Whole life insurance policy offers a unique approach to life insurance, providing lifelong coverage and the potential for cash value accumulation. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in effect as long as you pay your premiums, offering peace of mind for your loved ones and a financial safety net for you.

This type of insurance acts as a financial tool, offering a blend of protection and investment potential. It’s important to understand the nuances of whole life insurance, including its premiums, cash value growth, and the various riders and options available, to determine if it aligns with your individual financial goals.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay your premiums. It is a valuable financial tool that can provide peace of mind for your loved ones and help you achieve your long-term financial goals.

Core Concept

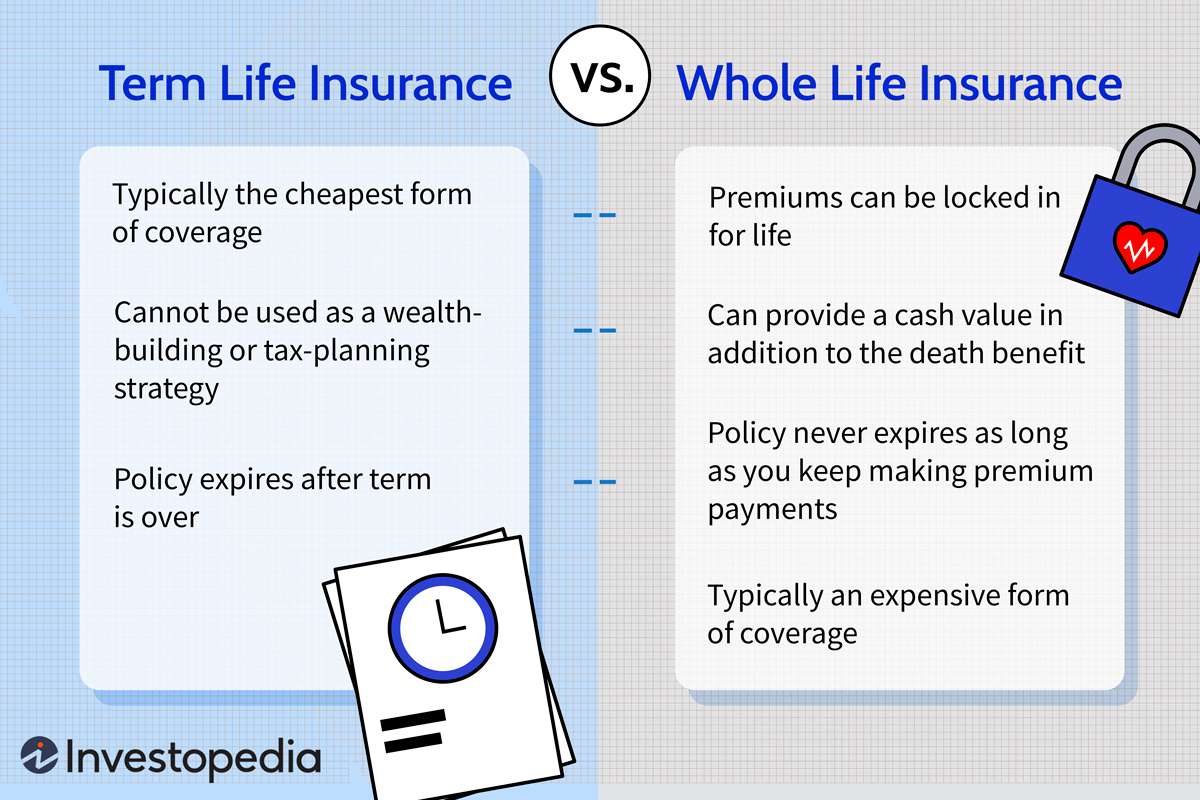

Whole life insurance is designed to provide lifelong coverage, ensuring that your beneficiaries receive a death benefit upon your passing, regardless of when that occurs. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers permanent protection.

This makes it a suitable option for individuals seeking financial security for their families over the long term.

Key Differences, Whole life insurance policy

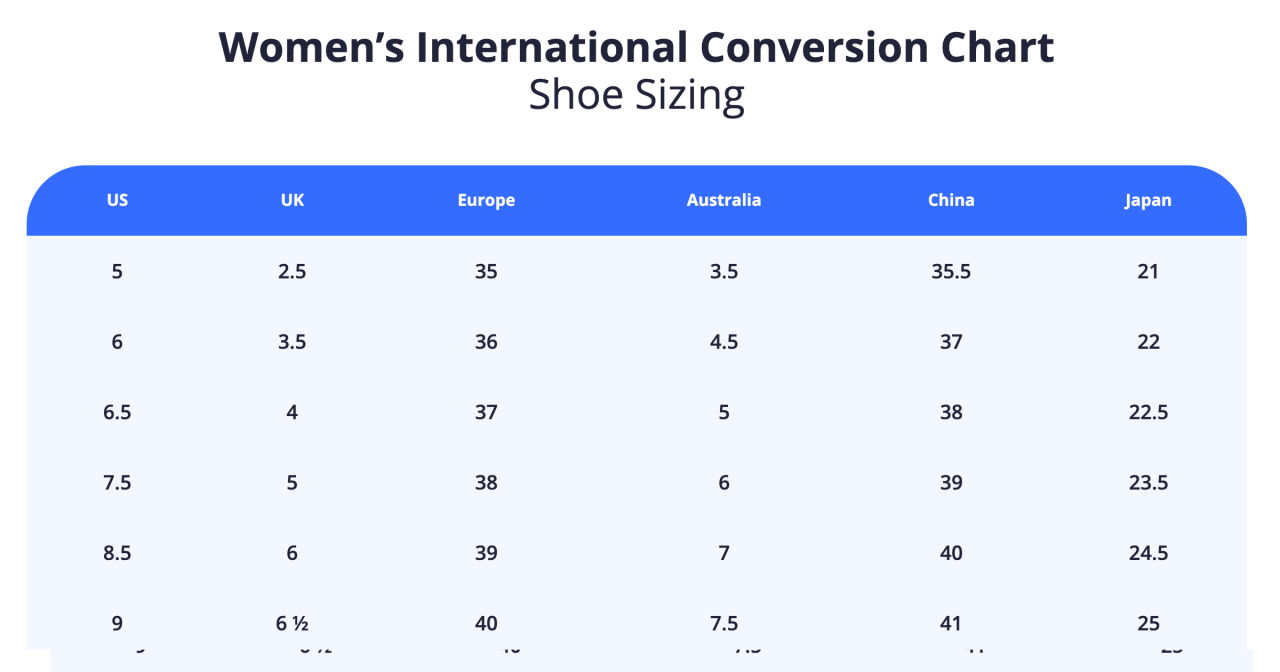

Whole life insurance stands apart from other types of life insurance, such as term life insurance and universal life insurance, due to its unique features and characteristics. Here’s a breakdown of the key differences:

- Term Life Insurance:Provides coverage for a specific period, typically 10, 20, or 30 years. Premiums are generally lower than whole life insurance, but coverage ends at the end of the term. If you die before the term ends, your beneficiaries receive the death benefit.

If you outlive the term, the coverage ends, and you receive nothing.

- Universal Life Insurance:Offers more flexibility in premium payments and death benefit amounts. It also has a cash value component, but it may have higher premiums and fees than whole life insurance. The death benefit and cash value can fluctuate based on market performance.

- Whole Life Insurance:Provides lifetime coverage, guaranteeing a death benefit regardless of when you pass away. Premiums are typically fixed and level, ensuring predictable costs. It also accumulates cash value, which grows tax-deferred and can be accessed through withdrawals, loans, or used to pay premiums.

Key Features

Whole life insurance is defined by its unique features, which set it apart from other types of life insurance. Here are some key features that distinguish whole life insurance:

- Lifetime Coverage:Provides continuous protection for your entire life, as long as you continue paying premiums. This ensures that your beneficiaries receive a death benefit regardless of when you pass away.

- Fixed Premiums:Offers predictable and stable premiums that remain the same throughout the policy’s duration. This helps you budget for your insurance costs and provides financial stability.

- Cash Value Accumulation:A portion of your premium goes towards building a cash value component, which grows tax-deferred. This cash value can be accessed through withdrawals, loans, or used to pay premiums.

- Guaranteed Death Benefit:The death benefit is guaranteed, meaning that your beneficiaries will receive a specific amount upon your passing, regardless of market fluctuations or changes in your health.

Benefits of Whole Life Insurance

Whole life insurance offers a range of benefits that can be valuable for individuals and families seeking long-term financial security and protection.

Lifetime Coverage

The primary benefit of whole life insurance is its lifetime coverage. This means that your beneficiaries are guaranteed to receive a death benefit, regardless of when you pass away. This provides peace of mind and financial stability for your loved ones, knowing that they will be financially protected in the event of your passing.

Cash Value Accumulation

Whole life insurance policies build cash value over time, which can be accessed through withdrawals, loans, or used to pay premiums. This cash value component can provide a source of funds for various purposes, such as:

- Retirement planning:You can use the cash value to supplement your retirement income.

- Emergency funds:Access the cash value in times of unexpected financial need.

- Education expenses:Use the cash value to pay for your children’s education.

- Debt consolidation:Borrow against the cash value to consolidate high-interest debts.

Long-Term Investment

Whole life insurance can serve as a long-term investment vehicle. The cash value component grows tax-deferred, meaning that you won’t have to pay taxes on the earnings until you withdraw them. This can help you build wealth over time and achieve your financial goals.

Considerations for Choosing Whole Life Insurance

Before deciding if whole life insurance is the right choice for you, it’s essential to carefully consider various factors.

Suitability

Whole life insurance may not be suitable for everyone. Consider these factors when deciding if it’s right for you:

- Financial goals:If you’re looking for lifetime coverage and want to build cash value, whole life insurance could be a good option. However, if you need coverage for a specific period and prioritize affordability, term life insurance might be a better choice.

- Risk tolerance:Whole life insurance provides guaranteed coverage and cash value growth, but it typically has higher premiums than term life insurance. If you are risk-averse and value financial stability, whole life insurance might be suitable.

- Time horizon:Whole life insurance is a long-term investment. If you have a long-term financial plan and are seeking lifetime coverage, it can be a valuable tool. However, if you have a shorter time horizon, term life insurance might be more appropriate.

Cost Comparison

Whole life insurance premiums are generally higher than term life insurance premiums. This is because whole life insurance provides lifetime coverage and includes a cash value component. Compare the costs of whole life insurance with other types of life insurance to determine which option best fits your budget and financial needs.

Looking for a new car insurance policy? Getting a car insurance quote is the first step. This will help you compare prices and coverage options from different insurers, so you can find the best deal for your needs.

Premium Impact on Financial Planning

The cost of whole life insurance premiums can significantly impact your financial planning. Consider the impact of these premiums on your overall budget and financial goals. Make sure that you can comfortably afford the premiums without jeopardizing your other financial priorities.

Understanding Policy Features: Whole Life Insurance Policy

Whole life insurance policies offer various features that can enhance their value and flexibility. Understanding these features is crucial for making informed decisions about your policy.

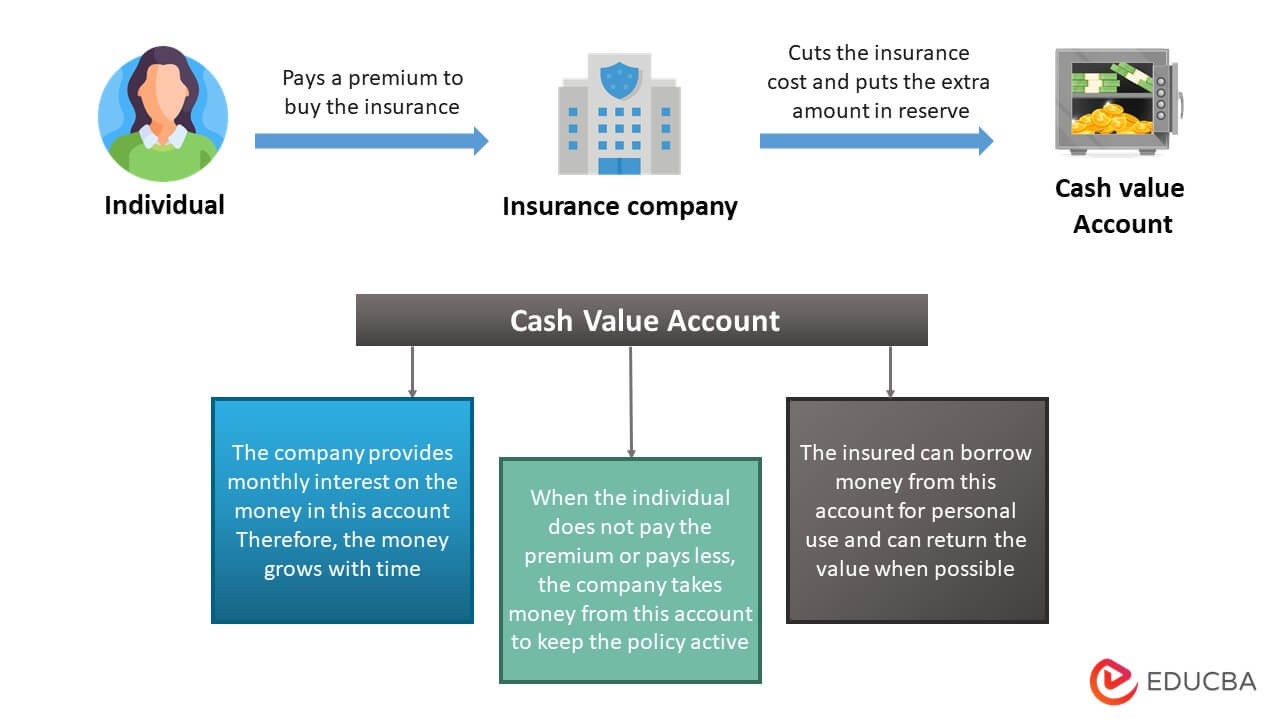

Cash Value

Cash value is a key feature of whole life insurance. A portion of your premium goes towards building a cash value component, which grows tax-deferred. This cash value can be accessed through withdrawals, loans, or used to pay premiums.

- Growth potential:The cash value grows at a predetermined rate, typically based on the insurance company’s investment performance. This growth is tax-deferred, meaning that you won’t have to pay taxes on the earnings until you withdraw them.

- Access options:You can access the cash value through withdrawals, loans, or use it to pay premiums. Withdrawals are generally taxed as ordinary income, while loans are typically interest-bearing and may be subject to interest charges.

- Loan options:You can borrow against the cash value of your policy. This can provide a source of funds for various purposes, such as home improvements, education expenses, or debt consolidation. However, it’s essential to understand the interest rates and repayment terms associated with loans.

Policy Riders

Policy riders are optional features that can be added to your whole life insurance policy to provide additional coverage or benefits. Common policy riders include:

- Accidental death benefit rider:Provides an additional death benefit if you die due to an accident.

- Living benefits rider:Allows you to access a portion of your death benefit while you are still alive, if you are terminally ill or have a critical illness.

- Disability income rider:Provides income replacement if you become disabled and unable to work.

Loan Options and Withdrawals

Whole life insurance policies allow you to access the cash value through loans and withdrawals. Loans are typically interest-bearing, while withdrawals are generally taxed as ordinary income. It’s essential to understand the terms and conditions associated with loans and withdrawals before accessing your cash value.

Choosing a Whole Life Insurance Policy

Selecting a suitable whole life insurance policy requires careful consideration and planning. Here’s a step-by-step guide to help you make an informed decision.

Step-by-Step Guide

- Determine your needs:Identify your financial goals, risk tolerance, and time horizon to determine the appropriate level of coverage and cash value accumulation.

- Compare quotes:Obtain quotes from multiple reputable insurance providers to compare premiums, death benefits, and policy features.

- Review policy terms:Carefully review the policy terms and conditions, including the death benefit, premiums, cash value growth, and any riders or exclusions.

- Consider the insurance provider:Research the financial stability and reputation of the insurance provider. Look for companies with strong financial ratings and a history of customer satisfaction.

- Seek professional advice:Consult with a financial advisor or insurance broker to get personalized guidance and recommendations based on your specific circumstances.

Tips for Finding a Reputable Provider

- Check financial ratings:Look for insurance providers with strong financial ratings from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s.

- Read customer reviews:Check online reviews and testimonials from other customers to get an idea of the provider’s reputation for customer service and claims handling.

- Ask for referrals:Ask friends, family, or financial professionals for recommendations on reputable insurance providers.

Comparing Quotes and Policy Terms

When comparing quotes, pay attention to the following factors:

- Death benefit:Ensure that the death benefit is sufficient to meet your family’s financial needs.

- Premiums:Compare the premiums from different providers to find the most affordable option.

- Cash value growth:Review the projected cash value growth rates and understand the factors that can affect this growth.

- Policy features:Compare the policy features, including riders, loan options, and withdrawal provisions.

Managing Your Whole Life Insurance Policy

Managing your whole life insurance policy effectively ensures that you maximize its benefits and protect your financial interests.

Key Aspects of Policy Management

| Aspect | Description |

|---|---|

| Regular Reviews | Review your policy periodically to ensure that it still meets your needs and financial goals. Consider factors like changes in your family size, income, or financial goals. |

| Premium Payments | Make sure to pay your premiums on time to avoid policy lapse. Consider setting up automatic payments to ensure consistency. |

| Cash Value Management | Monitor the growth of your cash value and consider accessing it for specific purposes, such as retirement planning, emergency funds, or debt consolidation. |

| Policy Changes | If your needs change, consider making adjustments to your policy, such as increasing or decreasing the death benefit, adding or removing riders, or changing the premium payment schedule. |

| Communication with Provider | Maintain open communication with your insurance provider. Keep them informed of any changes in your contact information, health status, or financial situation. |

Regular Policy Reviews

Regular policy reviews are essential for ensuring that your whole life insurance policy continues to meet your needs and financial goals. Review your policy at least annually or whenever significant life events occur, such as marriage, birth of a child, or changes in your income or financial goals.

Shopping for car insurance can be a bit overwhelming, but it doesn’t have to be. Start by getting a car insurance quote from a few different companies. This will give you a good idea of what rates are available and help you compare coverage options.

Don’t forget to factor in your driving history, the type of car you drive, and your location when you’re comparing quotes.

Making Policy Changes

You may need to make changes to your whole life insurance policy over time. These changes could include increasing or decreasing the death benefit, adding or removing riders, or changing the premium payment schedule. Contact your insurance provider to discuss any potential changes and understand the process for making adjustments.

Final Wrap-Up

Whole life insurance can be a valuable asset for those seeking long-term financial security and a guaranteed death benefit. However, it’s crucial to weigh the costs and benefits carefully and consider your individual needs and financial situation. By understanding the intricacies of this type of policy, you can make an informed decision about whether whole life insurance is the right choice for you.