Private medical insurance offers a way to supplement or replace public healthcare systems, providing individuals with access to a wider range of medical services and potentially faster treatment. This type of insurance allows you to choose your healthcare providers and often provides coverage for services not covered by public healthcare.

There are different types of private medical insurance plans available, each with its own set of benefits, coverage, and costs. Understanding the various options, including factors like premiums, deductibles, and co-pays, is crucial when making an informed decision about private medical insurance.

Private Medical Insurance: An Overview

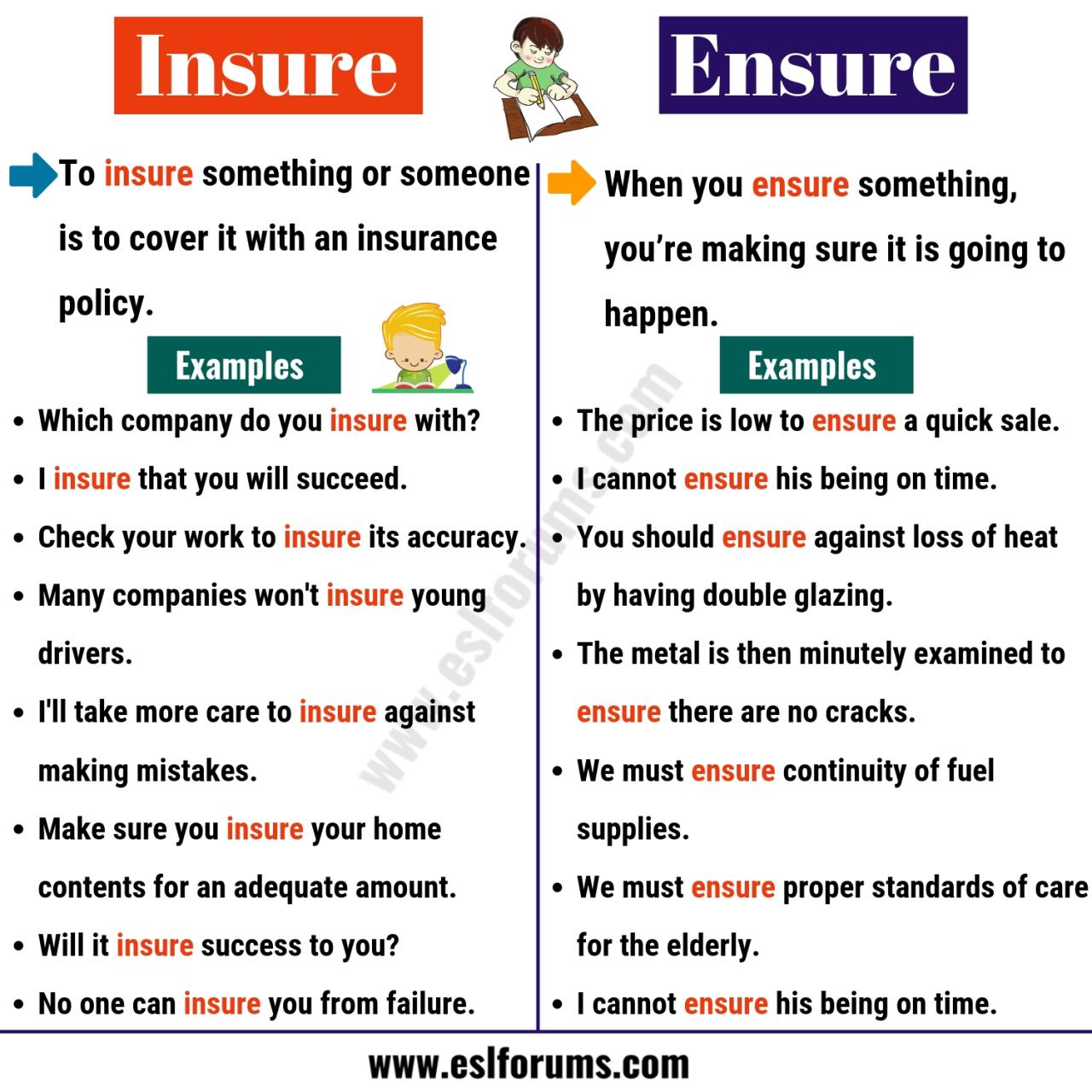

Private medical insurance, often referred to as health insurance, is a financial agreement between an individual and an insurance company. This agreement ensures that the individual receives coverage for various healthcare expenses, including doctor visits, hospital stays, surgeries, and other medical treatments.

Cybersecurity is becoming increasingly important for businesses of all sizes. If you’re looking for ways to protect your company from cyberattacks, you might want to consider getting cyber insurance coverage from Silverfort. This type of insurance can help cover the costs of data breaches, ransomware attacks, and other cyber threats.

In essence, it provides a safety net for individuals and families against the potentially crippling financial burden of unexpected medical bills.

Types of Private Medical Insurance Plans

Private medical insurance plans come in a variety of forms, each tailored to different needs and budgets. Here’s a breakdown of some common types:

- Individual Plans:These plans are designed for individuals and cover their personal medical expenses.

- Family Plans:These plans extend coverage to an individual’s spouse and children, providing comprehensive protection for the entire family.

- Group Plans:Offered by employers or organizations, group plans provide coverage to a collective of individuals, often at discounted rates.

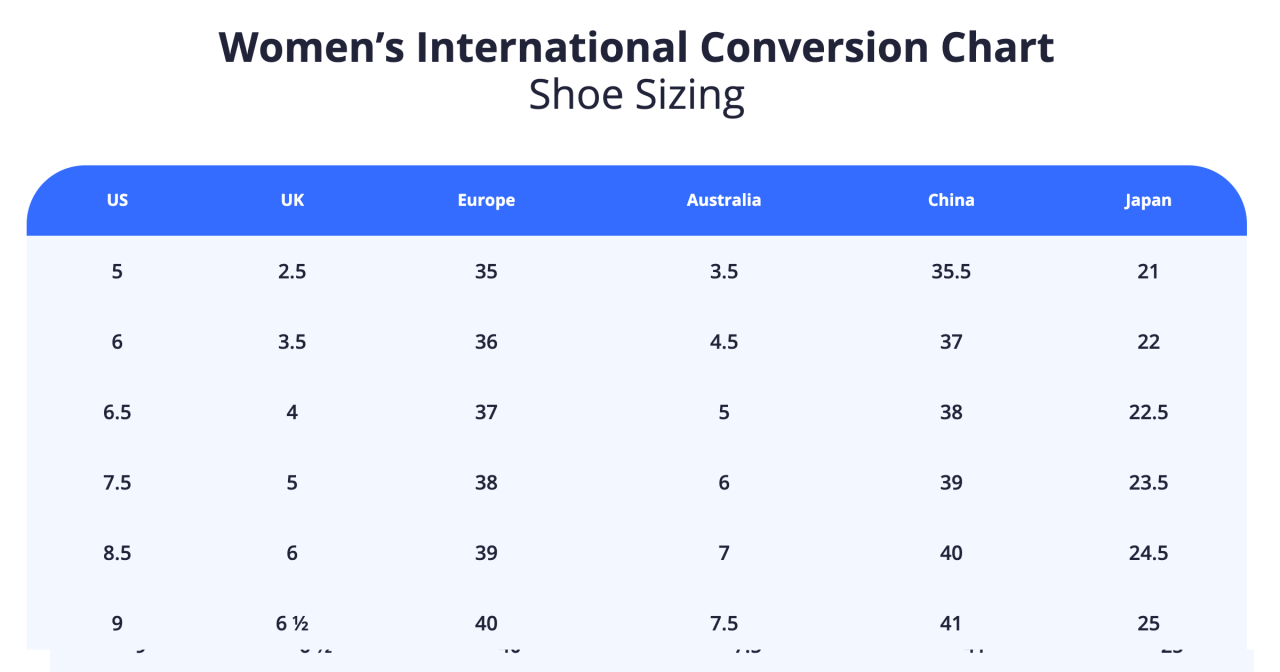

- International Plans:These plans are specifically designed for individuals who frequently travel internationally and need medical coverage in multiple countries.

Key Features and Benefits

Private medical insurance offers several key features and benefits that can significantly enhance an individual’s healthcare experience.

- Access to Specialized Care:Private insurance often grants access to specialized medical professionals and facilities, including renowned hospitals and clinics.

- Faster Treatment Times:Private insurance holders often experience shorter waiting times for consultations, diagnoses, and treatments compared to public healthcare systems.

- Choice of Healthcare Providers:Private insurance allows individuals to choose their preferred healthcare providers, giving them greater control over their medical care.

- Coverage for Pre-existing Conditions:Many private insurance plans cover pre-existing medical conditions, providing financial protection for individuals with chronic illnesses.

- Peace of Mind:Private medical insurance offers peace of mind knowing that unexpected medical expenses will be covered, reducing financial stress during challenging times.

Cost and Coverage of Private Medical Insurance

The cost of private medical insurance premiums is influenced by a range of factors, each playing a significant role in determining the final price.

Cybersecurity is a critical concern for businesses of all sizes, and it’s important to have adequate protection in place. One way to mitigate the financial impact of a cyberattack is through cyber insurance. If you’re looking for a comprehensive solution, check out cyber insurance coverage silverfort , which offers a range of coverage options to protect your business from various cyber threats.

Factors Influencing Premium Costs

- Age:Older individuals generally face higher premiums due to an increased likelihood of health issues.

- Health Status:Individuals with pre-existing conditions or a history of health problems often pay higher premiums.

- Coverage Level:Plans with higher coverage levels, including more comprehensive benefits, typically come with higher premiums.

- Location:The cost of living and healthcare expenses in different regions can influence premium costs.

- Lifestyle Factors:Factors like smoking, alcohol consumption, and physical activity can impact premium rates.

Coverage Provided by Private Medical Insurance Plans

The coverage provided by private medical insurance plans varies significantly, with some offering comprehensive protection while others focus on specific aspects of healthcare.

- Hospitalization:Most private insurance plans cover hospitalization costs, including room and board, surgical procedures, and medical care.

- Outpatient Care:Plans may cover doctor visits, diagnostic tests, and other outpatient services.

- Prescription Drugs:Coverage for prescription medications can vary depending on the plan, with some offering full coverage while others require co-payments.

- Dental and Vision Care:Some plans may include coverage for dental and vision care, while others offer these benefits as optional add-ons.

- Mental Health Services:Many private insurance plans now include coverage for mental health services, recognizing the importance of addressing mental well-being.

Cost-Effectiveness of Private Medical Insurance

The cost-effectiveness of private medical insurance depends on individual circumstances and the healthcare system in place. In countries with robust public healthcare systems, private insurance may be considered an optional luxury, while in systems with limited public coverage, private insurance can be a necessity.

Advantages and Disadvantages of Private Medical Insurance

Private medical insurance offers a range of advantages, but it also comes with potential drawbacks that should be carefully considered.

Advantages of Private Medical Insurance

- Faster Access to Care:Private insurance often provides faster access to medical services, reducing waiting times for consultations and treatments.

- Greater Choice of Providers:Individuals with private insurance can choose their preferred healthcare providers, including specialists and hospitals.

- Enhanced Comfort and Amenities:Private insurance may provide access to more comfortable and well-equipped healthcare facilities, including private rooms and specialized amenities.

- Protection from Unexpected Expenses:Private insurance acts as a financial safety net, shielding individuals from the potentially devastating costs of unexpected medical events.

Disadvantages of Private Medical Insurance

- High Premiums:Private insurance premiums can be expensive, especially for individuals with pre-existing conditions or who choose comprehensive coverage.

- Limited Coverage:Some private insurance plans may have limitations on coverage, excluding certain services or treatments.

- Administrative Burden:Navigating the complexities of private insurance, including claims processing and coverage limitations, can be time-consuming and frustrating.

- Potential for Denial of Coverage:Insurance companies may deny coverage for certain treatments or procedures based on pre-existing conditions or other factors.

Situations Where Private Medical Insurance Might Be Beneficial or Problematic

Private medical insurance can be particularly beneficial in situations where individuals require specialized care, have pre-existing conditions, or are concerned about long waiting times in public healthcare systems. However, it can be problematic for individuals with limited financial resources, those who are healthy and rarely require medical care, or those living in countries with comprehensive public healthcare systems.

Choosing the Right Private Medical Insurance Plan

Selecting the right private medical insurance plan requires careful consideration of individual needs, financial resources, and healthcare preferences.

Tips for Choosing a Private Medical Insurance Plan

- Assess Your Healthcare Needs:Determine your current and potential healthcare needs, considering factors like age, health status, and lifestyle.

- Compare Plans and Coverage:Obtain quotes from multiple insurance providers and compare their plans, coverage levels, and premium costs.

- Consider Your Budget:Choose a plan that fits your financial resources and provides adequate coverage without putting a strain on your finances.

- Read the Fine Print:Carefully review the policy documents, including exclusions, limitations, and waiting periods, to ensure you understand the terms and conditions.

- Seek Professional Advice:Consult with a financial advisor or insurance broker to get expert guidance on selecting the most suitable plan.

Checklist of Factors to Consider

- Coverage Level:Determine the level of coverage you require, including hospital stays, outpatient care, prescription drugs, and other services.

- Premium Costs:Compare premium costs from different providers and choose a plan that fits your budget.

- Co-payments and Deductibles:Understand the co-payments and deductibles associated with the plan, as these can impact your out-of-pocket expenses.

- Network of Providers:Ensure that the plan covers your preferred healthcare providers, including doctors, hospitals, and specialists.

- Claims Processing:Inquire about the insurance company’s claims processing procedures and their track record for timely and efficient handling of claims.

Table Comparing Private Medical Insurance Plans

A table comparing different private medical insurance plans based on their key features and benefits would be helpful for individuals seeking to make an informed decision. However, due to the vast number of insurance providers and plan variations, creating a comprehensive table within this context would be impractical.

It is recommended that individuals consult with insurance brokers or financial advisors to obtain detailed comparisons of specific plans.

The Role of Private Medical Insurance in Healthcare Systems

Private medical insurance plays a significant role in shaping healthcare systems around the world, influencing access to care, quality of services, and overall healthcare expenditure.

Impact of Private Medical Insurance on Healthcare Systems

- Increased Access to Care:Private insurance can provide individuals with access to healthcare services that may not be readily available through public systems, particularly in countries with limited public coverage.

- Competition and Innovation:The presence of private insurance providers can stimulate competition within the healthcare industry, encouraging innovation and improved quality of services.

- Financial Burden on Public Systems:In countries with dual healthcare systems, private insurance can contribute to a shift in financial burden from public systems to individuals, potentially leading to disparities in access to care.

- Influence on Healthcare Policy:Private insurance companies can exert influence on healthcare policy, advocating for policies that benefit their interests and potentially impacting the overall healthcare landscape.

Benefits and Drawbacks of a Dual Healthcare System

A dual healthcare system, where both public and private insurance operate, can offer benefits such as increased choice and access to care. However, it can also lead to disparities in access, higher overall healthcare costs, and complexity in navigating the system.

Interaction Between Private Medical Insurance and Public Healthcare

A visual representation of the interaction between private medical insurance and public healthcare could be a diagram or flowchart illustrating the different pathways for accessing healthcare services, the roles of public and private insurers, and the potential for coordination or fragmentation in the system.

However, creating such a visual representation within this context would be beyond the scope of this overview. It is recommended that individuals consult with healthcare experts or researchers for a comprehensive understanding of the complex interplay between private insurance and public healthcare.

Final Summary

Whether you’re looking for additional coverage beyond public healthcare, seeking faster access to specialists, or desire greater control over your medical choices, private medical insurance presents a viable option. However, it’s important to carefully evaluate your needs, budget, and the specific plans available to ensure you make a decision that aligns with your healthcare goals.