Average car insurance cost is a crucial consideration for any driver, and understanding the factors that influence it is essential for securing affordable coverage. From your age and driving history to the make and model of your car, numerous elements contribute to the price you pay for insurance.

This exploration dives into the intricacies of average car insurance cost, providing insights into how it’s calculated and strategies to potentially reduce your premiums.

Beyond individual factors, understanding the broader landscape of car insurance premiums is key. This includes exploring the different types of coverage, the role of deductibles, and the impact of bundling policies. We’ll delve into these aspects and offer practical tips for navigating the world of car insurance.

Factors Influencing Average Car Insurance Cost

Car insurance is a crucial aspect of responsible car ownership, safeguarding you financially against potential accidents and other unforeseen events. However, the cost of car insurance can vary significantly based on a multitude of factors. Understanding these factors is essential for making informed decisions and potentially lowering your insurance premiums.

Looking for the best deal on auto insurance? You’re not alone! It can be overwhelming to compare all the different options out there. That’s why it’s a good idea to use a website that can help you get auto insurance quotes from multiple companies.

This way, you can easily compare prices and coverage and find the policy that best suits your needs.

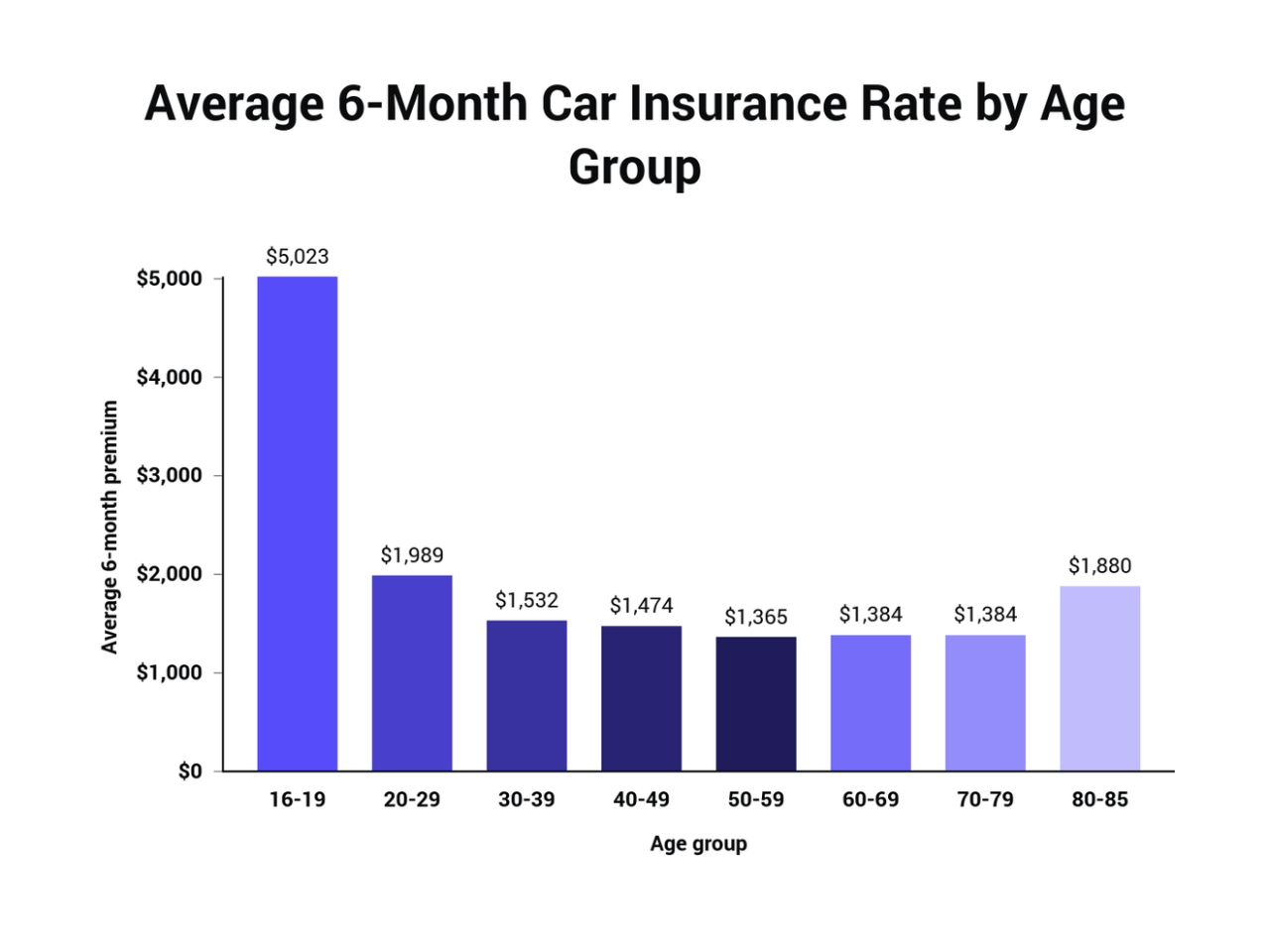

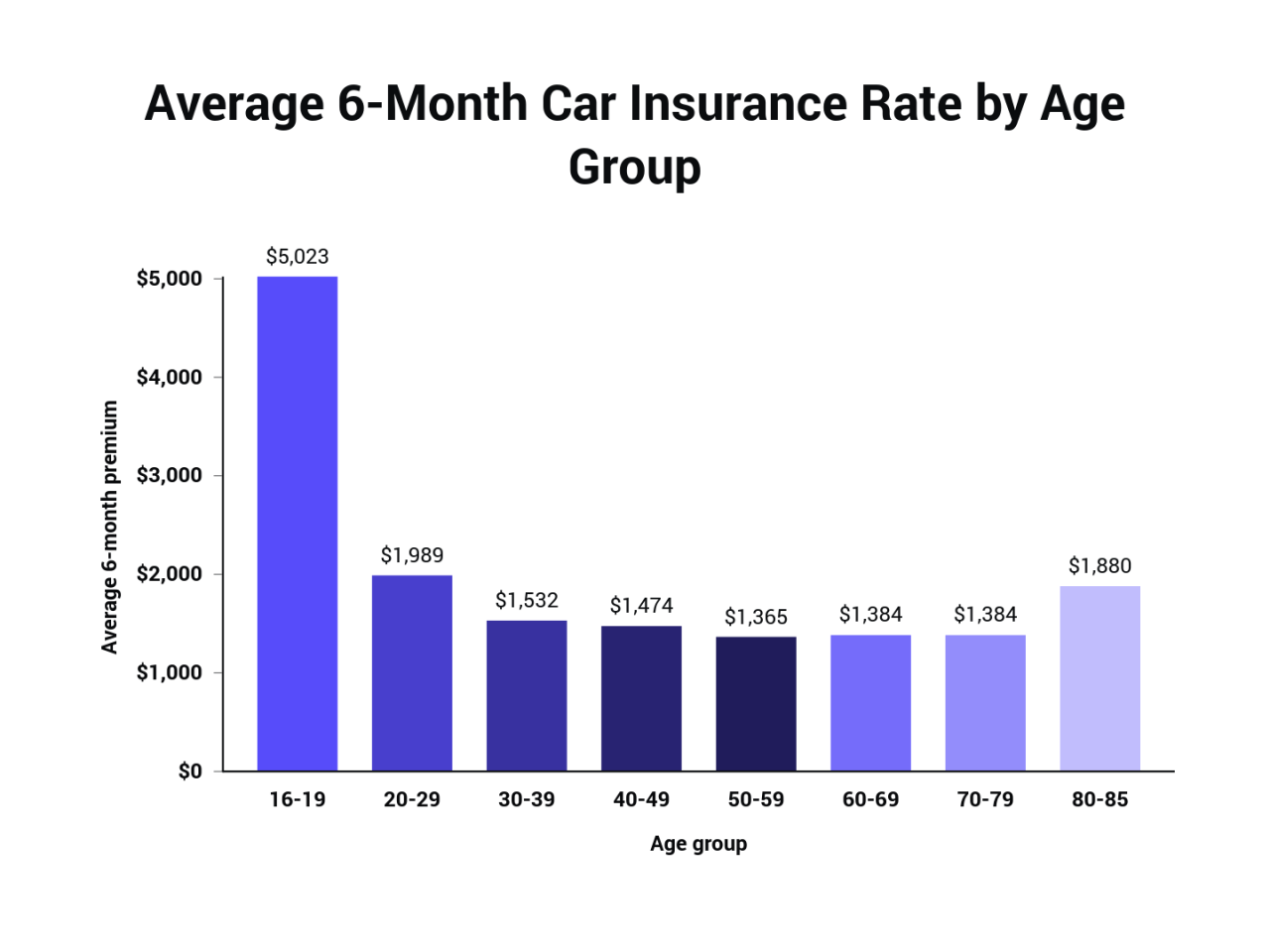

Age

Age plays a significant role in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors such as inexperience and risk-taking behavior. Insurance companies recognize this trend and often charge higher premiums for younger drivers.

As drivers gain experience and age, their premiums tend to decrease.

Driving History

Your driving history is a critical factor in determining your car insurance cost. Insurance companies meticulously review your driving record, looking for any instances of accidents, traffic violations, or other incidents that might indicate a higher risk of future claims.

Drivers with clean driving records typically enjoy lower premiums, while those with a history of accidents or violations face higher rates.

Car Model and Make

The type of car you drive can significantly impact your insurance cost. Insurance companies assess the safety features, repair costs, and theft risk associated with different car models and makes. Vehicles with advanced safety features, such as airbags, anti-lock brakes, and stability control, often qualify for lower premiums.

On the other hand, luxury cars or those with a history of high repair costs may attract higher premiums.

Location

Your location can also influence car insurance rates. Urban areas with higher traffic density and crime rates often have higher insurance costs due to the increased risk of accidents and theft. Conversely, rural areas with lower population density and less traffic may have lower insurance rates.

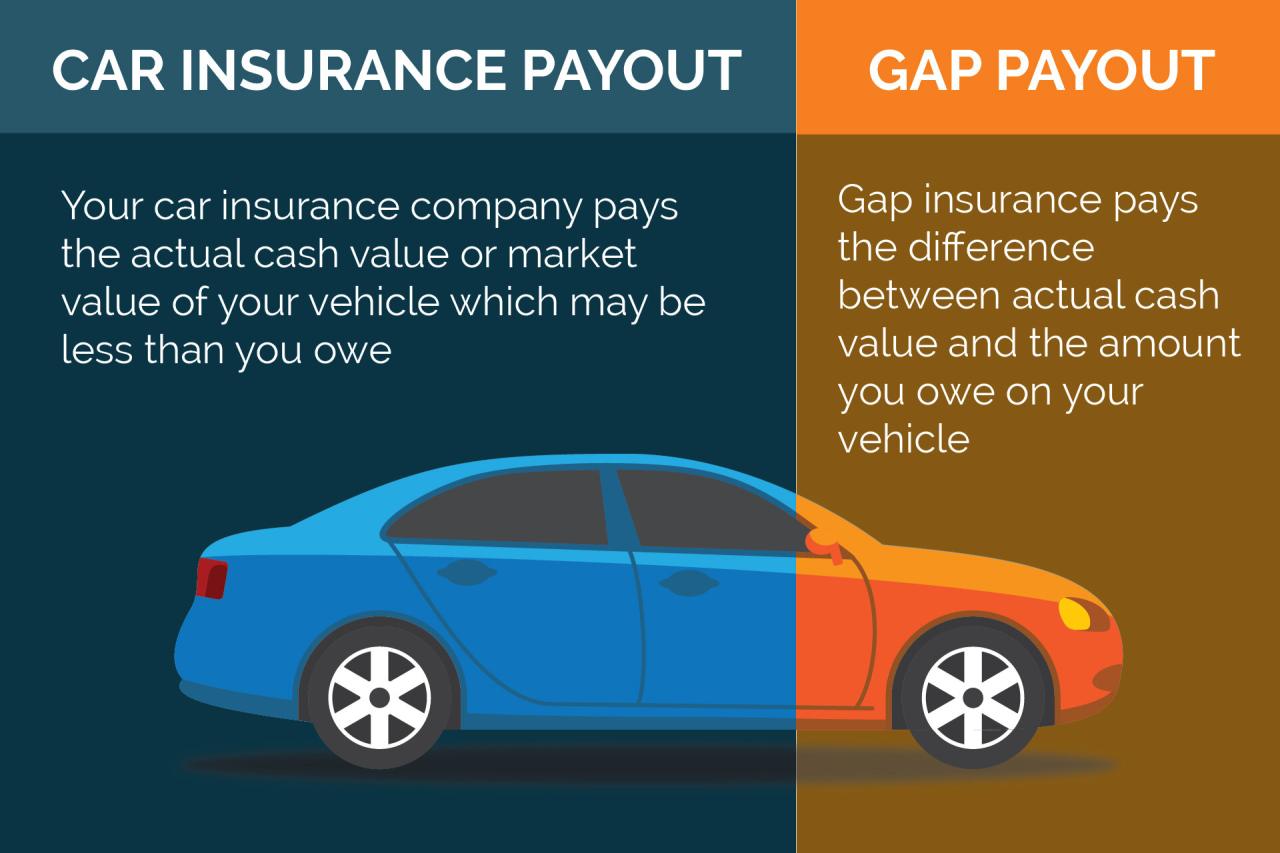

Coverage Levels

The amount of coverage you choose for your car insurance policy directly affects the premium. Higher coverage levels, such as comprehensive and collision coverage, provide greater financial protection but also come with higher premiums. Conversely, lower coverage levels, such as liability-only coverage, offer less protection but may be more affordable.

Understanding Car Insurance Premiums

Car insurance premiums are calculated based on a complex formula that considers various factors. Understanding the components of these premiums can help you make informed decisions about your insurance coverage.

Components of Car Insurance Premiums

Car insurance premiums are typically comprised of the following components:

- Base Premium:This is the foundation of your premium, determined by factors such as your age, driving history, and location.

- Vehicle Factors:The type of car you drive, its safety features, and its estimated repair costs contribute to this component.

- Coverage Levels:The amount of coverage you choose, such as liability, collision, and comprehensive, affects your premium.

- Deductible:This is the amount you agree to pay out of pocket for a covered claim. A higher deductible typically leads to lower premiums.

- Risk Assessment:Insurance companies use sophisticated algorithms and data analytics to assess your individual risk profile and adjust your premiums accordingly.

How Insurance Companies Calculate Premiums

Insurance companies use a variety of factors to calculate premiums, including:

- Credit History:Your credit score can be used as an indicator of your financial responsibility and risk.

- Driving History:As mentioned earlier, your driving record plays a significant role in determining your premiums.

- Vehicle Information:The make, model, year, and safety features of your car are considered.

- Location:Your address and the surrounding area’s risk factors are factored in.

- Coverage Levels:The amount of coverage you choose, such as liability, collision, and comprehensive, directly impacts your premium.

Impact of Deductibles on Car Insurance Costs, Average car insurance cost

A deductible is the amount you agree to pay out of pocket for a covered claim before your insurance coverage kicks in. Choosing a higher deductible can significantly lower your premiums. However, it’s essential to consider your financial capacity to handle a higher deductible if you need to file a claim.

Shopping for car insurance can be a hassle, but it doesn’t have to be. You can easily compare rates and find the best coverage for your needs by getting auto insurance quotes online. Just enter some basic information about your car and driving history, and you’ll receive personalized quotes from multiple insurers.

This way, you can compare apples to apples and make sure you’re getting the best deal possible.

Average Premiums for Different Types of Coverage

The average cost of car insurance can vary depending on the type of coverage you choose. Here’s a table comparing the average premiums for different types of coverage:

| Coverage Type | Average Premium |

|---|---|

| Liability-only | $500

|

| Collision and Comprehensive | $1,000

|

| Full Coverage | $1,500

|

Note: These are just estimates, and actual premiums may vary based on individual factors.

Strategies to Reduce Car Insurance Costs

While car insurance is essential, you can take steps to reduce your premiums and make it more affordable. Here are some effective strategies:

Improve Driving Habits

By adopting safe driving practices, you can lower your risk of accidents and potentially reduce your premiums. Consider these tips:

- Avoid Distracted Driving:Put away your phone and avoid texting or using social media while driving.

- Obey Traffic Laws:Follow speed limits, signal properly, and avoid reckless driving.

- Maintain Your Vehicle:Regular maintenance ensures your car is in good working order, reducing the risk of breakdowns and accidents.

- Take Defensive Driving Courses:These courses can teach you valuable skills to avoid accidents and potentially earn you discounts.

Bundle Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance and homeowners or renters insurance. By combining your policies with the same insurer, you can often save money on your premiums.

Find Discounts and Negotiate Lower Rates

Insurance companies offer various discounts to their policyholders. Explore these options:

- Good Student Discounts:If you have a high GPA, you may qualify for a discount.

- Safe Driver Discounts:Maintaining a clean driving record can earn you discounts.

- Multi-Car Discounts:If you insure multiple cars with the same company, you may qualify for a discount.

- Loyalty Discounts:Staying with the same insurance company for a long period can lead to discounts.

- Anti-theft Device Discounts:Installing anti-theft devices in your car can reduce your premiums.

Don’t hesitate to negotiate with your insurance company. Explain your good driving history, safety features in your car, and any other factors that might qualify you for a lower rate.

Common Car Insurance Myths

Here are some common car insurance myths and their factual explanations:

- Myth:“If I have a clean driving record, I don’t need car insurance.” Fact:Even with a clean record, accidents can happen, and car insurance is essential for financial protection.

- Myth:“I can save money by only having liability insurance.” Fact:While liability coverage is essential, it doesn’t cover damage to your own car. Collision and comprehensive coverage provide additional protection.

- Myth:“My insurance rates will automatically go down after I turn 25.” Fact:While insurance rates often decrease after 25, this isn’t guaranteed and depends on other factors.

Choosing the Right Car Insurance Policy

Selecting the right car insurance policy is crucial to ensure adequate financial protection and affordability. It’s important to compare different policies and consider your individual needs and circumstances.

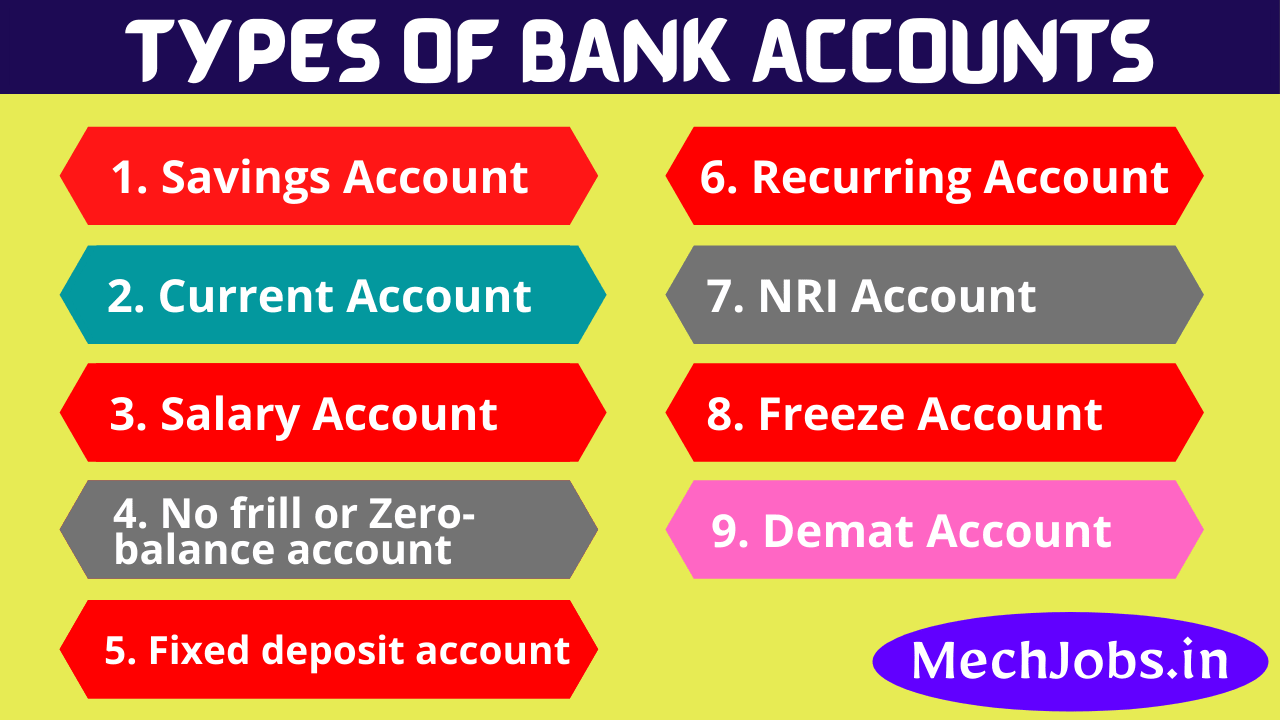

Types of Car Insurance Coverage

Car insurance policies typically offer various types of coverage, each providing different levels of protection:

- Liability Coverage:This covers damages to other people’s property or injuries caused by an accident for which you are responsible.

- Collision Coverage:This covers damages to your car if you are involved in an accident, regardless of fault.

- Comprehensive Coverage:This covers damages to your car caused by non-accident events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage:This protects you if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Medical Payments Coverage:This covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

Importance of Considering Individual Needs

When choosing a car insurance policy, consider your specific needs and circumstances, including:

- Your driving history:If you have a clean record, you may need less liability coverage.

- The value of your car:If you have a new or expensive car, comprehensive and collision coverage may be essential.

- Your financial situation:Consider your ability to pay deductibles and your overall risk tolerance.

- Your driving habits:If you drive frequently in high-traffic areas, you may need higher liability coverage.

Step-by-Step Guide to Shopping for Car Insurance

Follow these steps to shop for car insurance effectively:

- Get Quotes from Multiple Insurers:Compare quotes from at least three different insurance companies to find the best rates.

- Review Coverage Options:Carefully consider the different coverage levels and deductibles offered by each insurer.

- Check for Discounts:Inquire about any available discounts, such as good student, safe driver, or multi-car discounts.

- Read Policy Documents:Understand the terms and conditions of each policy before making a decision.

- Choose the Right Policy:Select the policy that offers the best combination of coverage, price, and customer service.

Decision-Making Process Flowchart

Here’s a flowchart to help you visualize the decision-making process for choosing car insurance:

[Flowchart Illustration]

This flowchart can guide you through the steps of comparing quotes, considering coverage options, and ultimately selecting the right car insurance policy for your needs.

Conclusion

By understanding the factors that shape average car insurance cost, drivers can make informed decisions about their coverage. Whether you’re a seasoned driver or just starting out, exploring strategies for reducing premiums and choosing the right policy can save you money in the long run.

Remember, car insurance is a critical aspect of responsible driving, and by taking an active approach, you can ensure you’re protected while optimizing your budget.