State Farm insurance quotes are a crucial part of finding the right coverage for your needs. Whether you’re a new driver or a seasoned veteran, understanding the process and factors that influence pricing is essential. State Farm, known for its reliable service and wide range of products, offers quotes tailored to your specific circumstances, ensuring you’re adequately protected.

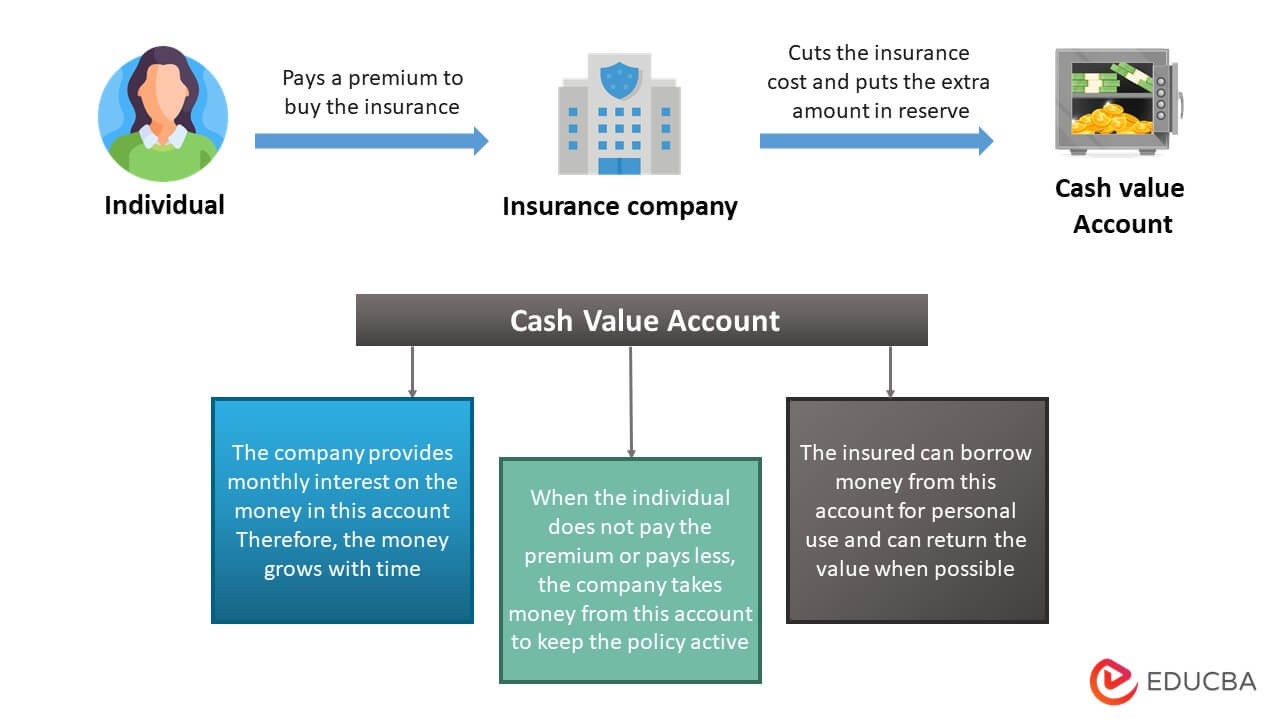

If you’re looking for a life insurance policy that doubles as an investment, cash value life insurance might be a good option for you. It offers a death benefit like traditional life insurance, but it also builds cash value that you can borrow against or withdraw from.

This guide will delve into the intricacies of obtaining a State Farm insurance quote, exploring the different methods, necessary information, and key factors that determine your premium. We’ll also compare State Farm’s offerings to competitors and provide tips for securing the best possible rate.

State Farm Insurance: Overview

State Farm is a leading provider of insurance and financial services in the United States. Founded in 1922, State Farm has grown to become one of the largest and most trusted insurance companies in the country. The company offers a wide range of products and services, including auto, home, life, health, and business insurance, as well as banking and investment products.

History and Background

State Farm was founded by George J. Mecherle in Bloomington, Illinois, in 1922. Mecherle was a farmer who wanted to provide affordable auto insurance to his fellow farmers. The company’s initial focus was on auto insurance, but it quickly expanded to offer other types of insurance, including home, life, and health insurance.

Today, State Farm is a Fortune 500 company with a vast network of agents and employees across the United States.

Products and Services

State Farm offers a wide range of insurance products and financial services, including:

- Auto insurance

- Home insurance

- Life insurance

- Health insurance

- Business insurance

- Bank accounts

- Mutual funds

- Annuities

Market Presence and Customer Base

State Farm is the largest provider of auto insurance in the United States, with over 83 million policies in force. The company also has a large customer base for home, life, and health insurance. State Farm’s commitment to customer service and its strong financial standing have contributed to its reputation as a trusted and reliable insurance provider.

Obtaining a State Farm Insurance Quote

Getting a State Farm insurance quote is a straightforward process. You can choose from several methods to obtain a quote, each offering its own benefits and convenience.

Methods for Obtaining a Quote

- Online:State Farm’s website provides a convenient and user-friendly platform to request a quote. You can enter your information online, and the system will generate a personalized quote within minutes.

- Phone:You can call State Farm’s customer service line to request a quote over the phone. This allows you to speak with a representative and ask questions about the quote process and coverage options.

- Agent:Visiting a local State Farm agent is another option. This allows for a more personalized experience, where you can discuss your insurance needs in detail with an agent who can provide tailored advice and recommendations.

Information Needed for a Quote

To obtain an accurate insurance quote, State Farm will need certain information from you, including:

- Vehicle details:Year, make, model, and VIN (Vehicle Identification Number)

- Driving history:Age, driving experience, and any past accidents or violations

- Location:Your address and zip code

- Coverage preferences:The type and amount of coverage you desire

Factors Influencing Quote Pricing

Several factors influence the pricing of a State Farm insurance quote. These include:

- Age:Younger drivers typically pay higher premiums due to their higher risk profile.

- Location:Insurance rates vary by location based on factors like crime rates, traffic congestion, and weather patterns.

- Driving record:Drivers with a clean driving record typically pay lower premiums than those with accidents or violations.

- Vehicle type:Certain types of vehicles, such as high-performance cars or luxury vehicles, may have higher insurance premiums.

- Coverage level:The amount of coverage you choose, such as liability limits or comprehensive and collision coverage, affects the premium.

Understanding State Farm Insurance Quotes

State Farm insurance quotes are comprehensive documents that Artikel the coverage options, deductibles, and premiums associated with a potential insurance policy. Understanding the components of a quote is crucial for making informed decisions about your insurance needs.

Components of a State Farm Insurance Quote

- Coverage Options:State Farm offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each coverage option protects you from different types of risks, and the quote will specify the coverage levels available to you.

- Deductibles:Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums. The quote will list the deductible options available for each coverage type.

- Premiums:Premiums are the monthly or annual payments you make for your insurance coverage. The quote will provide a detailed breakdown of the premium, including the cost of each coverage option and any applicable discounts.

Comparison of Coverage Options

State Farm offers a variety of coverage options, each designed to address specific insurance needs. Here’s a brief comparison of some common coverage types:

- Liability Coverage:Protects you financially if you cause an accident that results in injury or property damage to others.

- Collision Coverage:Covers damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage:Protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage:Provides financial protection if you are injured in an accident caused by a driver without insurance or with insufficient coverage.

Importance of Understanding Policy Terms and Conditions

It is essential to carefully review the terms and conditions of a State Farm insurance policy before accepting it. This includes understanding the coverage limits, deductibles, exclusions, and any specific requirements or limitations. A thorough understanding of the policy ensures that you are adequately protected and aware of your rights and responsibilities as a policyholder.

If you’re looking for a life insurance policy that offers both death benefit coverage and the potential for cash accumulation, you might want to consider cash value life insurance. This type of policy allows you to build up cash value over time, which you can access through loans or withdrawals.

State Farm Insurance Quotes vs. Competitors

State Farm is one of many insurance providers in the market, and it’s important to compare quotes from different companies to find the best value for your needs. This section will discuss how State Farm insurance quotes stack up against those offered by other major insurance providers.

Comparison of Coverage, Pricing, and Customer Service, State farm insurance quote

When comparing insurance quotes, consider the following factors:

- Coverage:Compare the coverage options offered by each provider, ensuring that the policies meet your specific needs and provide adequate protection.

- Pricing:Obtain quotes from multiple providers and compare the premiums for similar coverage levels. Consider any discounts or promotions offered by each company.

- Customer Service:Research each provider’s reputation for customer service, including factors like responsiveness, accessibility, and claims handling processes.

Pros and Cons of Choosing State Farm

State Farm has a strong reputation and a loyal customer base, but it’s essential to weigh the pros and cons before making a decision.

Pros:

- Wide range of products and services:State Farm offers a comprehensive suite of insurance products and financial services, catering to diverse customer needs.

- Strong financial standing:State Farm is a financially stable company with a history of paying claims promptly and fairly.

- Extensive agent network:State Farm has a vast network of agents across the country, providing easy access to local expertise and personalized service.

Cons:

- Potentially higher premiums:State Farm’s premiums may be higher than those offered by some competitors, especially for certain types of coverage.

- Limited online tools:While State Farm offers online quote tools, some competitors may provide more advanced online platforms for managing policies and making payments.

Tips for Getting the Best State Farm Insurance Quote

To get the most competitive State Farm insurance quote, consider these tips and strategies.

Negotiating a Better Rate

- Shop around:Obtain quotes from multiple insurance providers to compare pricing and coverage options.

- Bundle your policies:Combining your auto and home insurance policies with State Farm can often result in discounts.

- Ask about discounts:Inquire about available discounts, such as good driver discounts, safe driver courses, or multi-car discounts.

- Increase your deductible:Raising your deductible can lower your premium, but be sure to choose a deductible you can comfortably afford in case of an accident.

Maximizing Discounts and Minimizing Premiums

Here are some additional tips for maximizing discounts and minimizing your State Farm insurance premiums:

- Maintain a good driving record:Avoid accidents and traffic violations to qualify for good driver discounts.

- Install safety features:Consider installing safety features in your vehicle, such as anti-theft devices or airbags, which may qualify for discounts.

- Improve your credit score:A good credit score can sometimes result in lower insurance premiums.

- Pay your premiums on time:Prompt payment can often lead to discounts or rewards programs.

Resources and Tools for Comparing Insurance Quotes

Several online resources and tools can help you compare insurance quotes from different providers, including:

- Insurance comparison websites:Websites like Insurance.com and The Zebra allow you to compare quotes from multiple insurers in one place.

- Your state’s insurance department:Most states have insurance departments that provide consumer resources and information, including tools for comparing insurance quotes.

Outcome Summary: State Farm Insurance Quote

Navigating the world of insurance quotes can feel overwhelming, but understanding the process and your options empowers you to make informed decisions. By exploring the factors that influence your State Farm insurance quote, you can tailor your coverage to your needs and budget.

Remember to compare rates, utilize available discounts, and stay informed about policy terms and conditions to ensure you’re getting the best value for your money.