SR22 insurance is a specialized type of insurance that drivers are required to obtain after certain driving violations. It serves as proof of financial responsibility to the state, ensuring that you can cover the costs of any future accidents or injuries you may cause.

These violations can range from driving under the influence (DUI) to reckless driving or even multiple traffic tickets. If you’ve been ordered by the court to obtain SR-22 insurance, it’s crucial to understand what it entails and how it affects your driving privileges.

SR-22 Insurance: What It Is and Why You Need It

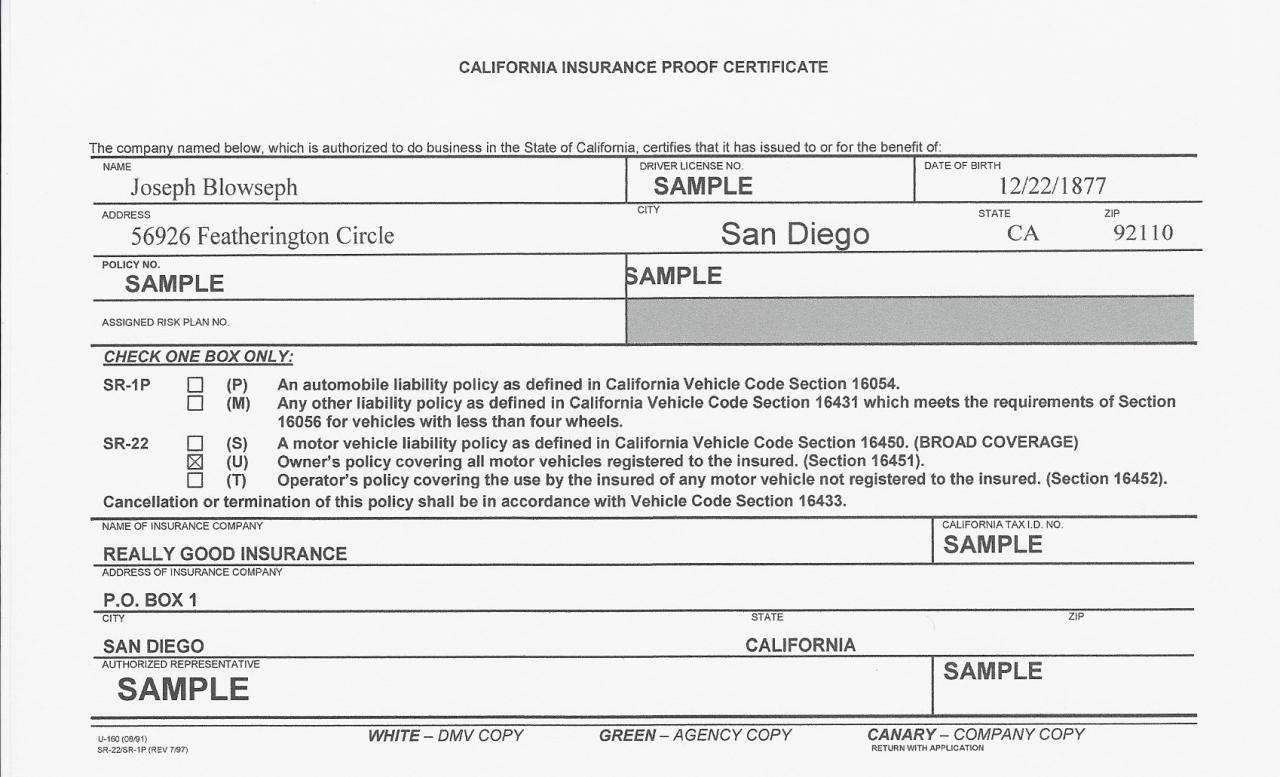

SR-22 insurance is a type of financial responsibility insurance that is required in many states for drivers who have been convicted of certain driving offenses. It’s a certificate that assures the state that you have the minimum required liability insurance coverage.

This insurance is a way for states to ensure that drivers who have been involved in accidents or have committed serious traffic violations are financially responsible for any future damages they may cause.

Types of Driving Offenses Requiring SR-22 Insurance

SR-22 insurance is typically required for drivers who have been convicted of the following types of offenses:

- Driving Under the Influence (DUI) or Driving While Intoxicated (DWI)

- Reckless driving

- Hit-and-run accidents

- Driving without insurance

- Multiple traffic violations

Examples of Situations Requiring SR-22 Insurance

Here are some examples of situations where an individual might need SR-22 insurance:

- A driver is convicted of DUI and is required to carry SR-22 insurance for a specific period.

- A driver is involved in a hit-and-run accident and is ordered by the court to obtain SR-22 insurance.

- A driver is caught driving without insurance and is required to get SR-22 insurance to reinstate their driving privileges.

How SR-22 Insurance Works

SR-22 insurance is not a separate type of insurance policy but rather a certificate that is filed with the state by your insurance company. It confirms that you have the required liability coverage.

Obtaining SR-22 Insurance

To obtain SR-22 insurance, you will need to contact an insurance company and request a quote. The process typically involves the following steps:

- Provide your driver’s license information and proof of your driving violations.

- Complete an application for SR-22 insurance.

- Pay the required premium.

- The insurance company will file the SR-22 certificate with the state.

Duration of SR-22 Requirement

The duration of the SR-22 requirement varies by state and the severity of the driving offense. It can range from a few months to several years. Once the required period is complete, you can request for the SR-22 to be removed from your driving record.

Impact on Insurance Premiums

SR-22 insurance premiums are typically higher than standard auto insurance premiums due to the increased risk associated with drivers who have committed driving offenses. The cost can vary depending on factors such as your driving history, the type of violation, and the state you live in.

Finding and Choosing an SR-22 Insurance Provider

When selecting an SR-22 insurance provider, it’s important to consider factors that will ensure you get the best coverage at a reasonable price.

Factors to Consider

- Reputation and Financial Stability:Choose a reputable company with a strong financial standing to ensure they can meet your insurance needs.

- Coverage Options:Compare the coverage options offered by different insurers to ensure they meet your specific requirements.

- Customer Service:Look for a company with a responsive and helpful customer service team.

- Price:Obtain quotes from multiple insurers to compare prices and coverage options.

Comparing Quotes

When comparing quotes, be sure to consider the following:

- Deductibles:Higher deductibles generally result in lower premiums, but you’ll have to pay more out-of-pocket if you file a claim.

- Coverage Limits:Ensure the coverage limits meet your needs and comply with state requirements.

- Additional Coverage:Consider options such as uninsured/underinsured motorist coverage and collision coverage.

Understanding Coverage Details, Sr22 insurance

It’s crucial to thoroughly understand the coverage details and policy terms before signing up for SR-22 insurance. Ask questions and seek clarification if you are unsure about any aspect of the policy.

Maintaining Your SR-22 Insurance

Maintaining SR-22 insurance is essential to avoid serious consequences.

Consequences of Failing to Maintain SR-22 Insurance

Failing to maintain SR-22 insurance can lead to:

- Suspension of your driver’s license:The state may suspend your driving privileges if your insurance lapses.

- Fines and penalties:You may be subject to fines and penalties for violating the SR-22 requirement.

- Difficulty obtaining insurance in the future:Having an SR-22 on your record can make it harder and more expensive to obtain insurance in the future.

Renewing SR-22 Insurance

SR-22 insurance typically needs to be renewed annually. You will receive a renewal notice from your insurance company. Make sure to pay your premium on time to avoid any lapse in coverage.

Potential Changes in Coverage

When renewing your SR-22 insurance, your insurance company may adjust your coverage or premium based on factors such as your driving record and the duration of your SR-22 requirement.

Avoiding Future Driving Violations

The best way to avoid future driving violations that could require SR-22 insurance is to practice safe driving habits. This includes:

- Always wear your seatbelt.

- Never drive under the influence of alcohol or drugs.

- Obey all traffic laws and speed limits.

- Avoid distractions while driving.

- Get enough rest before driving long distances.

The Cost of SR-22 Insurance: Sr22 Insurance

The cost of SR-22 insurance can vary significantly depending on several factors.

Factors Influencing Cost

- Driving history:Drivers with a history of violations will typically pay higher premiums.

- Type of violation:More serious violations, such as DUI, will generally result in higher premiums.

- State of residence:SR-22 insurance costs can vary significantly from state to state.

- Insurance company:Different insurance companies have different pricing structures.

- Vehicle type:The type of vehicle you drive can also affect your premium.

Comparison to Standard Auto Insurance Premiums

SR-22 insurance premiums are generally higher than standard auto insurance premiums. The difference in cost can be substantial, depending on the factors mentioned above.

Tips for Reducing Costs

While SR-22 insurance is generally more expensive, there are some things you can do to potentially reduce the cost:

- Shop around:Get quotes from multiple insurance companies to compare prices and coverage options.

- Improve your driving record:Maintain a clean driving record to demonstrate that you are a responsible driver.

- Consider increasing your deductible:A higher deductible can lead to lower premiums.

- Take a defensive driving course:Some states offer discounts on insurance premiums for drivers who complete a defensive driving course.

SR-22 Insurance and Your Driving Record

SR-22 insurance can have a significant impact on your driving record.

Impact on Driving Record

Having an SR-22 on your record can indicate to potential insurers that you have a history of driving violations. This can make it more difficult and expensive to obtain insurance in the future.

Getting Your SR-22 Requirement Removed

Once the required period for your SR-22 insurance is complete, you can request for it to be removed from your driving record. You will need to provide proof of your clean driving record to your insurance company, who will then file a request with the state.

Long-Term Implications

Having an SR-22 on your record can have long-term implications for your driving privileges and insurance costs. It is essential to maintain a clean driving record to minimize the impact of the SR-22 requirement.

Final Summary

Navigating the world of SR-22 insurance can feel overwhelming, but understanding the basics can make the process smoother. Remember that maintaining your SR-22 insurance is essential to keep your driving privileges, and avoiding future violations is the best way to avoid this requirement altogether.

By working with a reputable insurance provider and driving responsibly, you can regain your driving freedom and avoid the financial burden of SR-22 insurance.