Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to provide a death benefit to your beneficiaries if you pass away during the policy term.

Unlike permanent life insurance, which builds cash value, term life insurance is purely a death benefit policy.

Term life insurance is often considered the most affordable type of life insurance, making it a popular choice for individuals and families with limited budgets. It can be a valuable tool for protecting your loved ones financially in the event of your untimely death.

For example, if you have a mortgage, dependents, or other financial obligations, term life insurance can help ensure that your loved ones can continue to meet their financial needs.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to provide a death benefit to your beneficiaries if you pass away during the policy term.

This benefit can help your loved ones cover expenses such as funeral costs, outstanding debts, or lost income.

Key Features of Term Life Insurance

Term life insurance is distinct from other types of life insurance due to its key features:

- Temporary Coverage:Term life insurance provides coverage for a specific period, after which the policy expires.

- Lower Premiums:Compared to permanent life insurance, term life insurance premiums are generally lower because you are only paying for coverage for a limited time.

- No Cash Value:Term life insurance policies do not accumulate cash value, unlike permanent life insurance policies.

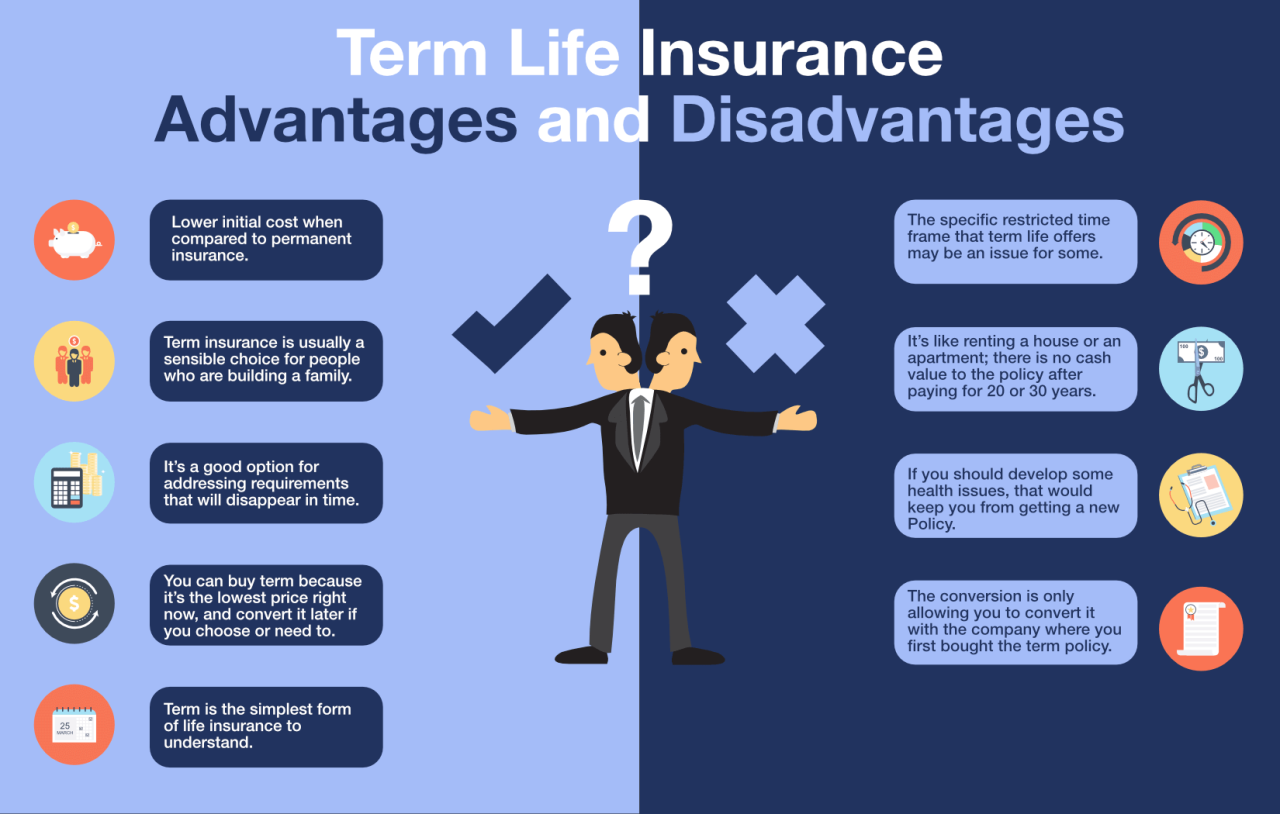

Benefits of Term Life Insurance

Term life insurance offers several benefits:

- Financial Protection for Loved Ones:The death benefit can provide financial security for your family in case of your untimely demise.

- Affordable Coverage:Term life insurance premiums are generally lower than permanent life insurance premiums, making it a more affordable option for many individuals.

- Simple and Straightforward:Term life insurance policies are typically straightforward and easy to understand.

Drawbacks of Term Life Insurance

While term life insurance has its advantages, it also has some drawbacks:

- Temporary Coverage:The coverage period is limited, and the policy expires after the term ends.

- No Cash Value:You cannot access the policy’s value as a savings or investment vehicle.

- Renewability:Premiums may increase when you renew the policy, especially as you get older.

How Term Life Insurance Works

Term life insurance works by providing a death benefit to your beneficiaries if you pass away during the policy term. The death benefit is a lump sum payment that can be used to cover various expenses.

Death Benefit Payment

When you die during the policy term, your beneficiaries will receive the death benefit payment. The amount of the death benefit is determined when you purchase the policy and remains fixed throughout the policy term.

Applying for Term Life Insurance

The application process for term life insurance is typically straightforward:

- Contact an Insurance Agent or Broker:Start by contacting an insurance agent or broker to discuss your needs and explore different policy options.

- Provide Personal Information:You will need to provide personal information such as your name, address, date of birth, and health history.

- Complete a Medical Questionnaire:You may be required to complete a medical questionnaire or undergo a medical exam to assess your health risk.

- Receive a Policy Offer:Based on your information, the insurance company will provide you with a policy offer, including the premium amount and coverage details.

- Review and Sign the Policy:Carefully review the policy terms and conditions before signing it.

Factors Influencing Premium Costs

Several factors influence the cost of term life insurance premiums:

- Age:Premiums increase with age as the risk of death increases.

- Health Status:Individuals with pre-existing health conditions may pay higher premiums.

- Coverage Amount:Higher coverage amounts result in higher premiums.

- Policy Term:Longer policy terms generally lead to higher premiums.

- Lifestyle:Certain lifestyle factors, such as smoking or dangerous hobbies, can affect premiums.

Types of Term Life Insurance

There are different types of term life insurance policies available, each with its unique features and benefits:

Level Term Life Insurance

Level term life insurance provides a fixed death benefit throughout the policy term. Premiums remain constant throughout the policy term, making it a predictable and stable option.

Decreasing Term Life Insurance

Decreasing term life insurance provides a death benefit that gradually decreases over time. Premiums are typically lower than level term insurance, but the death benefit will be smaller as the policy term progresses.

Increasing Term Life Insurance

Increasing term life insurance provides a death benefit that increases over time. This type of policy is suitable for individuals whose financial needs are likely to grow over time, such as those with young children or a mortgage.

Renewable Term Life Insurance

Renewable term life insurance allows you to renew the policy at the end of the term, typically at a higher premium. This provides continued coverage, even if you are older and have a higher risk of death.

Convertible Term Life Insurance

Convertible term life insurance allows you to convert the policy to a permanent life insurance policy without undergoing a medical exam. This option can be beneficial if your financial needs change and you require permanent coverage.

Table of Term Life Insurance Types

| Type | Death Benefit | Premiums | Features |

|---|---|---|---|

| Level Term | Fixed | Constant | Predictable, stable |

| Decreasing Term | Decreases over time | Lower | Lower premiums, smaller death benefit |

| Increasing Term | Increases over time | Higher | Growing death benefit, suitable for growing needs |

| Renewable Term | Renewable at higher premiums | Increases with renewal | Continued coverage, higher premiums |

| Convertible Term | Convertible to permanent life insurance | Higher | Flexibility, no medical exam for conversion |

Factors to Consider When Choosing Term Life Insurance

Choosing the right term life insurance policy involves considering your individual needs and financial situation. Here are some key factors to consider:

Coverage Amount

The coverage amount should be sufficient to meet your family’s financial needs in case of your death. Consider factors such as outstanding debts, mortgage payments, living expenses, and future education costs.

Policy Length

The policy length should align with your coverage needs. Consider the duration for which you need financial protection, such as the remaining term of your mortgage or the age of your children.

Health Status

Your health status will affect your premium costs. Individuals with pre-existing health conditions may pay higher premiums. It is important to be honest about your health history when applying for insurance.

Checklist of Questions for Insurance Providers

Before making a decision, ask potential insurance providers these questions:

- What are the policy terms and conditions?

- What is the premium amount and how is it calculated?

- What are the coverage options and exclusions?

- What are the benefits and drawbacks of the policy?

- What are the renewal options and premium increases?

- What is the claims process?

- Are there any additional features or riders available?

Illustrative Examples

Young Couple with Mortgage and Children

A young couple with a mortgage and children may benefit from term life insurance. If one spouse dies, the death benefit can help cover the mortgage payments, provide for the children’s education, and maintain their living expenses.

Single Parent with Dependents

For a single parent with dependents, term life insurance is crucial. The death benefit can ensure their children’s financial security, cover living expenses, and provide for their education.

Estate Planning

Term life insurance can be used for estate planning purposes. The death benefit can be used to pay estate taxes, cover funeral expenses, and distribute assets according to the deceased’s wishes.

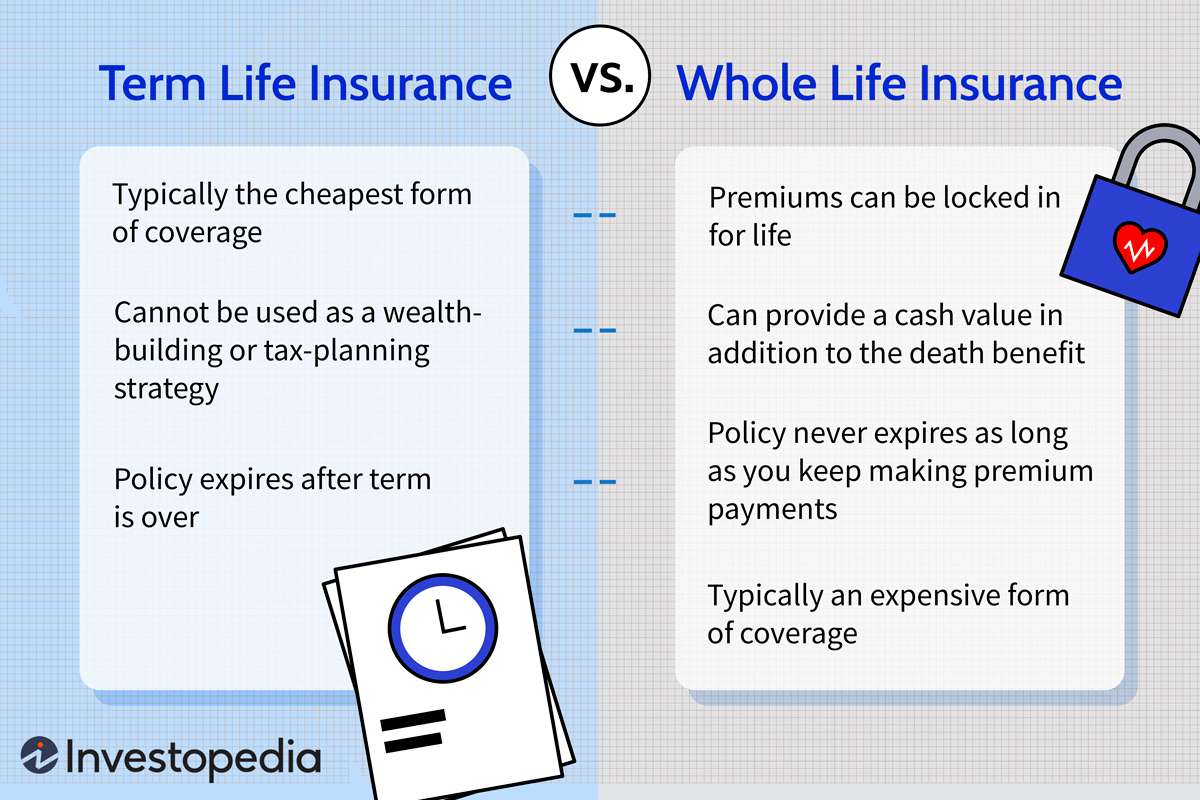

Term Life Insurance vs. Other Life Insurance Types

Term life insurance is often compared to other types of life insurance, such as whole life or universal life insurance. Understanding the key differences can help you choose the right type of coverage for your needs.

Comparison Table

| Type | Coverage | Premiums | Cash Value | Investment Features |

|---|---|---|---|---|

| Term Life | Temporary | Lower | None | None |

| Whole Life | Permanent | Higher | Accumulates cash value | Limited investment features |

| Universal Life | Permanent | Flexible | Accumulates cash value | More investment flexibility |

Advantages and Disadvantages, Term life insurance

Term Life Insurance

- Advantages:Affordable, simple, provides temporary coverage.

- Disadvantages:No cash value, premiums may increase with renewal.

Whole Life Insurance

- Advantages:Permanent coverage, accumulates cash value, provides investment features.

- Disadvantages:Higher premiums, limited investment flexibility.

Universal Life Insurance

- Advantages:Permanent coverage, flexible premiums, more investment flexibility.

- Disadvantages:More complex, premiums can fluctuate.

Last Word

Understanding the intricacies of term life insurance can be overwhelming. However, by carefully considering your individual needs and financial situation, you can make an informed decision that best suits your circumstances. Whether you are a young professional starting a family or a seasoned individual seeking financial security, term life insurance can be a valuable tool for protecting your loved ones and securing their financial future.