Universal life insurance, a flexible and customizable life insurance policy, offers a unique blend of death benefit coverage and cash value accumulation. Unlike traditional term life insurance, universal life insurance allows policyholders to adjust their premiums and death benefit over time, providing greater control and adaptability to their changing needs.

It also features a cash value component that can be invested in a variety of sub-accounts, potentially growing over time and offering additional financial benefits.

This type of insurance can be a valuable tool for individuals seeking a combination of life insurance protection and investment opportunities, particularly those with long-term financial goals. Understanding the nuances of universal life insurance, including its advantages, disadvantages, and suitability, is crucial before making an informed decision.

Universal Life Insurance: An Overview

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments, death benefit, and cash value accumulation. It combines a death benefit with a savings component, allowing policyholders to control how their premiums are allocated.

Key Features of Universal Life Insurance

Universal life insurance distinguishes itself from other life insurance types through its unique features:

- Flexible Premium Payments:Policyholders have the freedom to adjust their premium payments based on their financial situation.

- Adjustable Death Benefit:The death benefit can be increased or decreased, providing flexibility to meet changing needs.

- Cash Value Accumulation:A portion of the premium is allocated to a cash value account, which can grow through investment options.

- Investment Options:Policyholders have the option to invest their cash value in various sub-accounts, offering potential for growth.

Real-Life Scenarios for Universal Life Insurance

Universal life insurance can be a suitable option in various life situations:

- Individuals with fluctuating income:The flexible premium payments allow policyholders to adjust their contributions based on their financial circumstances.

- Families with growing needs:The adjustable death benefit provides the flexibility to increase coverage as family responsibilities change.

- Individuals seeking long-term savings:The cash value component can serve as a savings vehicle with potential for growth.

- Entrepreneurs with fluctuating business income:The flexible premium payments allow for adjustments based on business performance.

Components of Universal Life Insurance

Universal life insurance consists of two primary components: the death benefit and the cash value.

Death Benefit Component

The death benefit component is the primary purpose of life insurance. It provides a lump sum payment to beneficiaries upon the policyholder’s death. In universal life insurance, the death benefit is flexible and can be adjusted based on the policyholder’s needs.

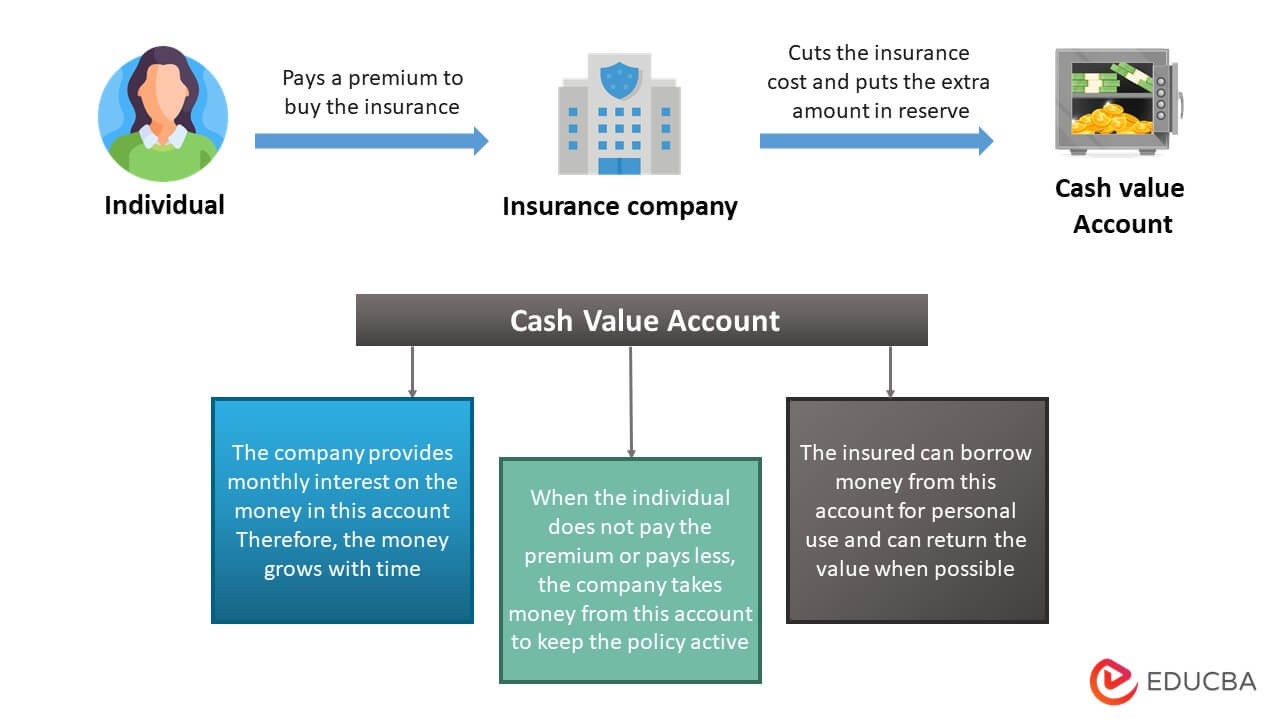

Cash Value Component

The cash value component is a savings feature that allows policyholders to accumulate funds over time. A portion of each premium payment is allocated to the cash value account, which can grow through investment options. Policyholders have the option to withdraw cash from the account, borrow against it, or leave it to grow tax-deferred.

Premium Payment Options

Universal life insurance offers various premium payment options, each with its own implications:

- Level premiums:A fixed premium amount is paid each month, providing predictability.

- Flexible premiums:Policyholders can adjust their premium payments based on their financial situation.

- Single premium:A lump sum payment is made to cover the entire policy term.

Advantages of Universal Life Insurance

Universal life insurance offers several advantages, making it an attractive option for many individuals:

Flexibility in Premium Payments and Death Benefit Adjustments

Policyholders have the freedom to adjust their premium payments and death benefit based on their changing needs and financial circumstances. This flexibility provides peace of mind and allows for customization.

Getting the best deal on car insurance can feel like a chore, but it doesn’t have to be! By comparing car insurance quotes from different providers, you can find the perfect policy that fits your needs and budget. Don’t settle for the first quote you see – shop around and save!

Potential for Cash Value Growth

The cash value component of universal life insurance can grow through investment options. Policyholders can choose from a variety of sub-accounts, offering potential for higher returns.

Tax Advantages

The cash value component of universal life insurance grows tax-deferred. This means that interest earned on the cash value is not taxed until it is withdrawn.

Disadvantages of Universal Life Insurance

Despite its advantages, universal life insurance also has some drawbacks to consider:

Potential for Higher Premiums, Universal life insurance

Universal life insurance premiums can be higher than those for other types of life insurance, such as term life insurance.

Finding the right car insurance can be a real headache. You don’t want to overpay, but you also want to make sure you’re properly covered. That’s why it’s so important to shop around and compare car insurance quotes from different providers.

This way, you can find the best deal for your needs and budget.

Risks Associated with Investment Options

Policyholders bear the investment risk associated with the cash value component. If the investments perform poorly, the cash value may not grow as expected, and the death benefit may be reduced.

Complexities Involved in Management

Universal life insurance policies can be complex to understand and manage. Policyholders need to carefully consider their investment options and make informed decisions about premium payments and death benefit adjustments.

Choosing Universal Life Insurance

When considering universal life insurance, it is essential to evaluate several factors:

Checklist for Evaluating Universal Life Insurance

- Your financial situation:Can you afford the premiums and manage the potential risks?

- Your insurance needs:How much coverage do you require? How long do you need it for?

- Your investment goals:Do you want to grow your cash value? Are you comfortable with the investment risks?

- Your risk tolerance:Are you comfortable with the potential for investment losses?

- The insurer’s reputation:Choose a reputable insurer with a strong financial track record.

- Policy features and costs:Carefully review the policy’s terms and conditions, including premiums, fees, and death benefit options.

Comparison with Other Life Insurance Options

Universal life insurance should be compared with other life insurance options, such as term life insurance and whole life insurance, to determine the best fit for your needs and circumstances.

Pros and Cons of Universal Life Insurance

| Pros | Cons |

|---|---|

| Flexibility in premium payments and death benefit | Higher premiums than other life insurance types |

| Potential for cash value growth | Investment risks associated with cash value |

| Tax advantages on cash value growth | Complexities involved in managing the policy |

Universal Life Insurance and Estate Planning

Universal life insurance can play a significant role in estate planning strategies, offering several benefits:

Minimizing Estate Taxes

Universal life insurance can be used to create a death benefit that can be used to pay estate taxes, minimizing the tax burden on heirs. The death benefit is generally tax-free to beneficiaries.

Integration into Estate Plans

Universal life insurance can be incorporated into estate plans in various ways, such as:

- Naming beneficiaries:Policyholders can name beneficiaries to receive the death benefit upon their passing.

- Irrevocable life insurance trusts:Policyholders can transfer ownership of the policy to an irrevocable life insurance trust, which can help reduce estate taxes.

- Estate planning strategies:Universal life insurance can be used to fund charitable donations or provide for business succession planning.

Outcome Summary

Universal life insurance offers a compelling blend of protection and investment potential, making it a viable option for individuals seeking a flexible and customizable life insurance solution. However, it’s essential to carefully weigh the advantages and disadvantages, considering factors like premium flexibility, cash value growth potential, and the complexities involved in managing the policy.

By understanding the intricacies of universal life insurance, you can determine if it aligns with your specific financial needs and long-term goals.