State Farm Home Insurance is a household name, synonymous with reliable protection for your most valuable asset: your home. For decades, State Farm has built a reputation for providing comprehensive coverage, competitive pricing, and exceptional customer service. This guide delves into the world of State Farm home insurance, exploring its features, benefits, and how it stacks up against the competition.

Whether you’re a first-time homeowner or a seasoned veteran, understanding the intricacies of home insurance is crucial. This guide will equip you with the knowledge to make informed decisions about your coverage, ensuring peace of mind knowing your home is protected from the unexpected.

State Farm Home Insurance Overview

State Farm is a leading provider of home insurance in the United States, known for its extensive network of agents, comprehensive coverage options, and competitive pricing. State Farm has a long history of providing reliable insurance protection to homeowners, with a strong reputation for customer service and financial stability.

If you’re planning a trip, it’s always a good idea to have some peace of mind. That’s where AAA travel insurance comes in. They offer a variety of plans to cover things like medical emergencies, trip cancellations, and lost luggage, so you can relax and enjoy your vacation knowing you’re protected.

Key Features and Benefits, State farm home insurance

State Farm home insurance policies offer a wide range of features and benefits designed to protect homeowners from various risks. These include:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the foundation, walls, roof, and attached structures, against covered perils like fire, windstorms, and hail.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, clothing, and electronics, from covered perils.

- Liability Coverage: This coverage provides financial protection if you are held liable for injuries or property damage to others on your property.

- Additional Living Expenses Coverage: This coverage helps cover the cost of temporary housing, meals, and other expenses if your home becomes uninhabitable due to a covered peril.

Coverage Options

State Farm offers a variety of coverage options to tailor your policy to your specific needs and budget. These options include:

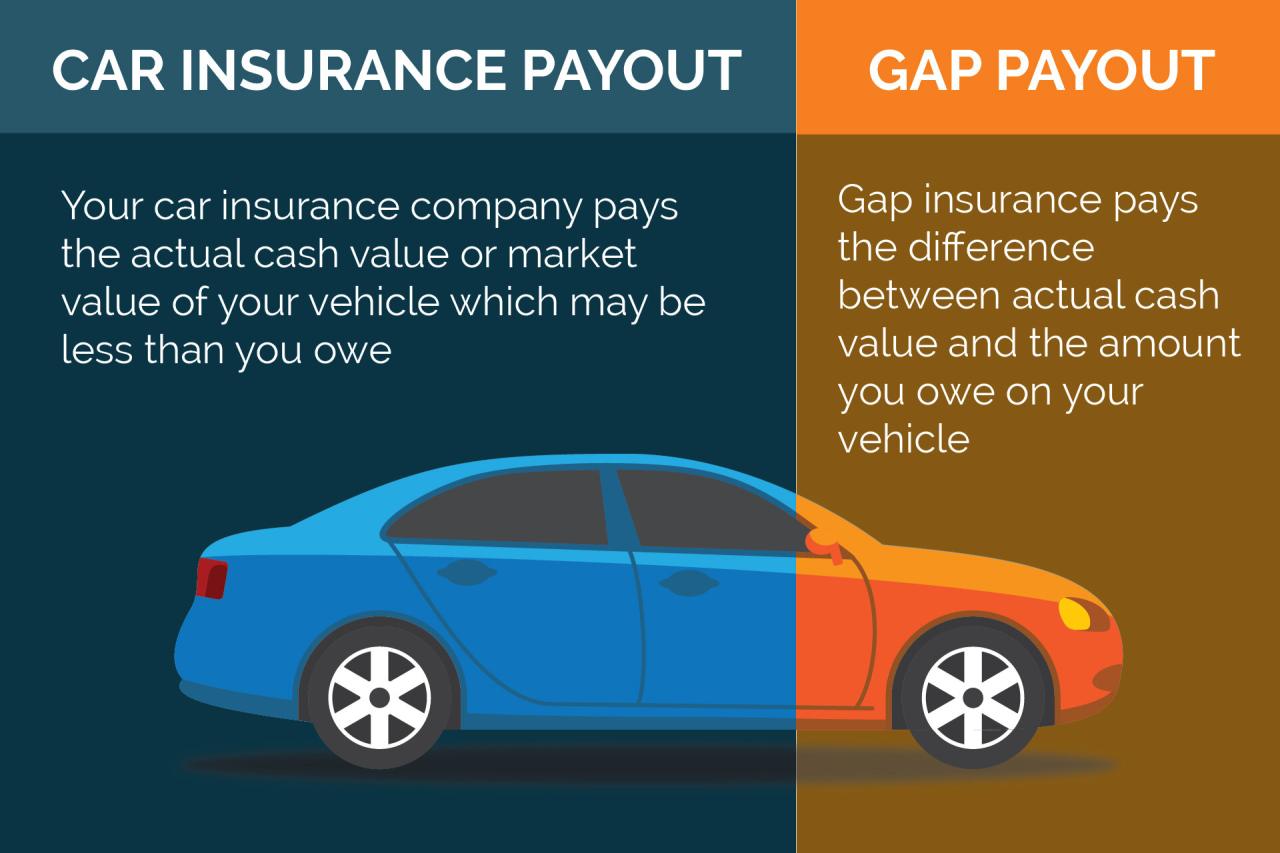

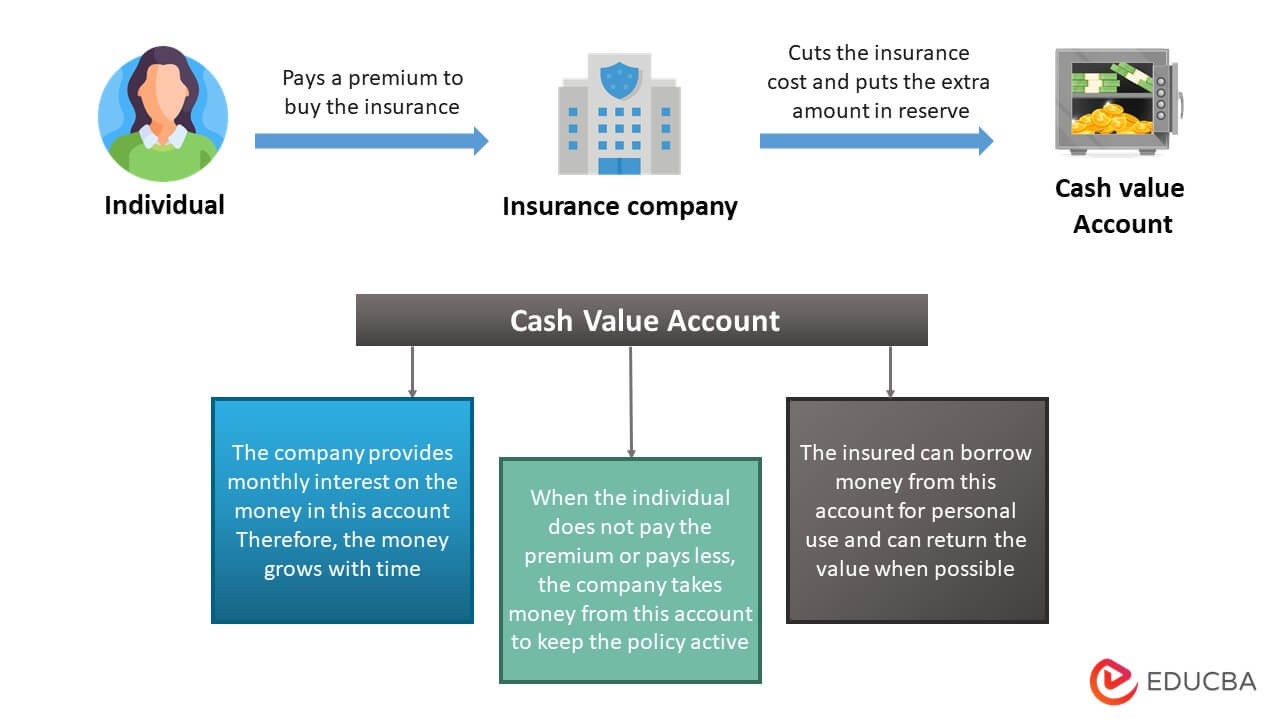

- Actual Cash Value (ACV): This option pays for the replacement cost of your damaged property minus depreciation.

- Replacement Cost Value (RCV): This option pays for the full replacement cost of your damaged property, regardless of depreciation.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. You can choose a deductible amount that suits your budget and risk tolerance.

Pricing and Cost Factors

The cost of State Farm home insurance premiums is influenced by several factors, including:

- Location: Homes in areas with higher risk of natural disasters, such as earthquakes, hurricanes, or floods, typically have higher premiums.

- Property Value: The higher the value of your home, the higher your premium will be.

- Coverage Level: The amount of coverage you choose will affect your premium. Higher coverage levels generally mean higher premiums.

- Risk Factors: Factors like your credit score, claims history, and the age and condition of your home can also influence your premium.

Comparison with Other Providers

State Farm’s pricing is generally competitive with other major home insurance providers. However, it’s important to compare quotes from multiple insurers to find the best rate for your specific needs.

Planning a trip? It’s always a good idea to have peace of mind with travel insurance. If you’re an AAA member, you might want to check out their travel insurance options. AAA travel insurance can help cover you for medical emergencies, lost luggage, and other unexpected situations that can arise during your travels.

Discounts

State Farm offers a variety of discounts to help lower your premiums. These discounts include:

- Safety Features: Discounts are available for homes with safety features such as smoke detectors, burglar alarms, and fire sprinklers.

- Bundling: You can often save money by bundling your home insurance with other policies, such as auto insurance.

- Loyalty Programs: State Farm offers discounts to long-term customers who maintain a good claims history.

Customer Experience and Service

Customer Reviews and Ratings

State Farm has generally received positive customer reviews and ratings. Here is a table summarizing customer feedback from various sources:

| Source | Rating | Comments |

|---|---|---|

| J.D. Power | 4 out of 5 stars | State Farm consistently ranks highly in customer satisfaction surveys. |

| Consumer Reports | 4 out of 5 stars | Customers praise State Farm for its reliable claims handling and responsive customer service. |

| Trustpilot | 4.5 out of 5 stars | Customers appreciate State Farm’s knowledgeable agents and transparent pricing. |

Claims Process

State Farm’s claims process is generally straightforward. You can report a claim online, by phone, or through a State Farm agent. The claims handling timeframe can vary depending on the complexity of the claim. However, State Farm is known for its prompt and efficient claims processing.

Customer Support

State Farm offers various customer support channels, including:

- Online Resources: State Farm has a comprehensive website with information about its policies, claims process, and other resources.

- Phone Support: You can reach State Farm’s customer service representatives by phone 24/7.

- Agent Availability: State Farm has a vast network of agents across the country who are available to provide personalized service and support.

Key Policy Features

Endorsements

State Farm offers various endorsements that can be added to your home insurance policy to provide additional coverage for specific risks. These endorsements include:

- Flood Insurance: This endorsement provides coverage for damage caused by flooding, which is not typically covered by standard home insurance policies.

- Earthquake Insurance: This endorsement provides coverage for damage caused by earthquakes, which is not typically covered by standard home insurance policies.

- Identity Theft Protection: This endorsement provides coverage for expenses related to identity theft, such as credit monitoring and legal fees.

Coverage Examples

State Farm’s home insurance coverage can apply to various scenarios, including:

- Fire Damage: Coverage for damage caused by a fire, including the cost of rebuilding your home and replacing your belongings.

- Theft: Coverage for stolen property, including valuables, electronics, and jewelry.

- Natural Disasters: Coverage for damage caused by natural disasters such as hurricanes, tornadoes, and hailstorms.

Claims Filing Process

To file a claim with State Farm, you can follow these steps:

- Report the claim: Contact State Farm by phone, online, or through an agent to report the claim.

- Provide details: Provide information about the claim, including the date, time, and location of the incident.

- Document the damage: Take photos or videos of the damage to your property.

- Submit a claim form: State Farm will provide you with a claim form to complete and submit.

- Work with an adjuster: A State Farm adjuster will inspect the damage and assess the claim.

- Receive a settlement: Once the claim is approved, State Farm will issue a settlement payment.

Comparison with Competitors

State Farm’s home insurance policies are comparable to those offered by other major insurance providers. However, there are some key differences in coverage, pricing, and customer service.

Comparison Table

Here is a table comparing the key features and benefits of State Farm home insurance with similar policies from other providers:

| Provider | Coverage | Pricing | Customer Service |

|---|---|---|---|

| State Farm | Comprehensive coverage options, including dwelling, personal property, liability, and additional living expenses | Generally competitive pricing, with discounts for safety features, bundling, and loyalty | Positive customer reviews and ratings, known for reliable claims handling and responsive customer service |

| Allstate | Comprehensive coverage options, with a focus on disaster preparedness and recovery | Competitive pricing, with discounts for good driving records and home safety features | Positive customer reviews and ratings, known for its claims handling speed and mobile app features |

| Liberty Mutual | Comprehensive coverage options, with a focus on customization and personalized service | Competitive pricing, with discounts for multiple policies and good driving records | Positive customer reviews and ratings, known for its online resources and customer support options |

Pros and Cons

Here are some of the pros and cons of choosing State Farm home insurance:

- Pros:

- Comprehensive coverage options

- Competitive pricing

- Extensive agent network

- Positive customer reviews and ratings

- Cons:

- May not be the cheapest option for all homeowners

- Claims handling process can be lengthy in some cases

Final Review

In conclusion, State Farm Home Insurance offers a comprehensive suite of coverage options, competitive pricing, and a commitment to customer satisfaction. By understanding the key features, pricing factors, and customer experience, you can make an informed decision about whether State Farm is the right choice for your home insurance needs.

Remember to carefully review your policy, explore available discounts, and don’t hesitate to contact State Farm with any questions or concerns.