Compare car insurance at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling casual but standard language style filled with unexpected twists and insights. Navigating the world of car insurance can feel like driving through a maze.

With so many different providers, coverage options, and prices, it’s easy to get lost. But don’t worry, this guide is here to help you navigate the twists and turns and find the best car insurance for your needs.

It’s important to know how much your deposits are insured by the FDIC. The FDIC insurance limit protects you against losing your money if a bank fails. It’s a good idea to check the limit and make sure your deposits are covered.

First, let’s talk about the basics. Car insurance is a must-have for any responsible driver. It protects you financially in case of accidents, injuries, or property damage. But how do you know which type of coverage is right for you?

It’s important to know how much your deposits are insured in case something happens to your bank. The FDIC insurance limit is currently $250,000 per depositor, per insured bank, for each account ownership category. This means that if your bank fails, you’re protected up to that amount.

It’s always a good idea to check the FDIC website for the most up-to-date information.

What factors should you consider when comparing quotes? We’ll break down all the essential information you need to make an informed decision.

Understanding Car Insurance Basics

Car insurance is an essential financial safety net that protects you and your vehicle in case of accidents, theft, or other unforeseen events. Understanding the different types of coverage, key factors influencing premiums, and common exclusions is crucial for making informed decisions about your car insurance.

Types of Car Insurance Coverage

Car insurance policies typically offer various coverage options, each addressing specific risks. Here’s a breakdown of common types:

- Liability Coverage:This is the most basic type of car insurance, covering damages you cause to other people or their property in an accident. It includes bodily injury liability and property damage liability.

- Collision Coverage:This covers damage to your vehicle caused by collisions with other vehicles or objects. It pays for repairs or replacement, minus your deductible.

- Comprehensive Coverage:This protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It also has a deductible.

- Uninsured/Underinsured Motorist Coverage:This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP):This coverage pays for medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who is at fault.

Factors Influencing Car Insurance Premiums

Car insurance premiums are calculated based on various factors that assess your risk. Key factors include:

- Age and Driving Experience:Younger and less experienced drivers are statistically more likely to be involved in accidents, leading to higher premiums.

- Driving History:Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. A clean driving record usually translates to lower premiums.

- Vehicle Type:The make, model, year, and value of your vehicle influence premiums. Expensive, high-performance vehicles are often associated with higher insurance costs.

- Location:Geographic location, including urban vs. rural areas, crime rates, and traffic congestion, can affect premiums. Areas with higher accident rates typically have higher premiums.

- Credit Score:In some states, insurance companies use credit scores as a factor in determining premiums, with better credit scores generally resulting in lower premiums.

Common Car Insurance Exclusions and Limitations

Car insurance policies often have exclusions and limitations, which are specific circumstances or situations not covered by the policy. Common examples include:

- Wear and Tear:Most policies don’t cover routine maintenance or wear and tear on your vehicle.

- Acts of War:Damage caused by acts of war or terrorism is generally excluded.

- Driving Under the Influence:If you’re involved in an accident while driving under the influence of alcohol or drugs, your coverage may be limited or denied.

- Driving Without Permission:If you’re driving a vehicle without the owner’s permission, your insurance may not cover any damages or injuries.

Comparing Car Insurance Quotes

Shopping around for car insurance quotes is essential to ensure you’re getting the best coverage at the most competitive price. Here are some tips for comparing quotes effectively:

Finding and Comparing Quotes

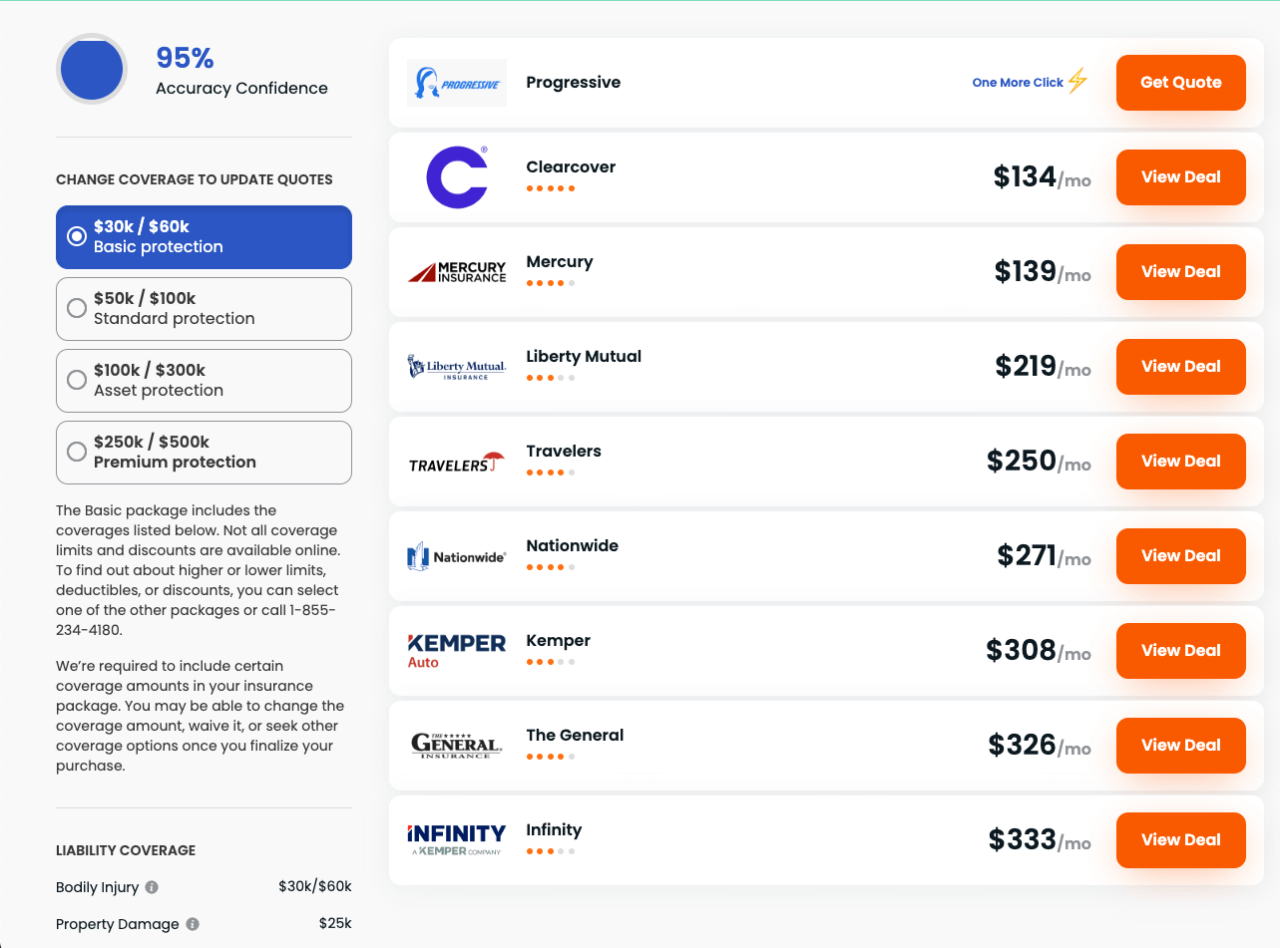

- Use Online Comparison Tools:Many websites allow you to enter your information and compare quotes from multiple insurance companies simultaneously. This saves you time and effort.

- Contact Insurance Brokers:Brokers can help you compare quotes from different companies and provide expert advice on finding the best coverage for your needs.

- Directly Contact Insurance Companies:You can also contact insurance companies directly to request quotes and discuss coverage options.

Key Considerations When Comparing Quotes

When comparing quotes, don’t just focus on the price. Consider these factors:

- Coverage Limits:Ensure that the coverage limits are adequate for your needs. Consider factors like your vehicle’s value, your driving habits, and your financial situation.

- Deductibles:A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you’ll have to pay more in case of an accident.

- Discounts:Many insurance companies offer discounts for good driving records, safety features, multiple policies, and other factors. Make sure to inquire about available discounts.

Benefits of Online Comparison Tools and Insurance Brokers

Online comparison tools and insurance brokers offer several benefits:

- Convenience:They allow you to compare quotes from multiple companies without leaving your home.

- Time Savings:They streamline the quote-gathering process, saving you time and effort.

- Expert Advice:Insurance brokers can provide personalized recommendations based on your specific needs.

Key Considerations for Car Insurance: Compare Car Insurance

Choosing the right car insurance policy requires understanding your individual needs and priorities. Here’s a look at some key considerations:

Factors to Consider When Choosing a Car Insurance Provider

When selecting a car insurance provider, consider these factors:

- Customer Service:Look for a company with a reputation for excellent customer service, prompt responses, and helpful agents.

- Claims Processing:Research the company’s claims processing procedures, including speed, efficiency, and transparency.

- Financial Stability:Choose a financially sound company with a strong track record of paying claims promptly.

- Reputation and Reviews:Read reviews and ratings from other customers to get an idea of the company’s overall performance.

Specific Needs of Different Types of Drivers

Different types of drivers have different insurance needs. Here’s a breakdown of some common categories:

- New Drivers:New drivers typically face higher premiums due to their lack of experience. Consider seeking discounts for good grades or driver’s education courses.

- Experienced Drivers:Experienced drivers with clean driving records may qualify for discounts and lower premiums.

- High-Risk Drivers:Drivers with a history of accidents, violations, or DUI convictions may have limited insurance options and higher premiums. Consider specialized insurance providers for high-risk drivers.

Understanding Your Personal Insurance Needs

It’s essential to understand your specific insurance needs and tailor your coverage accordingly. Consider these factors:

- Your Driving Habits:Do you drive frequently, in urban areas, or for long distances? This can influence your risk profile and coverage needs.

- Your Vehicle’s Value:The value of your vehicle impacts the amount of coverage you need. Consider comprehensive and collision coverage for newer or more expensive vehicles.

- Your Financial Situation:Assess your ability to pay deductibles and premiums. Choose coverage levels that fit your budget and risk tolerance.

Car Insurance and Driving Safety

Your driving habits and safety features play a significant role in determining your car insurance premiums. Here’s how you can impact your insurance costs and enhance your driving safety:

Impact of Driving Habits and Safety Features

- Defensive Driving:Practicing defensive driving techniques, such as maintaining a safe following distance, anticipating potential hazards, and avoiding distractions, can reduce your risk of accidents and lower your premiums.

- Safety Features:Vehicles equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and airbags, are often associated with lower insurance costs.

- Driving Record:Maintaining a clean driving record with no accidents or violations is crucial for keeping your premiums low. Avoid speeding, distracted driving, and driving under the influence.

Tips for Maintaining a Good Driving Record

Here are some tips for maintaining a good driving record and reducing the risk of accidents:

- Follow Traffic Laws:Obey speed limits, stop signs, and traffic signals to avoid citations and accidents.

- Avoid Distracted Driving:Put away your phone, avoid eating or drinking while driving, and focus on the road ahead.

- Be Aware of Your Surroundings:Pay attention to other vehicles, pedestrians, and road conditions. Anticipate potential hazards and react accordingly.

Car Insurance Coverage for Accidents and Damages

Car insurance policies provide financial protection in case of accidents, injuries, and property damage. Here’s how coverage works:

- Liability Coverage:Covers damages you cause to others, including medical expenses, property damage, and lost wages.

- Collision Coverage:Pays for repairs or replacement of your vehicle after a collision, minus your deductible.

- Comprehensive Coverage:Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage:Protects you if you’re hit by an uninsured or underinsured driver.

Navigating Car Insurance Claims

Filing a car insurance claim can be a stressful process, but understanding the steps involved can make it smoother. Here’s a guide to navigating car insurance claims:

Filing a Car Insurance Claim, Compare car insurance

- Contact Your Insurance Company:Report the accident to your insurance company as soon as possible, providing details of the incident, date, time, and location.

- Gather Documentation:Collect any relevant documentation, such as police reports, witness statements, photos of the damage, and medical records.

- File a Claim:Complete the necessary claim forms and provide all required documentation to your insurance company.

Role of the Insurance Adjuster

An insurance adjuster is assigned to your claim to assess the damages and determine the amount of compensation you’re entitled to. They will:

- Inspect the Damage:The adjuster will inspect your vehicle or property to assess the extent of the damage.

- Gather Information:They will gather information from you, witnesses, and other parties involved in the accident.

- Determine Coverage:The adjuster will determine whether your claim is covered by your policy and the amount of compensation you’re eligible for.

Resolving Car Insurance Claims

Here are some tips for resolving car insurance claims smoothly and efficiently:

- Communicate Clearly:Maintain open and clear communication with your insurance company and the adjuster.

- Be Patient:The claims process can take time, so be patient and cooperative throughout the process.

- Review the Settlement:Carefully review the settlement offer from your insurance company before accepting it.

Conclusion

In conclusion, finding the right car insurance involves more than just comparing prices. It’s about understanding your needs, researching different providers, and making informed choices. By following the tips and strategies Artikeld in this guide, you can confidently navigate the world of car insurance and secure the best coverage for your unique situation.

Remember, a little effort upfront can save you a lot of stress and money in the long run.