

- “Insure” is often followed by a direct object, as in “I insure my house against fire.” The direct object “house” clarifies what is being protected.

- “Ensure” usually takes a clause or prepositional phrase to specify the desired outcome. For example, “I ensure that the meeting will be productive.” The clause “that the meeting will be productive” explains the guaranteed outcome.

Exploring the Semantic Differences, Insure vs ensure

The semantic distinction between “insure” and “ensure” lies in their implications for meaning and context. “Insure” suggests a focus on mitigating risk and providing financial protection, while “ensure” emphasizes a commitment to achieving a specific outcome.

- Using “insure” implies a potential for loss or harm, suggesting that measures are being taken to minimize its impact. For instance, “I insure my health against unexpected medical expenses.” This statement suggests a concern about potential medical expenses and a desire to protect against them.

- Using “ensure” emphasizes a commitment to achieving a desired outcome, regardless of potential risks or obstacles. For example, “I ensure that the presentation is delivered flawlessly.” This statement implies a commitment to taking all necessary steps to ensure a flawless presentation, even if there are challenges along the way.

If you’re looking for a simple and affordable way to protect your loved ones financially in case of your passing, you might want to consider term life insurance. It provides coverage for a specific period, typically 10 to 30 years, and is generally cheaper than permanent life insurance.

Analyzing Usage in Different Fields

The choice between “insure” and “ensure” can impact the clarity and precision of communication in various professional fields. Here are examples of their usage in finance, law, and healthcare:

| Field | “Insure” | “Ensure” |

|---|---|---|

| Finance | “We insure our investments against market fluctuations.” | “We ensure the safety of our clients’ funds.” |

| Law | “The contract insures the buyer’s rights.” | “The lawyer ensures that the client’s interests are protected.” |

| Healthcare | “The insurance policy insures coverage for critical illnesses.” | “The doctor ensures the patient’s well-being.” |

Illustrating the Differences with Visual Examples

Imagine a tightrope walker attempting to cross a high-wire. “Insuring” the walker could involve providing a safety net below to catch them in case of a fall. This represents the concept of protecting against potential losses. “Ensuring” the walker’s success, on the other hand, would involve providing training, guidance, and support to help them maintain their balance and reach the other side.

This signifies guaranteeing a desired outcome.

Final Summary: Insure Vs Ensure

Ultimately, understanding the difference between “insure” and “ensure” is crucial for clear and effective communication. Whether you’re writing a legal document, a financial report, or simply an email to a colleague, choosing the right word ensures your message is accurately conveyed.

Remember, “insure” safeguards against risk, while “ensure” guarantees a desired outcome. By recognizing the subtle distinctions between these two words, you can enhance your writing and communicate with greater precision and clarity.