Small business insurance is more than just a policy; it’s a safety net that can shield your hard work and financial stability from unforeseen events. Imagine a fire destroying your storefront, a customer tripping and suing you, or an employee getting injured on the job.

These situations can be devastating, but with the right insurance, you can bounce back and keep your business running.

This guide explores the essential types of small business insurance, helping you understand the coverage you need, how to choose the right provider, and strategies for managing your insurance costs. We’ll also delve into the importance of understanding policy terms and conditions, and the process of filing a claim should the unexpected occur.

The Importance of Small Business Insurance

Small businesses are the backbone of the economy, but they face numerous risks that can threaten their survival. From property damage and liability claims to employee injuries and business interruptions, a wide range of unforeseen events can have devastating financial consequences.

This is where small business insurance plays a crucial role, providing a safety net to protect businesses from these risks and ensure their continued success.

Common Risks Faced by Small Businesses

Small businesses are vulnerable to a variety of risks, some of which are more common than others. These risks can arise from internal factors, such as employee negligence, or external factors, such as natural disasters or accidents.

- Property Damage:Fires, floods, theft, and vandalism can cause significant damage to a business’s property, including buildings, equipment, inventory, and other assets.

- Liability Claims:Businesses can be held liable for injuries or damages caused to customers, employees, or third parties. This can result in costly lawsuits and settlements.

- Employee Injuries:Accidents in the workplace can lead to employee injuries, resulting in workers’ compensation claims, medical expenses, and lost productivity.

- Business Interruptions:Events such as natural disasters, power outages, or equipment failures can disrupt business operations, leading to lost revenue and potential financial hardship.

Financial Impact of Uninsured Losses

The financial consequences of uninsured losses can be severe for small businesses. Without insurance coverage, businesses may be forced to bear the entire cost of repairs, legal fees, medical expenses, and lost income.

According to the Insurance Information Institute, over 40% of small businesses that experience a major disaster never reopen. This statistic highlights the importance of having adequate insurance coverage to protect against financial ruin.

Types of Small Business Insurance

Small businesses can choose from a variety of insurance policies to address their specific needs and risks. Here are some of the most common types of insurance purchased by small businesses:

General Liability Insurance, Small business insurance

General liability insurance provides protection against claims of bodily injury, property damage, and personal injury caused by the business’s operations or products. It covers legal defense costs and settlements, helping to protect the business’s assets and reputation.

Property Insurance

Property insurance protects businesses against losses to their physical assets, such as buildings, equipment, inventory, and furniture. This coverage can help businesses recover from damage caused by fire, theft, vandalism, natural disasters, and other perils.

Workers’ Compensation Insurance

Workers’ compensation insurance is required by law in most states and provides coverage for employees who are injured or become ill on the job. It covers medical expenses, lost wages, and disability benefits.

Business Interruption Insurance

Business interruption insurance provides financial protection during periods when a business is unable to operate due to a covered event, such as a fire or natural disaster. It helps businesses cover lost revenue, ongoing expenses, and other costs associated with a business interruption.

Professional Liability Insurance (E&O)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed for businesses that provide professional services, such as accountants, lawyers, and consultants. This coverage protects businesses against claims arising from negligence, errors, or omissions in the performance of their services.

Factors Influencing Insurance Needs

The specific insurance needs of a small business vary depending on a number of factors. It’s essential to consider these factors when determining the right insurance coverage for your business.

Industry Type

Different industries face different risks. For example, a construction company will have different insurance needs than a retail store. Construction companies may require additional coverage for workers’ compensation, while retail stores may need more comprehensive property insurance.

Business Size and Operations

The size and operations of a business can also impact its insurance needs. Larger businesses with more employees and assets may require more extensive coverage than smaller businesses. Businesses with complex operations may also need specialized insurance policies.

Location

The location of a business can influence its insurance needs. Businesses located in areas prone to natural disasters, such as earthquakes or hurricanes, may require additional coverage for these risks.

Number of Employees

The number of employees a business has will affect its workers’ compensation insurance needs. Businesses with more employees will have higher premiums, as the risk of workplace injuries increases with the number of employees.

Financial Resources

A business’s financial resources can also influence its insurance choices. Businesses with limited financial resources may need to prioritize essential insurance coverage and explore affordable options.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial for ensuring that your business has adequate coverage and receives excellent service. Here are some key factors to consider when choosing an insurance provider:

Financial Stability

Choose an insurance provider with a strong financial track record and a high rating from independent agencies, such as A.M. Best. This ensures that the insurer will be able to pay claims when you need them.

Customer Service

Look for an insurance provider with a reputation for excellent customer service. You’ll want an insurer that is responsive to your needs and provides clear and helpful information.

Competitive Pricing

Compare quotes from multiple insurance providers to find the best rates for the coverage you need. Don’t just focus on the lowest price; make sure you’re getting adequate coverage for your business.

Tailored Insurance Solutions

Choose an insurance provider that offers tailored insurance solutions to meet the specific needs of your business. They should be able to customize policies to address your unique risks and exposures.

Comparing Quotes

To compare quotes from different insurance providers, you can use online comparison tools, contact insurance brokers, or reach out to insurance companies directly. Be sure to provide accurate information about your business and its operations to get accurate quotes.

Understanding Policy Terms and Conditions: Small Business Insurance

Before signing any insurance policy, it’s essential to carefully review the terms and conditions. Understanding these terms will help you ensure that you have the coverage you need and avoid any surprises later on.

Coverage Limits

Coverage limits refer to the maximum amount that the insurer will pay for a covered loss. It’s important to make sure that the coverage limits are sufficient to cover your potential losses.

Deductibles

A deductible is the amount you are responsible for paying out of pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you’ll need to be prepared to pay more in the event of a claim.

Exclusions

Exclusions are specific events or circumstances that are not covered by the insurance policy. It’s crucial to review the exclusions carefully to ensure that your policy covers the risks that are most important to your business.

Premium Payment Schedules

The premium payment schedule Artikels how and when you will pay your insurance premiums. Be sure to understand the payment options and deadlines to avoid any late payment fees.

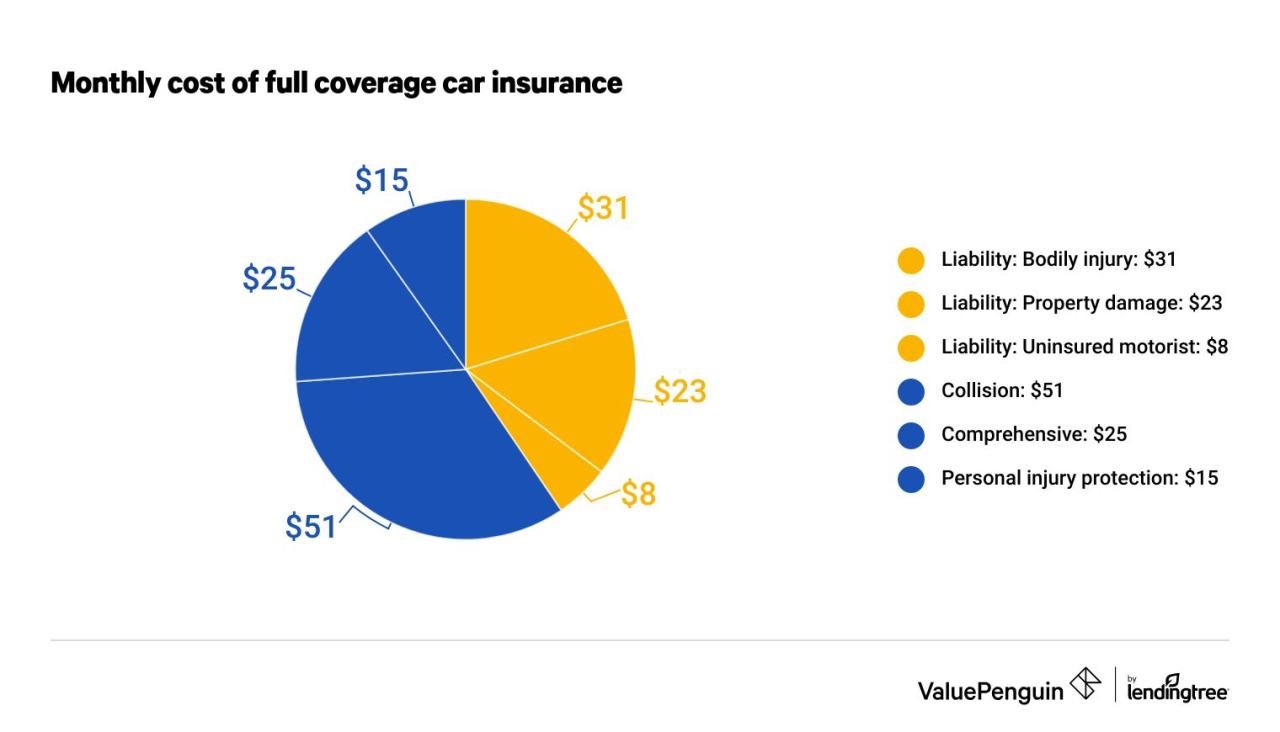

It’s important to understand the basics of liability car insurance before you hit the road. This type of insurance covers damages you cause to other people or their property in an accident. It’s usually required by law, and it can protect you from significant financial losses.

Managing Insurance Costs

Insurance premiums can be a significant expense for small businesses. There are a number of strategies you can use to manage insurance costs and ensure that you’re getting the best value for your money.

Implement Risk Management Practices

By implementing effective risk management practices, you can reduce the likelihood of claims and potentially lower your insurance premiums. This can include things like conducting regular safety inspections, providing employee training, and maintaining your property.

Negotiate Premium Discounts

Many insurance providers offer discounts for good safety records, bundling multiple insurance policies, or paying premiums in full. Don’t be afraid to negotiate with your insurer to see if you qualify for any discounts.

Bundle Multiple Insurance Policies

Bundling multiple insurance policies with the same insurer can often result in lower premiums. This is because insurers may offer discounts for having multiple policies with them.

Driving a car is a privilege, but it comes with responsibilities. One of the most important is having liability car insurance. This type of insurance protects you financially if you’re at fault in an accident, covering damages to the other vehicle and any injuries sustained.

It’s a legal requirement in most places, and it can save you from a significant financial burden in case of an accident.

Explore Alternative Insurance Options

There are alternative insurance options available for small businesses, such as self-insurance or captive insurance companies. These options may offer lower premiums, but they also come with increased risk and require careful consideration.

Filing a Claim

If you need to file a claim with your insurance provider, it’s important to understand the process and follow the necessary steps to ensure a smooth and successful claim experience.

Reporting the Incident

Immediately report the incident to your insurance provider, providing as much detail as possible about what happened. This includes the date, time, location, and any witnesses.

Gathering Necessary Documentation

Gather all necessary documentation related to the claim, such as police reports, medical records, repair estimates, and receipts. This will help support your claim and ensure that you receive the full amount of coverage.

Communicating with the Insurer

Communicate regularly with your insurance provider throughout the claims process. Be responsive to their requests for information and keep them updated on the progress of any repairs or treatments.

Maximizing Your Chances of a Successful Claim

To maximize your chances of a successful claim, it’s essential to follow the terms and conditions of your policy, provide accurate information, and cooperate with the insurer’s investigation.

Resources for Small Business Owners

There are a number of resources available to small business owners seeking information and support on insurance matters. These resources can help you understand your insurance needs, choose the right coverage, and navigate the claims process.

Industry Associations

Industry associations often offer resources and information on insurance for their members. These resources can provide insights into industry-specific risks and best practices for managing insurance.

Government Agencies

Government agencies, such as the Small Business Administration (SBA), provide information and resources on a variety of business topics, including insurance. They may offer guidance on choosing insurance, managing insurance costs, and accessing financial assistance.

Insurance Brokers

Insurance brokers can provide independent advice and help you find the best insurance coverage for your business. They work with multiple insurance companies and can help you compare quotes and choose the right policy.

Online Resources

There are a number of online resources available that provide information on small business insurance. These resources can help you learn about different types of coverage, compare insurance providers, and get tips on managing insurance costs.

Final Conclusion

Protecting your small business is an ongoing journey, and insurance is a crucial component of that journey. By understanding the different types of coverage available, choosing a reputable provider, and managing your insurance costs wisely, you can build a solid foundation for your business’s future.

Remember, being prepared for the unexpected can make all the difference in weathering the storms and achieving your entrepreneurial dreams.